Answered step by step

Verified Expert Solution

Question

1 Approved Answer

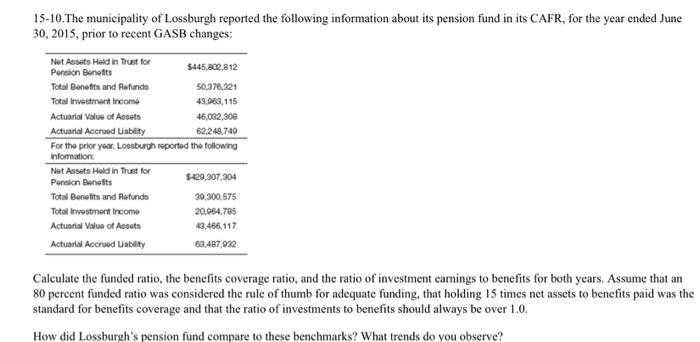

15-10.The municipality of Lossburgh reported the following information about its pension fund in its CAFR, for the year ended June 30, 2015, prior to recent

15-10.The municipality of Lossburgh reported the following information about its pension fund in its CAFR, for the year ended June 30, 2015, prior to recent GASB changes:

Calculate the funded ratio, the benefits coverage ratio, and the ratio of investment earnings to benefits for both years. Assume that an 80 percent funded ratio was considered the rule of thumb for adequate funding, that holding 15 times net assets to benefits paid was the standard for benefits coverage and that the ratio of investments to benefits should always be over 1.0.

How did Lossburghs pension fund compare to these benchmarks? What trends do you observe? (Finkler 584)

.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started