Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16 & 17. 16. A calendar-year corporation incurs $53,000 of start-up costs. If the corporation began business on August 31 of the current year, what

16 & 17.

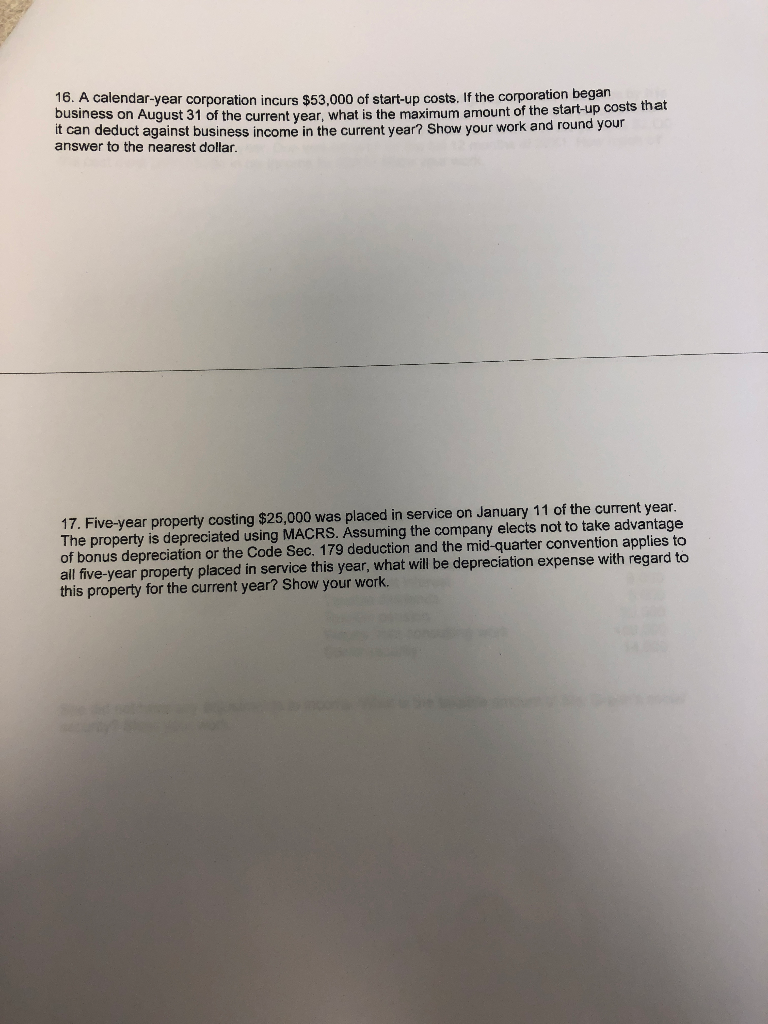

16. A calendar-year corporation incurs $53,000 of start-up costs. If the corporation began business on August 31 of the current year, what is the maximum amount of the start-up costs that it can deduct against business income in the current year? Show your work and round your answer to the nearest dollar. 17. Five-year property costing $25,000 was placed in service on January 11 of the current year. The property is depreciated using MACRS. Assuming the company elects not to take advantage of bonus depreciation or the Code Sec. 179 deduction and the mid-quarter convention applies to all five-year property placed in service this year, what will be depreciation expense with regard to this property for the current year? Show your workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started