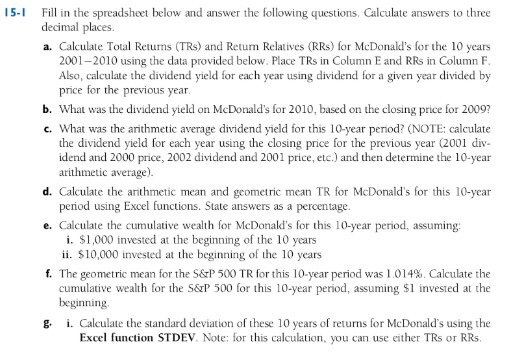

15-1 Fill in the spreadsheet below and answer the following questions. Calculate answers to three decimal places. a. Calculate Total Returns (TRS) and Return Relatives (RRS) for McDonald's for the 10 years 2001-2010 using the data provided below. Place TRs in Column E and RRs in Column F. Also, calculate the dividend yield for each year using dividend for a given year divided by price for the previous year b. What was the dividend yield on McDonald's for 2010, based on the closing price for 2009? c. What was the arithmetic average dividend yield for this 10-year period? (NOTE: calculate the dividend yield for each year using the closing price for the previous year 2001 div. idend and 2000 price, 2002 dividend and 2001 price, etc.) and then determine the 10-year arithmetic average). d. Calculate the arithmetic mean and geometric mean TR for McDonald's for this 10-year period using Excel functions. State answers as a percentage e. Calculate the cumulative wealth for McDonald's for this 10-year period, assuming i. $1,000 invested at the beginning of the 10 years ii. $10,000 invested at the beginning of the 10 years f. The geometric mean for the S&P 500 TR for this 10-year period was 1014%. Calculate the cumulative wealth for the S&P 500 for this 10-year period, assuming $1 invested at the beginning g. i. Calculate the standard deviation of these 10 years of returns for McDonald's using the Excel function STDEV. Note: for this calculation, you can use either TRS or RR 15-1 Fill in the spreadsheet below and answer the following questions. Calculate answers to three decimal places. a. Calculate Total Returns (TRS) and Return Relatives (RRS) for McDonald's for the 10 years 2001-2010 using the data provided below. Place TRs in Column E and RRs in Column F. Also, calculate the dividend yield for each year using dividend for a given year divided by price for the previous year b. What was the dividend yield on McDonald's for 2010, based on the closing price for 2009? c. What was the arithmetic average dividend yield for this 10-year period? (NOTE: calculate the dividend yield for each year using the closing price for the previous year 2001 div. idend and 2000 price, 2002 dividend and 2001 price, etc.) and then determine the 10-year arithmetic average). d. Calculate the arithmetic mean and geometric mean TR for McDonald's for this 10-year period using Excel functions. State answers as a percentage e. Calculate the cumulative wealth for McDonald's for this 10-year period, assuming i. $1,000 invested at the beginning of the 10 years ii. $10,000 invested at the beginning of the 10 years f. The geometric mean for the S&P 500 TR for this 10-year period was 1014%. Calculate the cumulative wealth for the S&P 500 for this 10-year period, assuming $1 invested at the beginning g. i. Calculate the standard deviation of these 10 years of returns for McDonald's using the Excel function STDEV. Note: for this calculation, you can use either TRS or RR