Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15-2 In January of 2018, the management of Mann Company concludes that it has sufficient cash to purchase long term investments in stocks and bonds.

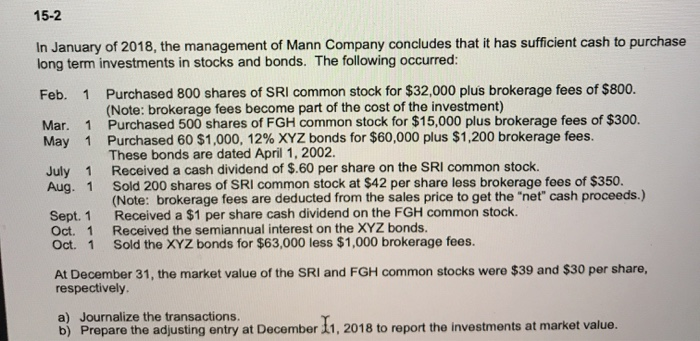

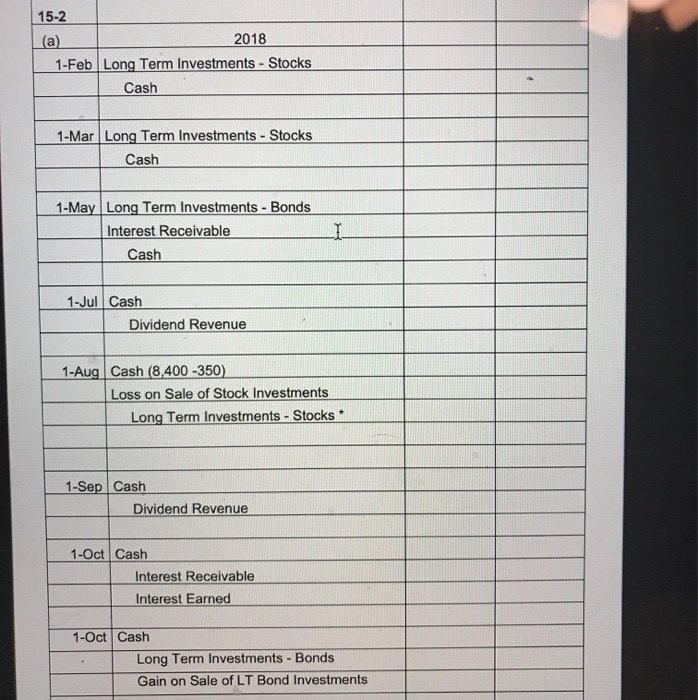

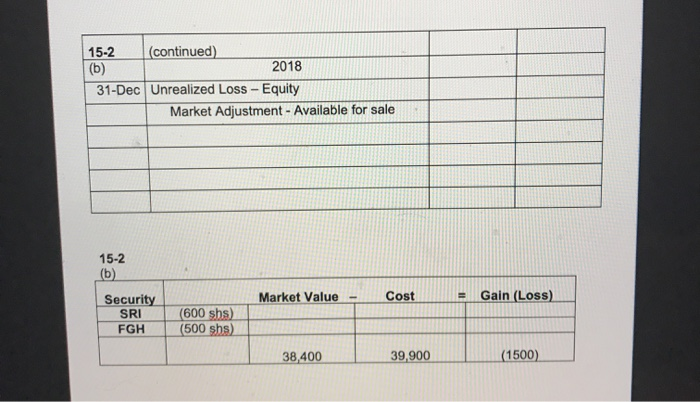

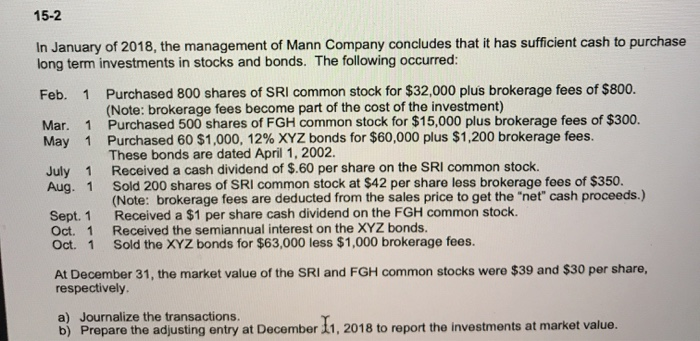

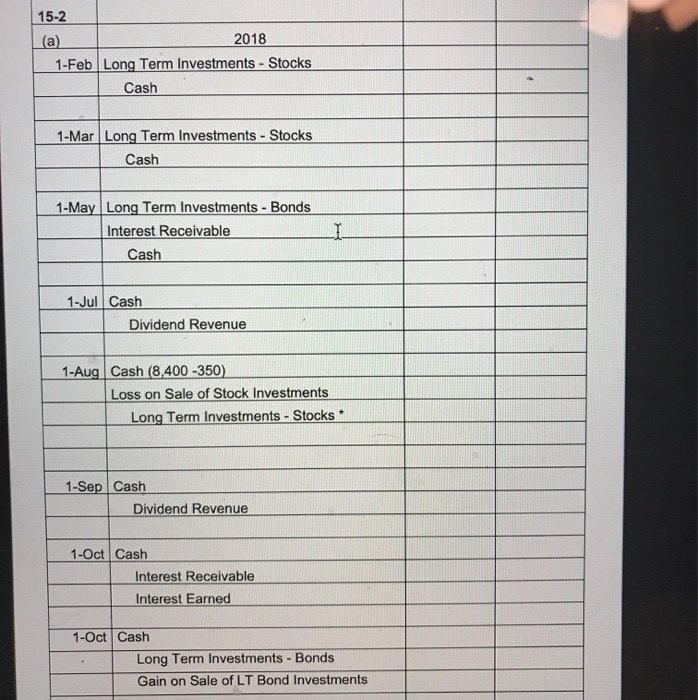

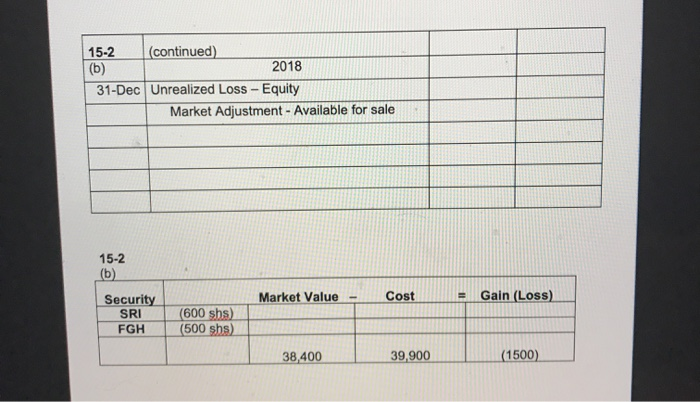

15-2 In January of 2018, the management of Mann Company concludes that it has sufficient cash to purchase long term investments in stocks and bonds. The following occurred: Feb. 1 Purchased 800 shares of SRI common stock for $32,000 plus brokerage fees of $800. (Note: brokerage fees become part of the cost of the investment) Mar. 1 Purchased 500 shares of FGH common stock for $15,000 plus brokerage fees of $300. May 1 Purchased 60 $1,000, 12% XYZ bonds for $60,000 plus $1,200 brokerage fees. These bonds are dated April 1, 2002. July 1 Received a cash dividend of $.60 per share on the SRI common stock. Aug. 1 Sold 200 shares of SRI common stock at $42 per share less brokerage fees of $350. (Note: brokerage fees are deducted from the sales price to get the "net" cash proceeds.) Sept. 1 Received a $1 per share cash dividend on the FGH common stock Oct. 1 Received the semiannual interest on the XYZ bonds. Oct. 1 Sold the XYZ bonds for $63,000 less $1,000 brokerage fees. At December 31, the market value of the SRI and FGH common stocks were $39 and $30 per share, respectively a) Journalize the transactions. b) Prepare the adjusting entry at December 11, 2018 to report the investments at market value. 15-2 (a) 2018 1-Feb Long Term Investments - Stocks Cash 1-Mar Long Term Investments - Stocks Cash 1-May Long Term Investments - Bonds Interest Receivable Cash 1-Jul Cash Dividend Revenue 1-Aug Cash (8,400 -350) Loss on Sale of Stock Investments Long Term Investments - Stocks * 1-Sep Cash Dividend Revenue 1-Oct Cash Interest Receivable Interest Earned 1-Oct Cash Long Term Investments - Bonds Gain on Sale of LT Bond Investments 15-2 (continued) (b) 2018 31-Dec Unrealized Loss - Equity Market Adjustment - Available for sale 15-2 (b) Market Value - Cost Gain (Loss) Security SRI FGH (600 sbs) (500 shs) 38,400 39.900 (1500)

15-2 In January of 2018, the management of Mann Company concludes that it has sufficient cash to purchase long term investments in stocks and bonds. The following occurred: Feb. 1 Purchased 800 shares of SRI common stock for $32,000 plus brokerage fees of $800. (Note: brokerage fees become part of the cost of the investment) Mar. 1 Purchased 500 shares of FGH common stock for $15,000 plus brokerage fees of $300. May 1 Purchased 60 $1,000, 12% XYZ bonds for $60,000 plus $1,200 brokerage fees. These bonds are dated April 1, 2002. July 1 Received a cash dividend of $.60 per share on the SRI common stock. Aug. 1 Sold 200 shares of SRI common stock at $42 per share less brokerage fees of $350. (Note: brokerage fees are deducted from the sales price to get the "net" cash proceeds.) Sept. 1 Received a $1 per share cash dividend on the FGH common stock Oct. 1 Received the semiannual interest on the XYZ bonds. Oct. 1 Sold the XYZ bonds for $63,000 less $1,000 brokerage fees. At December 31, the market value of the SRI and FGH common stocks were $39 and $30 per share, respectively a) Journalize the transactions. b) Prepare the adjusting entry at December 11, 2018 to report the investments at market value. 15-2 (a) 2018 1-Feb Long Term Investments - Stocks Cash 1-Mar Long Term Investments - Stocks Cash 1-May Long Term Investments - Bonds Interest Receivable Cash 1-Jul Cash Dividend Revenue 1-Aug Cash (8,400 -350) Loss on Sale of Stock Investments Long Term Investments - Stocks * 1-Sep Cash Dividend Revenue 1-Oct Cash Interest Receivable Interest Earned 1-Oct Cash Long Term Investments - Bonds Gain on Sale of LT Bond Investments 15-2 (continued) (b) 2018 31-Dec Unrealized Loss - Equity Market Adjustment - Available for sale 15-2 (b) Market Value - Cost Gain (Loss) Security SRI FGH (600 sbs) (500 shs) 38,400 39.900 (1500)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started