Answered step by step

Verified Expert Solution

Question

1 Approved Answer

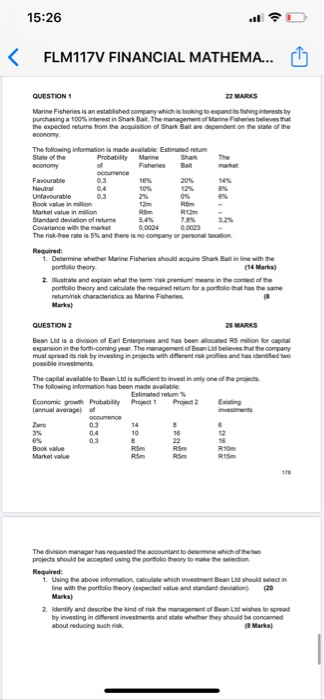

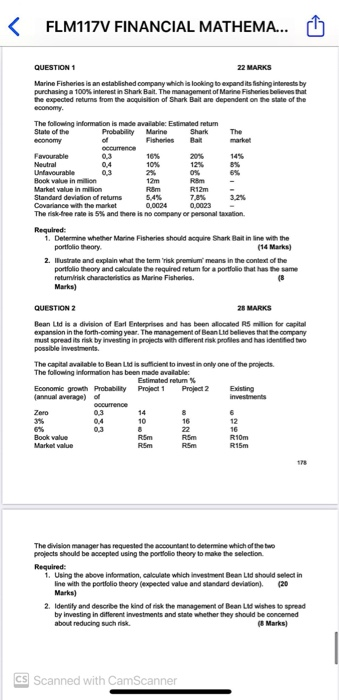

15:26 .. < FLM117V FINANCIAL MATHEMA... QUESTION 1 22 MARKS Marine Fisheries is an established company which is looking to expand its fishing interests

15:26 .. < FLM117V FINANCIAL MATHEMA... QUESTION 1 22 MARKS Marine Fisheries is an established company which is looking to expand its fishing interests by purchasing a 100% interest in Shark Bait. The management of Marine Fisheries believes that the expected returns from the acquisition of Shark Bait are dependent on the state of the economy The following information is made available: Estimated retur State of the economy Favourable Neutral Unfavourable Probability of Marine Shark The market occurence 0.3 20% 14% 0.4 10% 12% 0,3 2% 0% R12m 5.4% 0,0024 0,0023 Book value in million Market value in million Standard deviation of retums Covariance with the market The risk-free rate is 5% and there is no company or personal taxati Required: 1. Determine whether Marine Fisheries should acquire Shark Bait in line with the portfolio theory. (14 Marks) 2. Illustrate and explain what the term 'risk premium means in the context of the portfolio theory and calculate the required return for a portfolio that has the same return risk characteristics as Marine Fisheries. Marks) QUESTION 2 28 MARKS Bean Ltd is a division of Earl Enterprises and has been allocated RS million for capital expansion in the forthcoming year. The management of Bean Ltd believes that the company must spread its risk by investing in projects with different risk profiles and has identified two possible investments. The capital available to Bean Ltd is sufficient to invest in only one of the projects. The following information has been made available: Estimated return % Economic growth Probability Project 1 Project 2 Existing (annual average) of occurrence Zero 0.3 14 8 3% 0.4 10 16 6% 0.3 8 22 Book value R5m R5m R10m Market value R5m The division manager has requested the accountant to determine which of the two projects should be accepted using the portfolio theory to make the selection Required: 1. Using the above information, calculate which investment Bean Ltd should selectin line with the portfolio theory (expected value and standard deviation) (20 2. Identify and describe the kind of risk the management of Bean Ltd wishes to spread by investing in different investments and state whether they should be concemed about reducing such risk. (8 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started