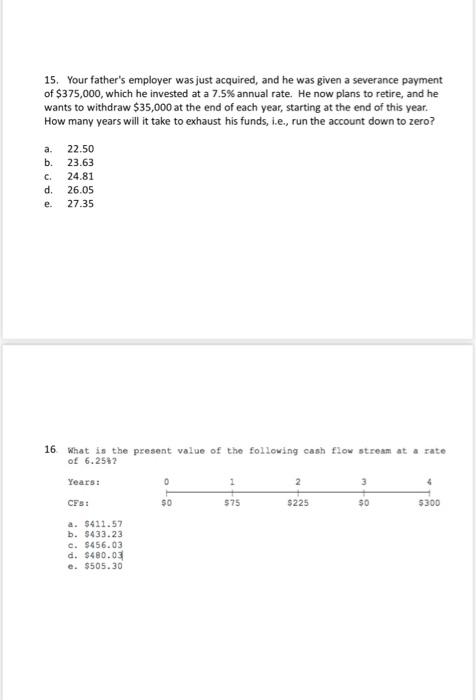

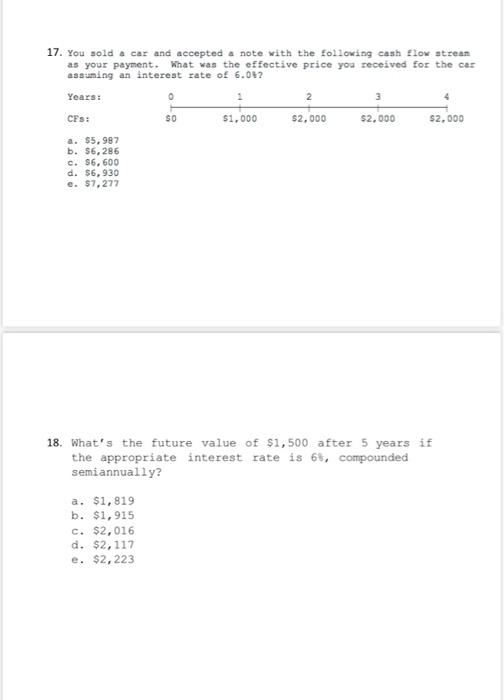

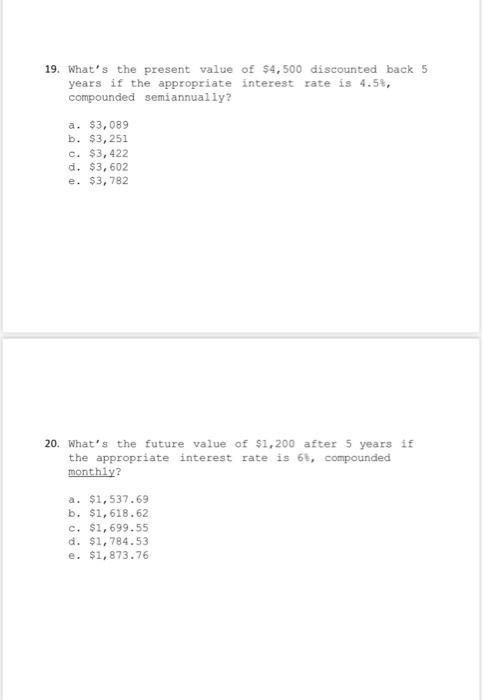

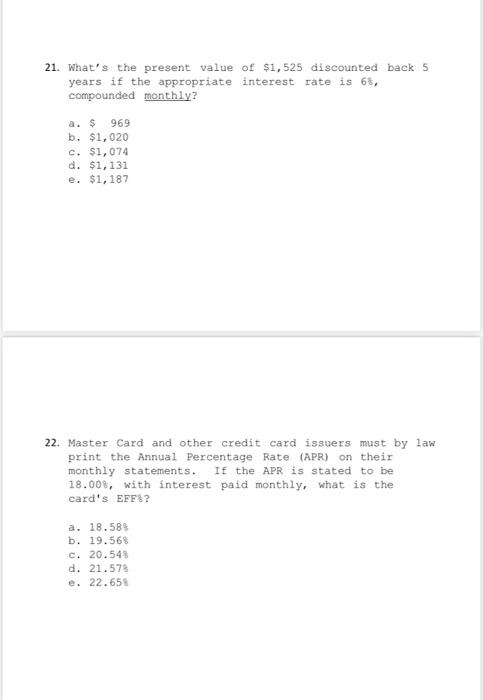

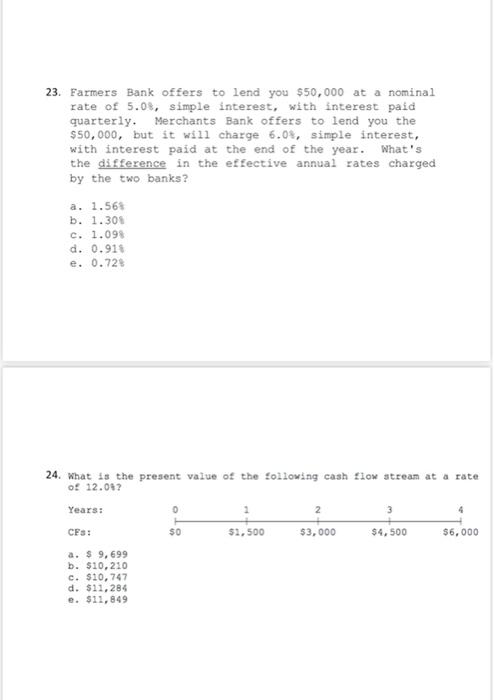

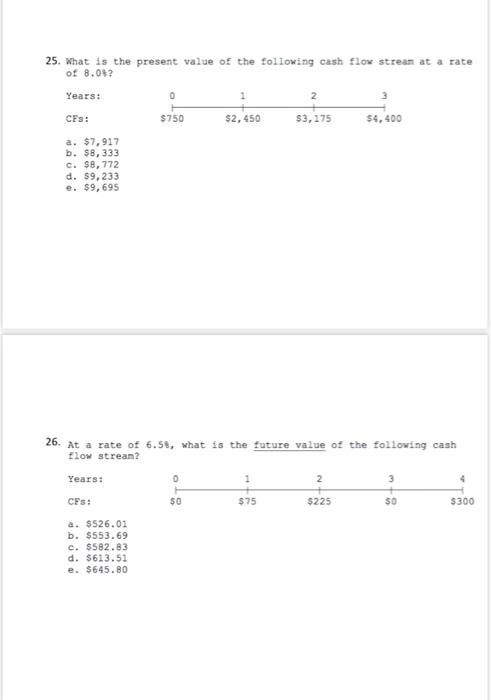

15. Your father's employer was just acquired, and he was given a severance payment of $375,000, which he invested at a 7.5% annual rate. He now plans to retire, and he wants to withdraw $35,000 at the end of each year, starting at the end of this year. How many years will it take to exhaust his funds, i.e., run the account down to zero? a. b. c. d. e. 22.50 23.63 24.81 26.05 27.35 16 What is the present value of the following cash flow stream at a rate of 6.2562 Years: 0 2 2 CES: $0 575 $225 $0 $300 a. $411.52 b. 5433.23 c. $456.03 d. $480.03 e. $505.30 17. You sold a car and accepted a note with the following cash flow strean as your payment. What was the effective price you received for the car assuming an interest rate of 6.04? Years: 0 2 CES: SO $1,000 $2,000 $2,000 $2,000 a. 55,982 b. 36,286 c. 6,600 d. 56,930 e. $7.272 18. What's the future value of $1,500 after 5 years if the appropriate interest rate is 65, compounded semiannually? a. $1,819 b. $1,915 c. $2,016 d. $2,117 e. $2,223 19. What's the present value of $4,500 discounted back 5 years if the appropriate interest rate is 4.5%, compounded semiannually? a. $3,089 b. $3,251 c. $3,422 d. $3,602 e. $3,782 20. What's the future value of $1,200 after 5 years if the appropriate interest rate is 65, compounded monthly? a. $1,537.69 b. $1,618.62 c. $1,699.55 d. $1,784.53 e. $1,873.76 21. What's the present value of $1,525 discounted back 5 years if the appropriate interest rate is 65, compounded monthly? a. S 969 b. $1,020 c. $1,074 d. $1,131 e. $1,187 22. Master Card and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 18.008, with interest paid monthly, what is the card's EFF!? a. 18.589 b. 19.56 c. 20.54 d. 21.575 e. 22.65 23. Farmers Bank offers to lend you $50,000 at a nominal rate of 5.0%, simple interest, with interest paid quarterly. Merchants Bank offers to lend you the $50,000, but it will charge 6.0%, simple interest, with interest paid at the end of the year. What's the difference in the effective annual rates charged by the two banks? a. 1.56 b. 1.305 c. 1.098 d. 0.914 e. 0.72 24. What is the present value of the following cash flow stream at a rate ob 12.08 Years: CES: $0 $1,500 $3,000 $4,500 $6,000 a. $ 9,699 b. $10,210 c. $10, 747 d. $11,284 e. $12,849 25. What is the present value of the following cash flow stream at a rate of 8.0%? Years: $750 $2,450 $3,175 $4,400 0 CES: a. $7,917 b. $8,333 c. $8,772 d. 59, 233 e. $9, 695 26. At a rate of 6.58, what is the future value of the following cash flow stream? Years: 0 CES: $0 $75 $225 $0 $300 a. $526.01 b. $553.69 c. $582.83 d. $613.52 e. $645.80