Answered step by step

Verified Expert Solution

Question

1 Approved Answer

152.5 points The lottery commission is offering the winner of a recent jackpot a payout of 13 yearly payments $95,000 with the first payment occurring

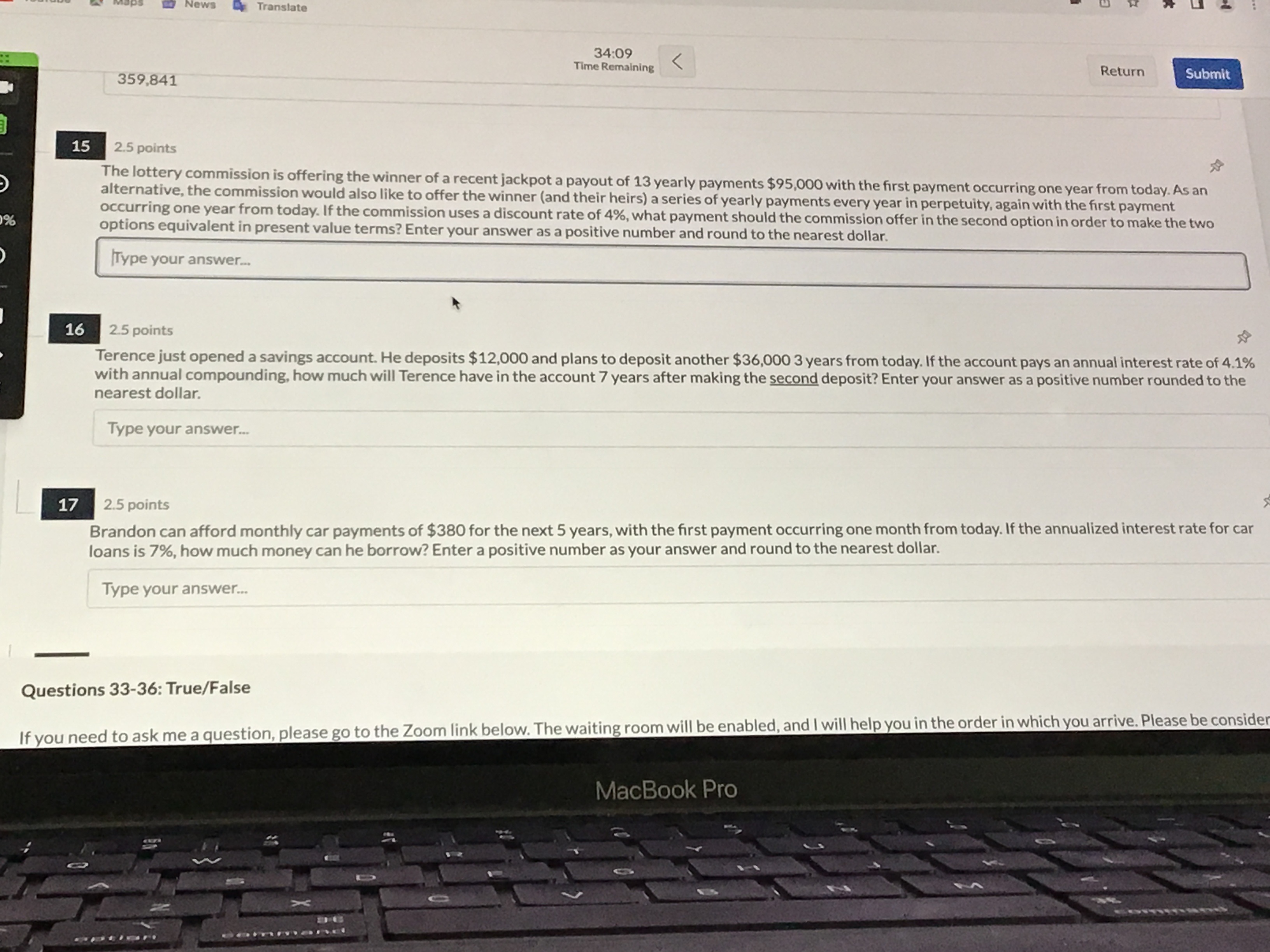

152.5 points The lottery commission is offering the winner of a recent jackpot a payout of 13 yearly payments $95,000 with the first payment occurring one year from today. As an alternative, the commission would also like to offer the winner (and their heirs) a series of yearly payments every year in perpetuity, again with the first payment occurring one year from today. If the commission uses a discount rate of 4%, what payment should the commission offer in the second option in order to make the two options equivalent in present value terms? Enter your answer as a positive number and round to the nearest dollar. Trype your answer.. 2.5 points Terence just opened a savings account. He deposits $12,000 and plans to deposit another $36,0003 years from today. If the account pays an annual interest rate of 4.1% with annual compounding, how much will Terence have in the account 7 years after making the second deposit? Enter your answer as a positive number rounded to the nearest dollar. Type your answer... 2.5 points Brandon can afford monthly car payments of $380 for the next 5 years, with the first payment occurring one month from today. If the annualized interest rate for car loans is 7%, how much money can he borrow? Enter a positive number as your answer and round to the nearest dollar

152.5 points The lottery commission is offering the winner of a recent jackpot a payout of 13 yearly payments $95,000 with the first payment occurring one year from today. As an alternative, the commission would also like to offer the winner (and their heirs) a series of yearly payments every year in perpetuity, again with the first payment occurring one year from today. If the commission uses a discount rate of 4%, what payment should the commission offer in the second option in order to make the two options equivalent in present value terms? Enter your answer as a positive number and round to the nearest dollar. Trype your answer.. 2.5 points Terence just opened a savings account. He deposits $12,000 and plans to deposit another $36,0003 years from today. If the account pays an annual interest rate of 4.1% with annual compounding, how much will Terence have in the account 7 years after making the second deposit? Enter your answer as a positive number rounded to the nearest dollar. Type your answer... 2.5 points Brandon can afford monthly car payments of $380 for the next 5 years, with the first payment occurring one month from today. If the annualized interest rate for car loans is 7%, how much money can he borrow? Enter a positive number as your answer and round to the nearest dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started