Question

150C2 Please don't handwrite it. My teacher knows my handwriting :( If the U.S. economy experiences growth in the future, the property will be worth

150C2 Please don't handwrite it. My teacher knows my handwriting :(

-

If the U.S. economy experiences growth in the future, the property will be worth $50,000,000 and the exchange course of 1 dollar will be 0.83 euro.

-

If the U.S. economy slows down, the property will be worth $40,000,000, but the U.S. dollar will be stronger and worth 0.89 euro.

-

The probability of the U.S. economy to experience growth is 40% while a slow-down will happen with a 60% probability.

-

Estimate your exposure b to the exchange risk.

-

Compute the variance of the dollar value of your property that is attributable to the exchange rate uncertainty.

-

Discuss which strategies you could suggest to your client to manage economic exposure

You may refer to the equations below. Please answer this well (and don't include random stuff from the internet), so after the teacher grades it I will return here and give you an upvote if the work was correct. NOTE: the other Chegg answers were incorrect, so I am asking one last time. Thank you very much!

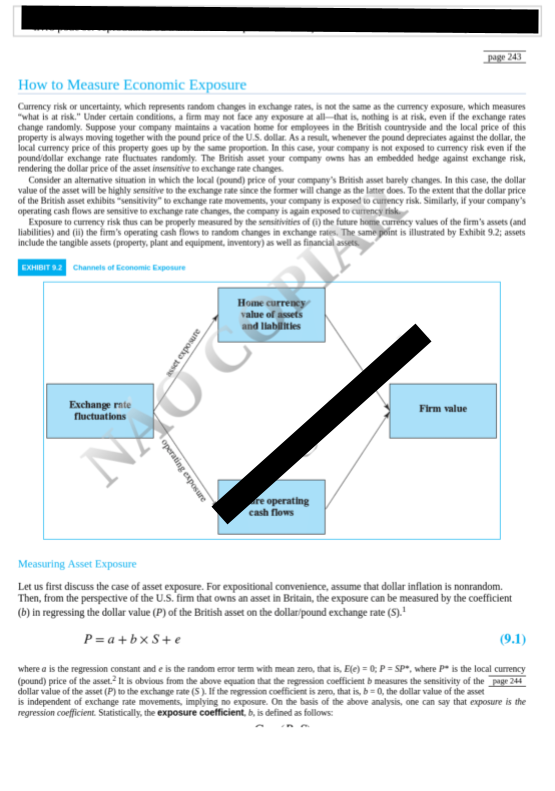

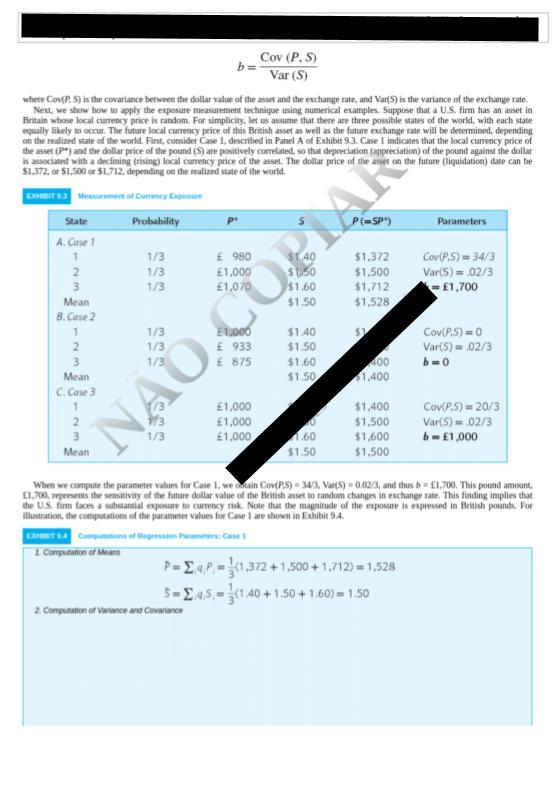

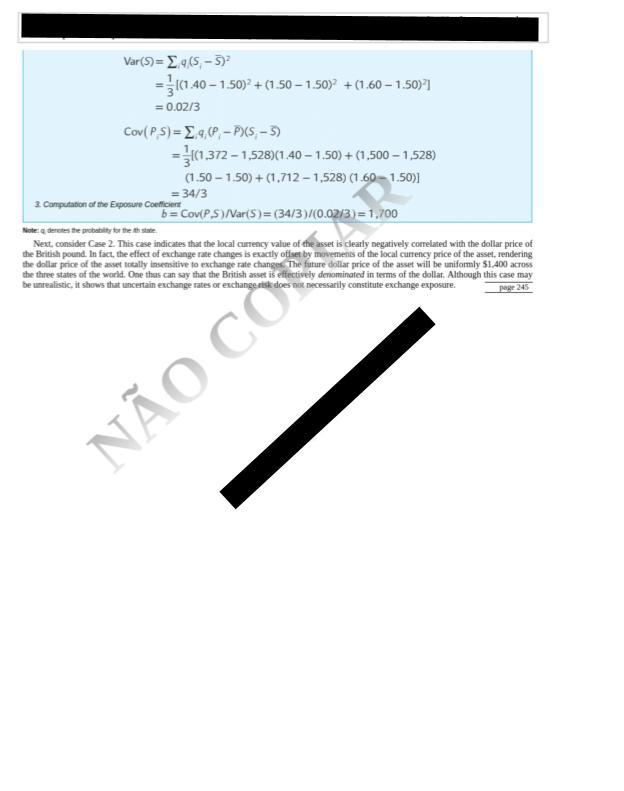

page 243 How to Measure Economic Exposure Currency risk or uncertainty, which represents random changes in exchange rates, is not the same as the currency exposure, which measures "What is at risk." Under certain conditions, a firm may not face any exposure at all that is nothing is at risk, even if the exchange rates change randomly. Suppose your company maintains a vacation home for employees in the British countryside and the local price of this property is always moving together with the pound price of the US dollar. As a result, whenever the pound depreciates against the dollar, the local currency price of this property goes up by the same proportion. In this case, your company is not exposed to currency risk even if the pound dollar exchange rate fluctuates randomly. The British asset your company owns has an embedded hedge against exchange risk, rendering the dollar price of the asset insensitive to exchange rate changes. Consider an alternative situation in which the local (pound) price of your company's British asset barely changes. In this case, the dollar value of the asset will be highly sensitive to the exchange rate since the former will change as the latter does. To the extent that the dollar price of the British asset exhibits sensitivity to exchange rate movements, your company is exposed to currency risk. Similarly, if your company's operating cash flows are sensitive to exchange rate changes, the company is again exposed to currency risk Exposure to currency risk thus can be properly measured by the sensitivities of the future home currency values of the firm's assets (and liabilities) and (i) the firm's operating cash flows to random changes in exchange rates. The same point is illustrated by Exhibit 9.2; assets include the tangible assets (property, plant and equipment, inventory) as well as financial assets. EXHIBIT 9.2 Channels of Economic Exposure Home currency value of assets and liabilities ada Exchange rate fluctuations Firm value INMO operating exposure re operating cash flows Measuring Asset Exposure Let us first discuss the case of asset exposure. For expositional convenience, assume that dollar inflation is nonrandom. Then, from the perspective of the U.S. firm that owns an asset in Britain, the exposure can be measured by the coefficient (b) in regressing the dollar value (P) of the British asset on the dollar/pound exchange rate (S). P=a+bx Sue (9.1) where a is the regression constant and e is the random error term with mean zero, that is, Ele) = 0; P = SP, where P is the local currency (pound) price of the asset. It is obvious from the above equation that the regression coefficient b measures the sensitivity of the page 244 dollar value of the asset (P) to the exchange rate (s). If the regression coefficient is zero, that is, b = 0, the dollar value of the asset is independent of exchange rate movements, implying to exposure. On the basis of the above analysis, one can say that exposure is the regression coefficient. Statistically, the exposure coefficient, b, is defined as follows: Cov (P.S) b Var (S) where Corp. 5) is the covariance between the dollar value of the asset and the exchange rate, and Var(5) is the variance of the exchange rate. Next, we show how to apply the exposure measurement technique using numerical examples. Suppose that a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, let us assume that there are three possible states of the world, with each state equally likely to occur. The future local currency price of this British asset as well as the future exchange rate will be determined, depending on the realized state of the world. First, consider Case 1, described in Panel A of Exhibit 9.3. Case 1 indicates that the local currency price of the asset (P) and the dollar price of the pound (S) are positively correlated, so that depreciation appreciation of the pound against the dollar is associated with a declining (rising) local currency price of the asset. The dollar price of the set on the future liquidation) date can be $1,372, or $1,500 or 51,712. depending on the realized state of the world. DIT Motor Cunny A State Probability pi P(=SP) Parameters NN 1/3 1/3 1/3 980 1,000 1,070 51 40 $1150 $1.60 $1.50 $1,372 $1.500 $1.712 $1.528 Cov(P,5) = 34/3 Var(s)=02/3 - 1,700 A. Case 1 1 2 3 Mean 8. Case 2 1 2 3 Mean C.Case 3 $1 a E1.000 933 875 $1.40 $1.50 $1.60 $1.50 Cov(P.S) - 0 Var(s) = .02/3 b=0 400 1,400 2 3 Mean 1,000 1,000 1,000 $1,400 $1.500 $1,600 $1,500 Cov(P.S) = 20/3 Var(s) = 02/3 b - 1,000 1.60 $1.50 When we compute the parameter values for Case I, we cain Cov(PS) - 34/3, Var(S) =0,02/3, and thus b = 1,700. This pound amount 1,700, represents the sensitivity of the future dollar value of the British asset to random changes in exchange rate. This finding implies that the U.S. firm faces a substantial exposure to currency risk. Note that the magnitude of the exposure is expressed in British pounds. For illustration, the computation of the parameter values for Case I are shown in Exhibit 94. DOT 4 Computations et lesson Parameters Cases 1 Computation of Man P= E.P. (1.372 +1.500 + 1.712) = 1,528 5=E,4,5 = {(1,40 +1.50 +1.60) = 1,50 2. Computation or Variance and Covariance Var(9)= 4( 5-3) 10.40 - 1.50)2 + (1.50 1.50)2 + (1.60 - 1.50)-1 = 0.02/3 Cov( PS) = 2,4,6P,- P/S - 3) 10.372 - 1,528)(1.40 1.50) + (1,500 - 1,528) (1.50 -1.50) +(1.712 - 1,528) (1.60-1.50) = 34/3 3. Computation of the Exposure Coefficient b = Covip.s)/Var(s)= (34/3)/(0.02/3)=1.700 Next, consider Case 2. This case indicates that the local currency value of the asset is clearly negatively correlated with the dollar price of the British pound. In fact, the effect of exchange rate changes is exactly offset by movements of the local currency price of the asset, rendering the dollar price of the asset totally insensitive to exchange rate changes. The future dollar price of the asset will be uniformly 51,400 across the three states of the world. One this can say that the British asset is effectively denominated in terms of the dollat. Although this case may be unrealistic, it shows that uncertain exchange rates or exchange is does not necessarily constitute exchange exposure NO CO page 243 How to Measure Economic Exposure Currency risk or uncertainty, which represents random changes in exchange rates, is not the same as the currency exposure, which measures "What is at risk." Under certain conditions, a firm may not face any exposure at all that is nothing is at risk, even if the exchange rates change randomly. Suppose your company maintains a vacation home for employees in the British countryside and the local price of this property is always moving together with the pound price of the US dollar. As a result, whenever the pound depreciates against the dollar, the local currency price of this property goes up by the same proportion. In this case, your company is not exposed to currency risk even if the pound dollar exchange rate fluctuates randomly. The British asset your company owns has an embedded hedge against exchange risk, rendering the dollar price of the asset insensitive to exchange rate changes. Consider an alternative situation in which the local (pound) price of your company's British asset barely changes. In this case, the dollar value of the asset will be highly sensitive to the exchange rate since the former will change as the latter does. To the extent that the dollar price of the British asset exhibits sensitivity to exchange rate movements, your company is exposed to currency risk. Similarly, if your company's operating cash flows are sensitive to exchange rate changes, the company is again exposed to currency risk Exposure to currency risk thus can be properly measured by the sensitivities of the future home currency values of the firm's assets (and liabilities) and (i) the firm's operating cash flows to random changes in exchange rates. The same point is illustrated by Exhibit 9.2; assets include the tangible assets (property, plant and equipment, inventory) as well as financial assets. EXHIBIT 9.2 Channels of Economic Exposure Home currency value of assets and liabilities ada Exchange rate fluctuations Firm value INMO operating exposure re operating cash flows Measuring Asset Exposure Let us first discuss the case of asset exposure. For expositional convenience, assume that dollar inflation is nonrandom. Then, from the perspective of the U.S. firm that owns an asset in Britain, the exposure can be measured by the coefficient (b) in regressing the dollar value (P) of the British asset on the dollar/pound exchange rate (S). P=a+bx Sue (9.1) where a is the regression constant and e is the random error term with mean zero, that is, Ele) = 0; P = SP, where P is the local currency (pound) price of the asset. It is obvious from the above equation that the regression coefficient b measures the sensitivity of the page 244 dollar value of the asset (P) to the exchange rate (s). If the regression coefficient is zero, that is, b = 0, the dollar value of the asset is independent of exchange rate movements, implying to exposure. On the basis of the above analysis, one can say that exposure is the regression coefficient. Statistically, the exposure coefficient, b, is defined as follows: Cov (P.S) b Var (S) where Corp. 5) is the covariance between the dollar value of the asset and the exchange rate, and Var(5) is the variance of the exchange rate. Next, we show how to apply the exposure measurement technique using numerical examples. Suppose that a U.S. firm has an asset in Britain whose local currency price is random. For simplicity, let us assume that there are three possible states of the world, with each state equally likely to occur. The future local currency price of this British asset as well as the future exchange rate will be determined, depending on the realized state of the world. First, consider Case 1, described in Panel A of Exhibit 9.3. Case 1 indicates that the local currency price of the asset (P) and the dollar price of the pound (S) are positively correlated, so that depreciation appreciation of the pound against the dollar is associated with a declining (rising) local currency price of the asset. The dollar price of the set on the future liquidation) date can be $1,372, or $1,500 or 51,712. depending on the realized state of the world. DIT Motor Cunny A State Probability pi P(=SP) Parameters NN 1/3 1/3 1/3 980 1,000 1,070 51 40 $1150 $1.60 $1.50 $1,372 $1.500 $1.712 $1.528 Cov(P,5) = 34/3 Var(s)=02/3 - 1,700 A. Case 1 1 2 3 Mean 8. Case 2 1 2 3 Mean C.Case 3 $1 a E1.000 933 875 $1.40 $1.50 $1.60 $1.50 Cov(P.S) - 0 Var(s) = .02/3 b=0 400 1,400 2 3 Mean 1,000 1,000 1,000 $1,400 $1.500 $1,600 $1,500 Cov(P.S) = 20/3 Var(s) = 02/3 b - 1,000 1.60 $1.50 When we compute the parameter values for Case I, we cain Cov(PS) - 34/3, Var(S) =0,02/3, and thus b = 1,700. This pound amount 1,700, represents the sensitivity of the future dollar value of the British asset to random changes in exchange rate. This finding implies that the U.S. firm faces a substantial exposure to currency risk. Note that the magnitude of the exposure is expressed in British pounds. For illustration, the computation of the parameter values for Case I are shown in Exhibit 94. DOT 4 Computations et lesson Parameters Cases 1 Computation of Man P= E.P. (1.372 +1.500 + 1.712) = 1,528 5=E,4,5 = {(1,40 +1.50 +1.60) = 1,50 2. Computation or Variance and Covariance Var(9)= 4( 5-3) 10.40 - 1.50)2 + (1.50 1.50)2 + (1.60 - 1.50)-1 = 0.02/3 Cov( PS) = 2,4,6P,- P/S - 3) 10.372 - 1,528)(1.40 1.50) + (1,500 - 1,528) (1.50 -1.50) +(1.712 - 1,528) (1.60-1.50) = 34/3 3. Computation of the Exposure Coefficient b = Covip.s)/Var(s)= (34/3)/(0.02/3)=1.700 Next, consider Case 2. This case indicates that the local currency value of the asset is clearly negatively correlated with the dollar price of the British pound. In fact, the effect of exchange rate changes is exactly offset by movements of the local currency price of the asset, rendering the dollar price of the asset totally insensitive to exchange rate changes. The future dollar price of the asset will be uniformly 51,400 across the three states of the world. One this can say that the British asset is effectively denominated in terms of the dollat. Although this case may be unrealistic, it shows that uncertain exchange rates or exchange is does not necessarily constitute exchange exposure NO CO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started