Answered step by step

Verified Expert Solution

Question

1 Approved Answer

158. Pursuant to a divorce decree finalized in March of 2022, Jessica was awarded the family home worth $275,000, alimony of $550 per month (

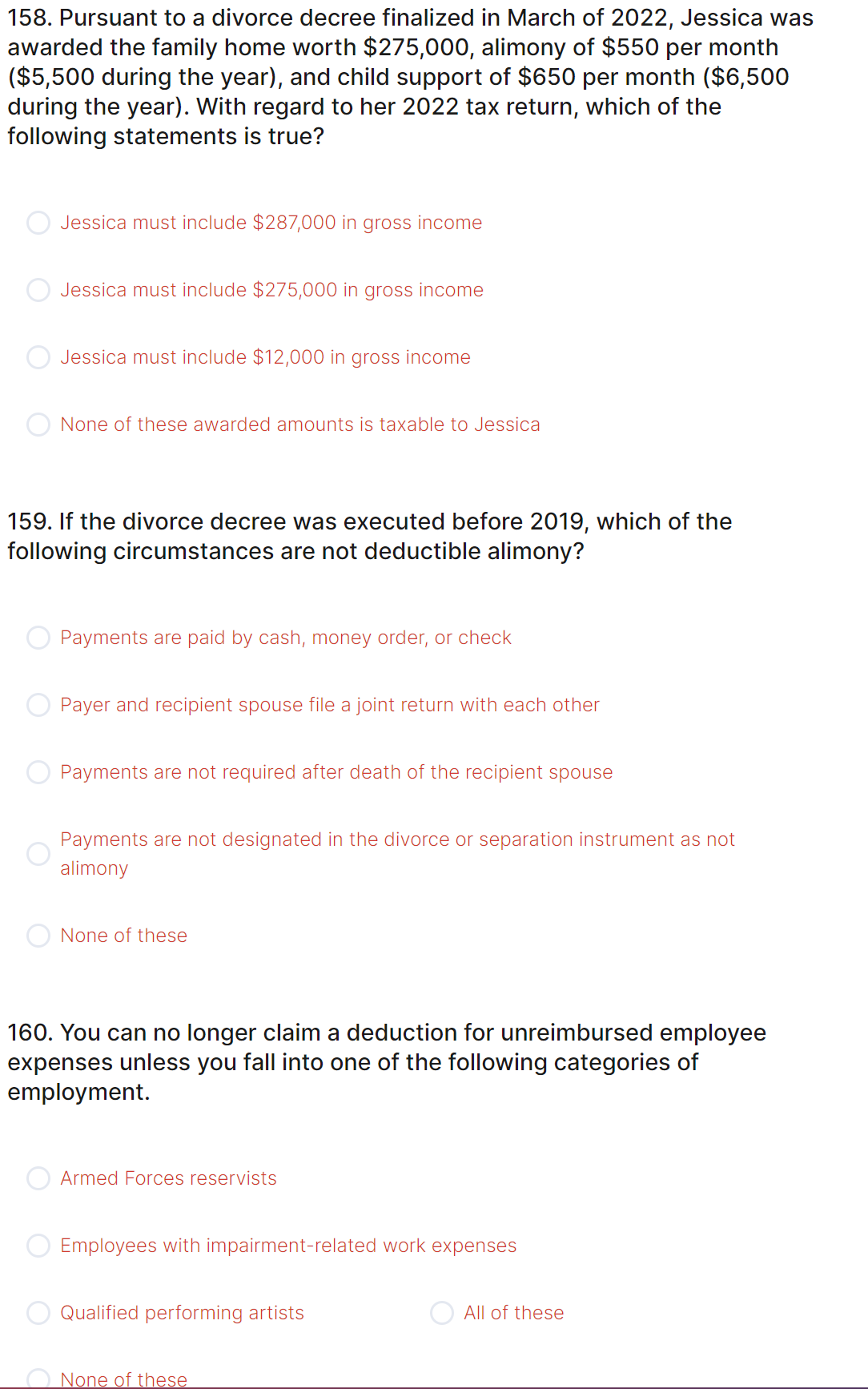

158. Pursuant to a divorce decree finalized in March of 2022, Jessica was awarded the family home worth $275,000, alimony of $550 per month ( $5,500 during the year), and child support of $650 per month ($6,500 during the year). With regard to her 2022 tax return, which of the following statements is true? Jessica must include $287,000 in gross income Jessica must include \$275,000 in gross income Jessica must include $12,000 in gross income None of these awarded amounts is taxable to Jessica 159. If the divorce decree was executed before 2019, which of the following circumstances are not deductible alimony? Payments are paid by cash, money order, or check Payer and recipient spouse file a joint return with each other Payments are not required after death of the recipient spouse Payments are not designated in the divorce or separation instrument as not alimony None of these 160. You can no longer claim a deduction for unreimbursed employee expenses unless you fall into one of the following categories of employment. Armed Forces reservists Employees with impairment-related work expenses Qualified performing artists All of these None of these

158. Pursuant to a divorce decree finalized in March of 2022, Jessica was awarded the family home worth $275,000, alimony of $550 per month ( $5,500 during the year), and child support of $650 per month ($6,500 during the year). With regard to her 2022 tax return, which of the following statements is true? Jessica must include $287,000 in gross income Jessica must include \$275,000 in gross income Jessica must include $12,000 in gross income None of these awarded amounts is taxable to Jessica 159. If the divorce decree was executed before 2019, which of the following circumstances are not deductible alimony? Payments are paid by cash, money order, or check Payer and recipient spouse file a joint return with each other Payments are not required after death of the recipient spouse Payments are not designated in the divorce or separation instrument as not alimony None of these 160. You can no longer claim a deduction for unreimbursed employee expenses unless you fall into one of the following categories of employment. Armed Forces reservists Employees with impairment-related work expenses Qualified performing artists All of these None of these Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started