Answered step by step

Verified Expert Solution

Question

1 Approved Answer

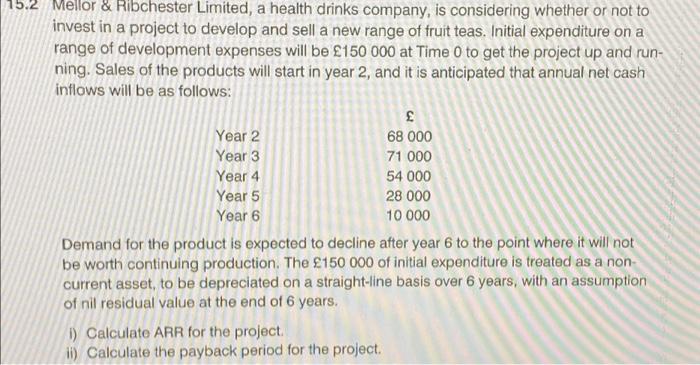

15.2 Mellor & Ribchester Limited, a health drinks company, is considering whether or not to invest in a project to develop and sell a new

15.2 Mellor & Ribchester Limited, a health drinks company, is considering whether or not to invest in a project to develop and sell a new range of fruit teas. Initial expenditure on a range of development expenses will be 150 000 at Time 0 to get the project up and run- ning. Sales of the products will start in year 2, and it is anticipated that annual net cash inflows will be as follows: Year 2 Year 3 Year 4 Year 5 Year 6 3 i) Calculate ARR for the project. ii) Calculate the payback period for the project. 68 000 71 000 54 000 28 000 10 000 Demand for the product is expected to decline after year 6 to the point where it will not be worth continuing production. The 150 000 of initial expenditure is treated as a non- current asset, to be depreciated on a straight-line basis over 6 years, with an assumption of nil residual value at the end of 6 years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started