Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. Toby breaks his leg at work when he falls down some stairs carrying boxes of stock. He also suffers a serious concussion and

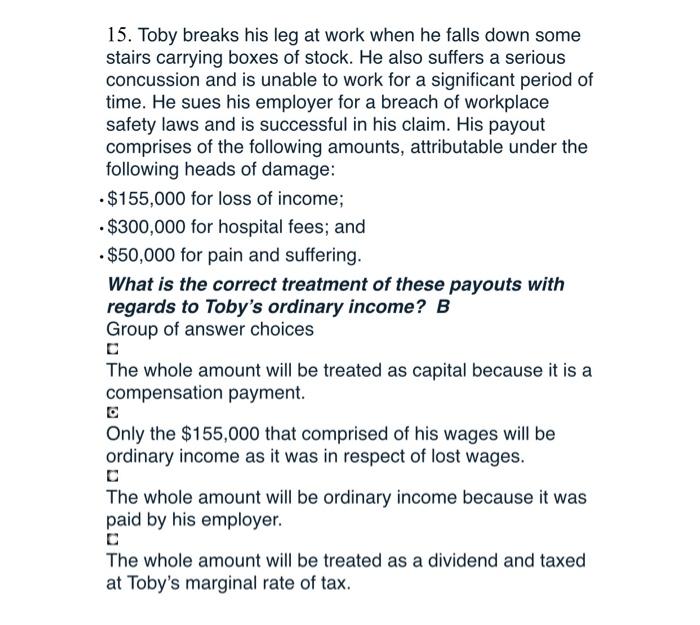

15. Toby breaks his leg at work when he falls down some stairs carrying boxes of stock. He also suffers a serious concussion and is unable to work for a significant period of time. He sues his employer for a breach of workplace safety laws and is successful in his claim. His payout comprises of the following amounts, attributable under the following heads of damage: .$155,000 for loss of income; $300,000 for hospital fees; and .$50,000 for pain and suffering. What is the correct treatment of these payouts with regards to Toby's ordinary income? B Group of answer choices C The whole amount will be treated as capital because it is a compensation payment. Only the $155,000 that comprised of his wages will be ordinary income as it was in respect of lost wages. C The whole amount will be ordinary income because it was paid by his employer. The whole amount will be treated as a dividend and taxed at Toby's marginal rate of tax.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Explanation The whole amount of 505000 will be ordinary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started