Question

15.1. A Long-Overdue Will for Nathan Nathan Cooper, a man of many talents and deep foresight, has built a large fleet of oceangoing oil tankers.

15.1. A Long-Overdue Will for Nathan

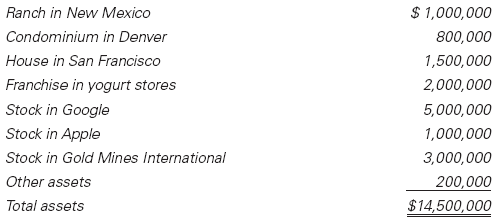

Nathan Cooper, a man of many talents and deep foresight, has built a large fleet of oceangoing oil tankers. Now a wealthy man in his 60s, he resides in San Francisco, with his second wife, Audrey, age 50. They have two sons, one in junior high school and one a high school freshman. For some time, Nathan has considered preparing a will to ensure that his estate will be properly distributed when he dies. A survey of his estate reveals the following:

(Table details: A table displays the estate survey in two columns. The first column displays the labels, while the second column displaying its respective values. The data from the table are as follows: Ranch in New Mexico, $1,000,000; Condominium in Denver, 800,000; House in San Francisco, 1,500,000; Franchise in yogurt stores, 2,000,000; Stock in Google, 5,000,000; Stock in Apple, 1,000,000; Stock in Gold Mines International, 3,000,000; Other assets, 200,000; Total assets, $14,500,000.)

The house and the Gold Mines International shares are held in joint tenancy with his wife, but all other property is in his name alone. He desires that there be a separate fund of $1 million for his sons education and that the balance of his estate be divided as follows: 40 percent to his sons, 40 percent to his wife, and 20 percent given to other relatives, friends, and charitable institutions. He has scheduled an appointment for drafting his will with his attorney and close friend, Sebastian Rogers. Nathan would like to appoint Sebastian, who is 70 years old, and Nathans 40-year-old cousin, Leo Cooper, a CPA, as co-executors. If one of them predeceases Nathan, hed like First National Bank to serve as co-executor.

Critical Thinking Questions

1. Does Nathan really need a will? Explain why or why not. What would happen to his estate if he were to die without a will?

2. Explain to Nathan the common features that need to be incorporated into a will.

3. Might the manner in which titles are held thwart his estate planning desires? What should be done to avoid problems?

4. Is a living trust an appropriate part of his estate plan? How would a living trust change the nature of Nathans will?

5. How does the age of Nathans children complicate the estate plan? What special provisions should he consider?

6. What options are available to Nathan if he decides later to change or revoke the will? Is it more difficult to change a living trust?

7. What duties will Sebastian Rogers and Leo Cooper have to perform as co-executors of Nathans estate? If a trust is created, what should Nathan consider in his selection of a trustee or co-trustees? Might Sebastian and Leo, serving together, be a good choice?

\begin{tabular}{lr} Ranch in New Mexico & $1,000,000 \\ Condominium in Denver & 800,000 \\ House in San Francisco & 1,500,000 \\ Franchise in yogurt stores & 2,000,000 \\ Stock in Google & 5,000,000 \\ Stock in Apple & 1,000,000 \\ Stock in Gold Mines International & 3,000,000 \\ Other assets & 200,000 \\ Total assets & $14,500,000 \\ \hline \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started