Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15. You own one share of a cumulative preferred stock which pays quarterly dividends. The firm has recently suffered some financial setbacks and has failed

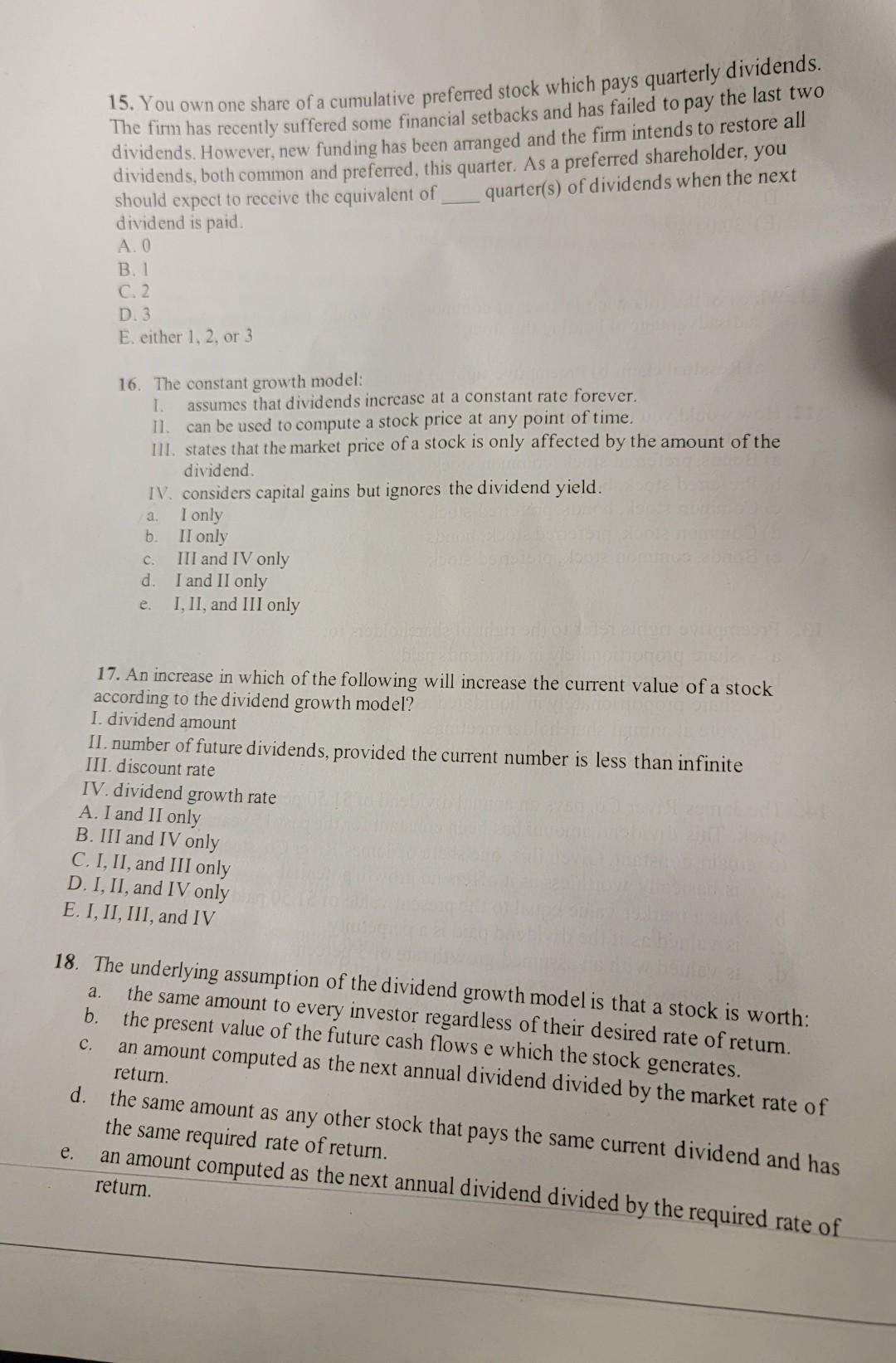

15. You own one share of a cumulative preferred stock which pays quarterly dividends. The firm has recently suffered some financial setbacks and has failed to pay the last two dividends. However, new funding has been arranged and the firm intends to restore all dividends, both common and preferred, this quarter. As a preferred shareholder, you should expect to receive the equivalent of quarter(s) of dividends when the next dividend is paid. A. 0 B. 1 C. 2 E. either 1,2 , or 3 16. The constant growth model: 1. assumes that dividends increase at a constant rate forever. 11. can be used to compute a stock price at any point of time. III. states that the market price of a stock is only affected by the amount of the dividend. 1V. considers capital gains but ignores the dividend yield. a. I only b. II only c. III and IV only d. I and II only e. I, II, and III only 17. An increase in which of the following will increase the current value of a stock according to the dividend growth model? I. dividend amount II. number of future dividends, provided the current number is less than infinite III. discount rate IV. dividend growth rate A. I and II only B. III and IV only C. I, II, and III only D. I, II, and IV only E. I, II, III, and IV 18. The underlying assumption of the dividend growth model is that a stock is worth: a. the same amount to every investor regardless of their desired rate of return. b. the present value of the future cash flows e which the stock generates. c. an amount computed as the next annual dividend divided by the market rate of return. d. the same amount as any other stock that pays the same current dividend and has the same required rate of return. e. an amount computed as the next annual dividend divided by the required rate of return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started