Answered step by step

Verified Expert Solution

Question

1 Approved Answer

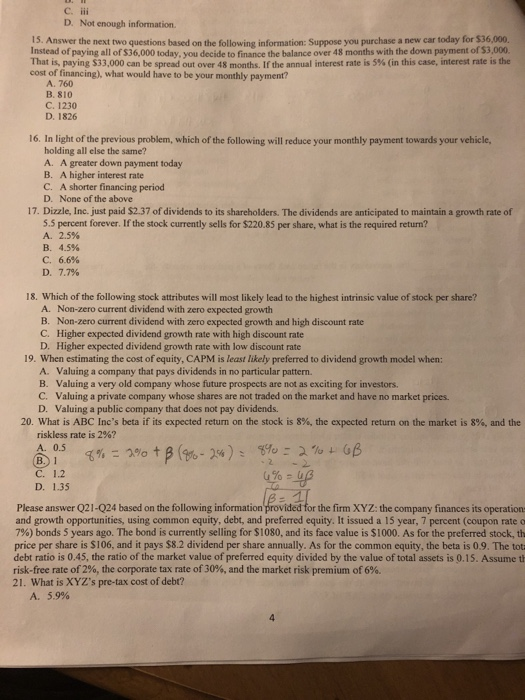

15-19 need help solving please and thanks D. Not enough information. 15. Answer the next two questions based on the following information: Suppose you purchase

15-19 need help solving please and thanks

D. Not enough information. 15. Answer the next two questions based on the following information: Suppose you purchase a new car today for $36,000 That is paying $33,000 can be spread out over 48 months. If the annual interest rate is 5% (in this case, interest rate is the cost of financing), what would have to be your monthly payment? A. 760 B. 810 C. 1230 D. 1826 16. In light of the previous problem, which of the following will reduce your monthly payment towards your vehicle, holding all else the same? A. A greater down payment today B. A higher interest rate C. A shorter financing period D. None of the above 17. Dizzle, Inc. just paid $2.37 of dividends to its shareholders. The dividends are anticipated to maintain a growth rate of 5.5 percent forever. If the stock currently sells for $220.85 per share, what is the required return? A. 2.5% B.4.5% C. 6.6% 18. Which of the following stock attributes will most likely lead to the highest intrinsic value of stock per share? Non-zero current dividend with zero expected growth B. A. Non-zero current dividend with zero expected growth and high discount rate C. Higher expected dividend growth rate with high discount rate D. Higher expected dividend growth rate with low discount rate 19. When estimating the cost of equity, CAPM is least likely preferred to dividend growth model when: A. Valuing a company that pays dividends in no particular pattern. Valuing a very old company whose future prospects are not as exciting for investors. C. B. Valuing a private company whose shares are not traded on the market and have no market prices. D. Valuing a public company that does not pay dividends. 20. What is ABC Inc's beta if its expected return on the stock is 8%, the expected return on the market is 8%, and the riskless rate is 2%? A. 0.5 B.) 1 C. 1.2 D. 1.35 Please answer Q21-024 based on the following information provided for the firm XYZ: the company finances its operation and growth opportunities, using common equity, debt, and preferred equity. It issued a 15 year, 7 percent (coupon rate o 7%) bonds 5 years ago. The bond is currently selling for S 1080, and its face value is $1000. As for the preferred stock, th price per share is $106, and it pays $8.2 dividend per share annually. As for the common equity, the beta is 0.9The tot debt ratio is 0.45, the ratio of the market value of preferred equity divided by the value of total assets is 0.15. Assume t risk-free rate of 2%, the corporate tax rate of 30%, and the market risk premium of 6%. 21. What is XYZ's pre-tax cost of debt? A. 5.9% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started