Answered step by step

Verified Expert Solution

Question

1 Approved Answer

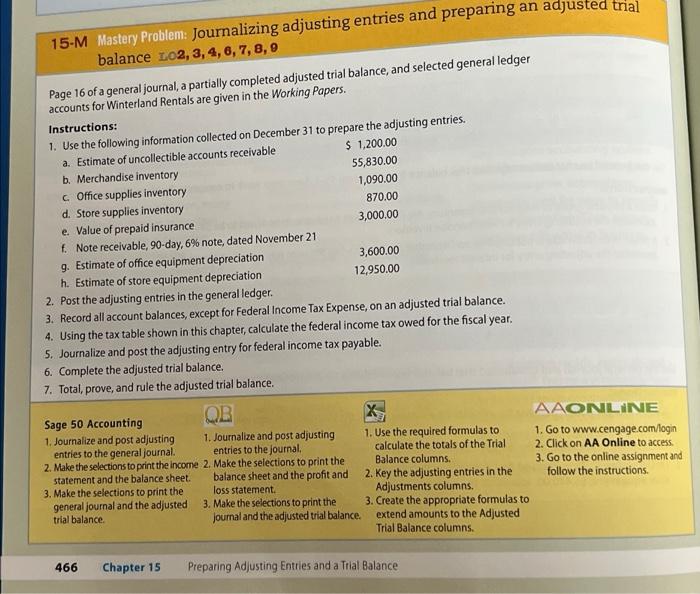

15-M Mastery Problem: Journalizing adjusting entries and preparing an adjusted trial balance L02, 3, 4, 6, 7, 8, 9 Page 16 of a general

15-M Mastery Problem: Journalizing adjusting entries and preparing an adjusted trial balance L02, 3, 4, 6, 7, 8, 9 Page 16 of a general journal, a partially completed adjusted trial balance, and selected general ledger accounts for Winterland Rentals are given in the Working Papers. Instructions: 1. Use the following information collected on December 31 to prepare the adjusting entries. a. Estimate of uncollectible accounts receivable b. Merchandise inventory c. Office supplies inventory $ 1,200.00 55,830.00 1,090.00 d. Store supplies inventory 870.00 e. Value of prepaid insurance 3,000.00 f. Note receivable, 90-day, 6 % note, dated November 21 g. Estimate of office equipment depreciation h. Estimate of store equipment depreciation 3,600.00 12,950.00 2. Post the adjusting entries in the general ledger. 3. Record all account balances, except for Federal Income Tax Expense, on an adjusted trial balance.. 4. Using the tax table shown in this chapter, calculate the federal income tax owed for the fiscal year. 5. Journalize and post the adjusting entry for federal income tax payable. 6. Complete the adjusted trial balance. 7. Total, prove, and rule the adjusted trial balance. Sage 50 Accounting 1. Journalize and post adjusting entries to the general journal. 2. Make the selections to print the income statement and the balance sheet. 3. Make the selections to print the general journal and the adjusted trial balance. 466 Chapter 15 QB 1. Journalize and post adjusting entries to the journal. 2. Make the selections to print the balance sheet and the profit and loss statement. 3. Make the selections to print the journal and the adjusted trial balance. 1. Use the required formulas to calculate the totals of the Trial. Balance columns. 2. Key the adjusting entries in the Adjustments columns. 3. Create the appropriate formulas to extend amounts to the Adjusted Trial Balance columns. Preparing Adjusting Entries and a Trial Balance AAONLINE 1. Go to www.cengage.com/login 2. Click on AA Online to access. 3. Go to the online assignment and follow the instructions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started