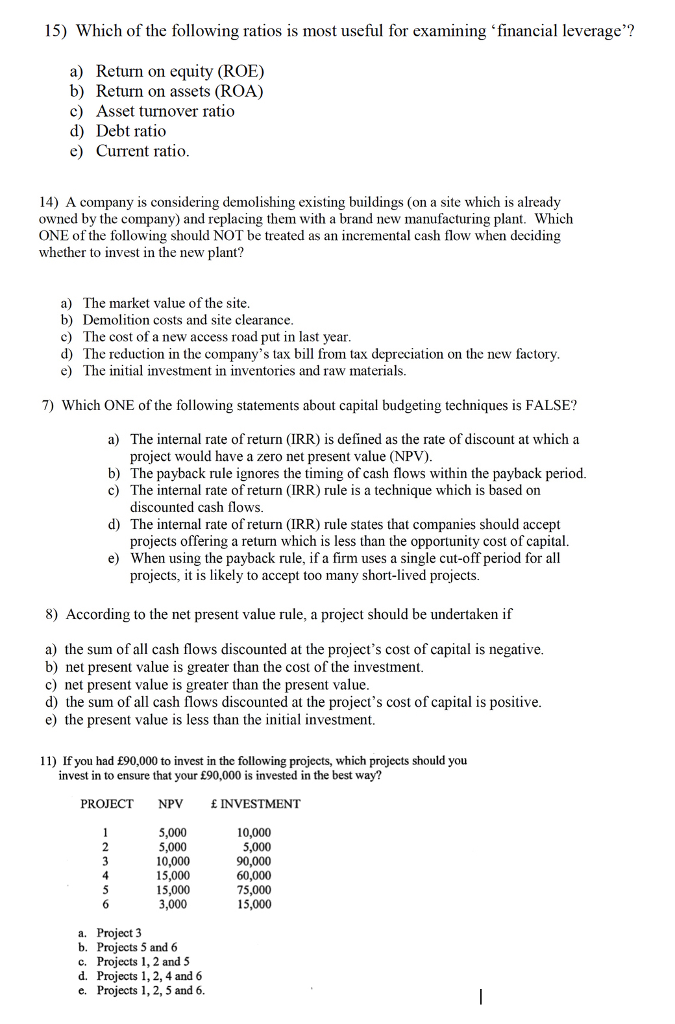

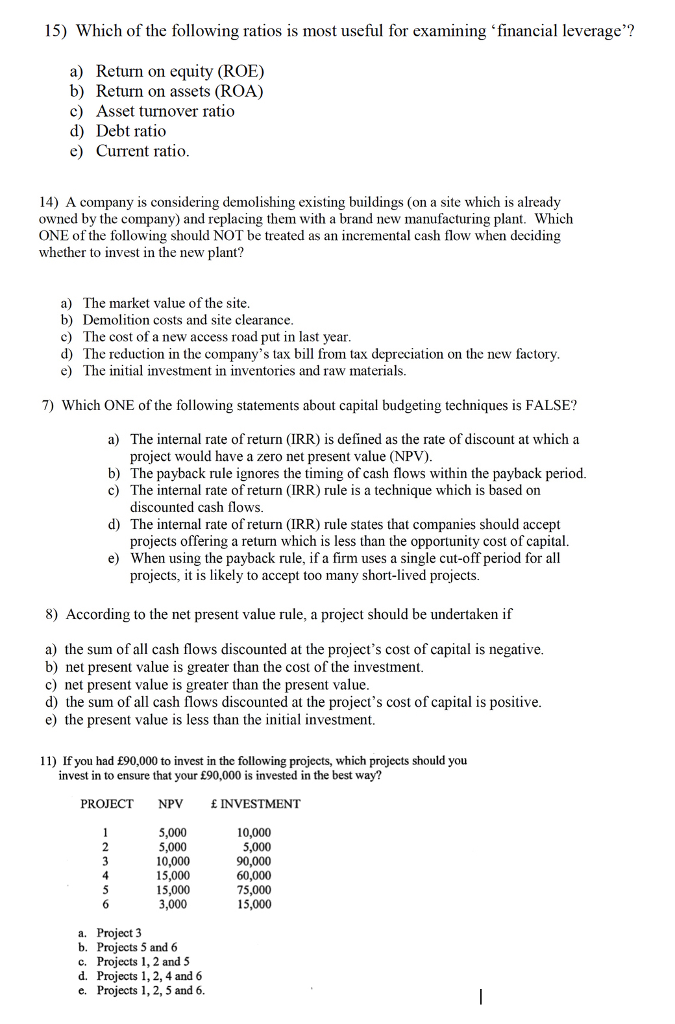

15) Which of the following ratios is most useful for examining 'financial leverage? a) Return on equity (ROE) b) Return on assets (ROA) c) Asset turnover ratio d) Debt ratio e) Current ratio 14) A company is considering demolishing existing buildings (on a site which is already owned by the company) and replacing them with a brand new manufacturing plant. Which ONE of the following should NOT be treated as an incremental cash flow when deciding whether to invest in the new plant? a) The market value of the site b) Demolition costs and site clearance c The cost of a new access road put in last year d) The reduction in the company's tax bill from tax depreciation on the new factory e) The initial investment in inventories and raw materials. 7) Which ONE of the following statements about capital budgeting techniques is FALSE? a) The internal rate of return (IRR) is defined as the rate of discount at which a project would have a zero net present value (NPV). b) The payback rule ignores the timing of cash flows within the payback period. c) The internal rate of return (IRR) rule is a technique which is based on d) The internal rate of return (IRR) rule states that companies should accept e) When using the payback rule, if a firm uses a single cut-off period for all discounted cash flows projects offering a return which is less than the opportunity cost of capital. projects, it is likely to accept too many short-lived projects. 8) According to the net present value rule, a project should be undertaken if a) the sum of all cash flows discounted at the project's cost of capital is negative b) net present value is greater than the cost of the investment. c) net present value is greater than the present value d) the sum of all cash flows discounted at the project's cost of capital is positive e) the present value is less than the initial investment. 11) If you had 90,000 to invest in the following projects, which projects should you invest in to ensure that your 90,000 is invested in the best way? PROJECT NPV INVESTMENT 5,000 5,000 10,000 15,000 15,000 3,000 10,000 5,000 90,000 60,000 75,000 15,000 a. b. c. d. e. Project 3 Projects 5 and 6 Projects 1, 2 and 5 Projects 1,2, 4 and 6 Projects 1, 2, 5 and 6