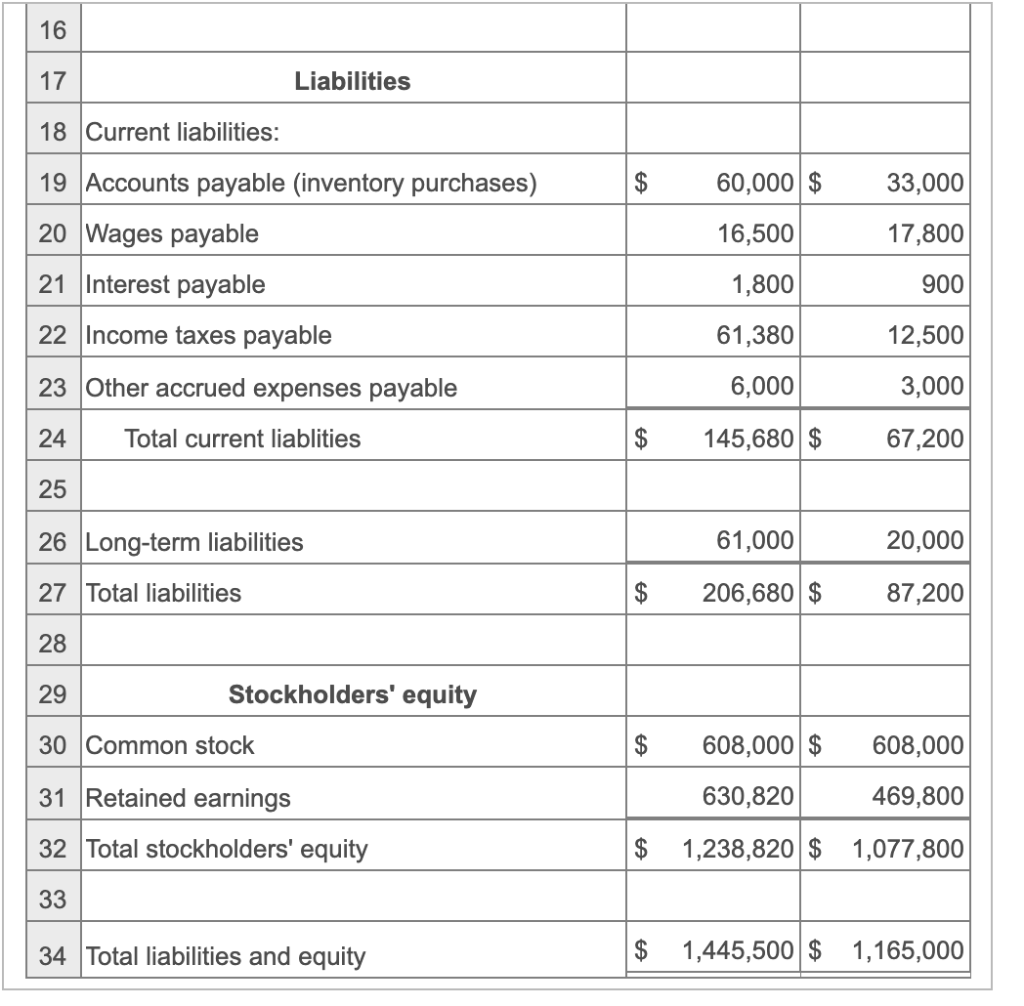

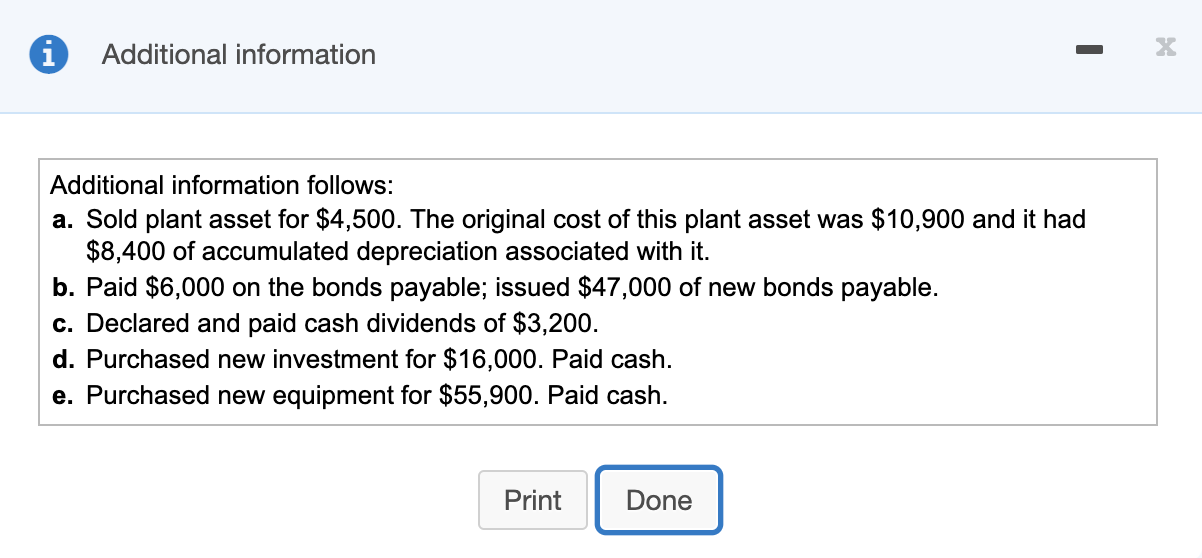

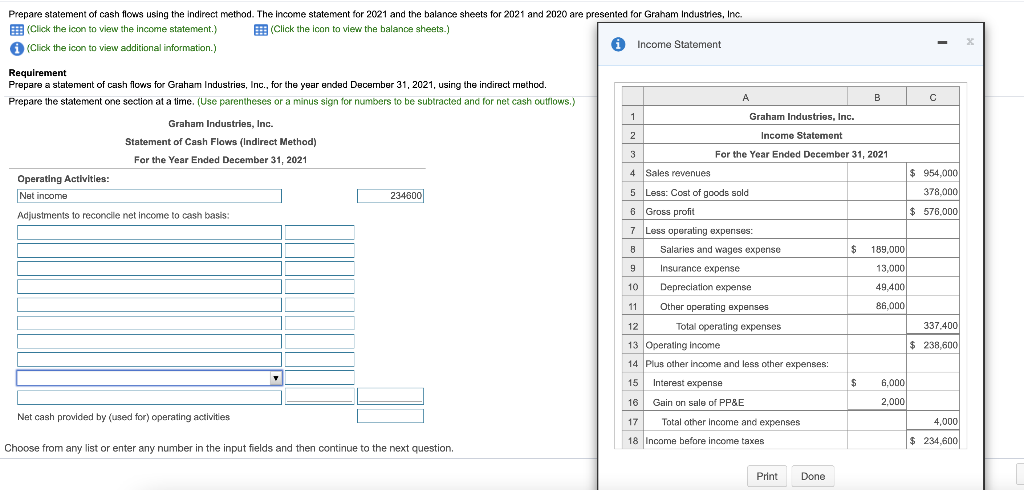

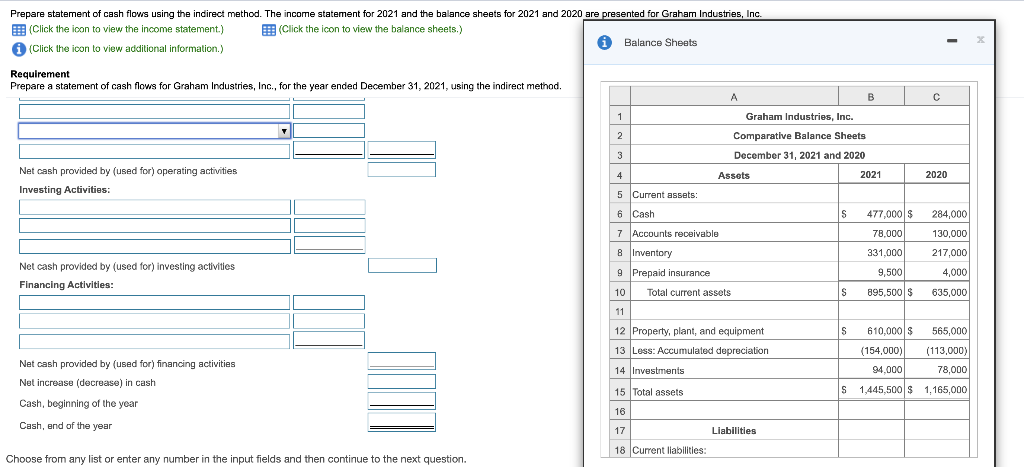

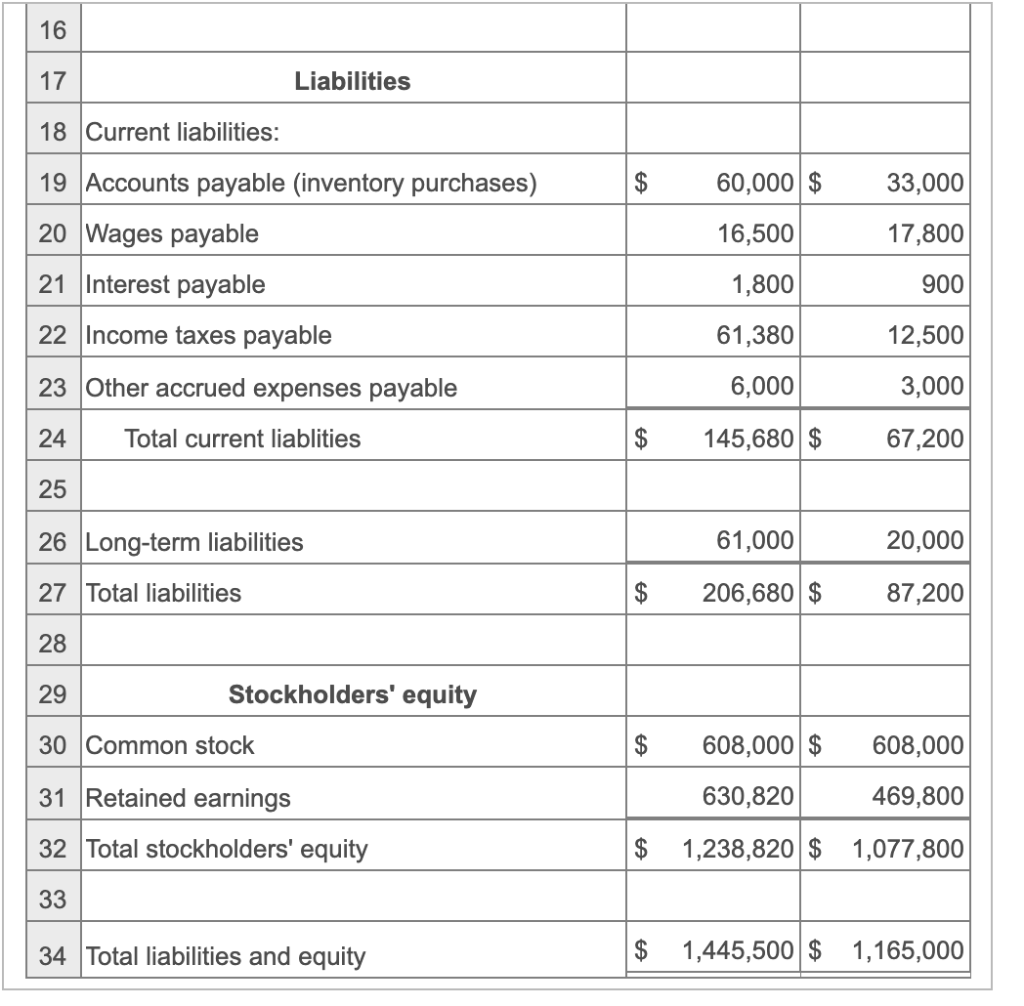

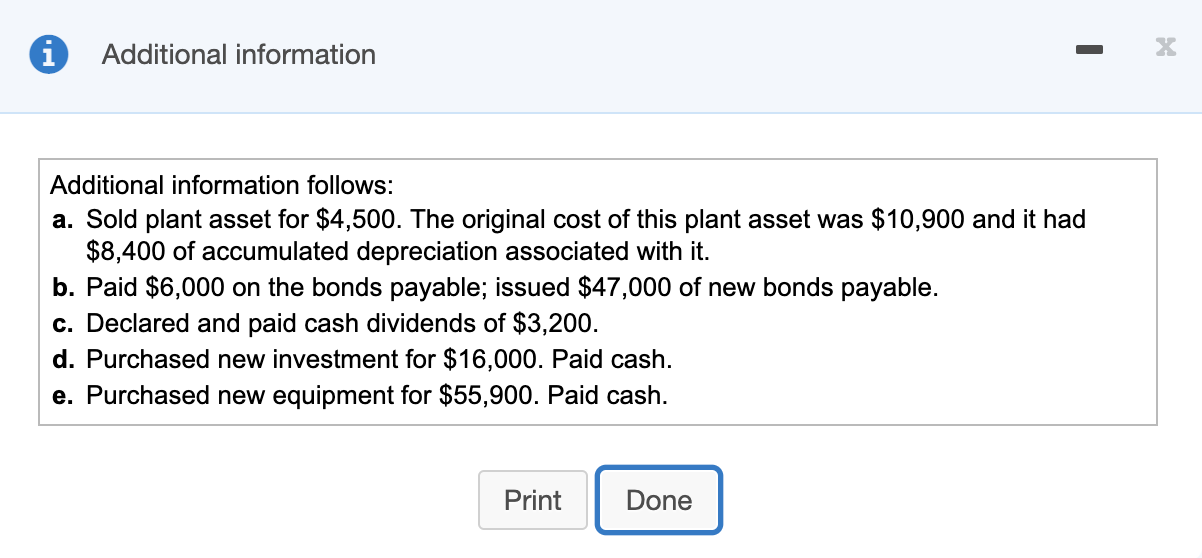

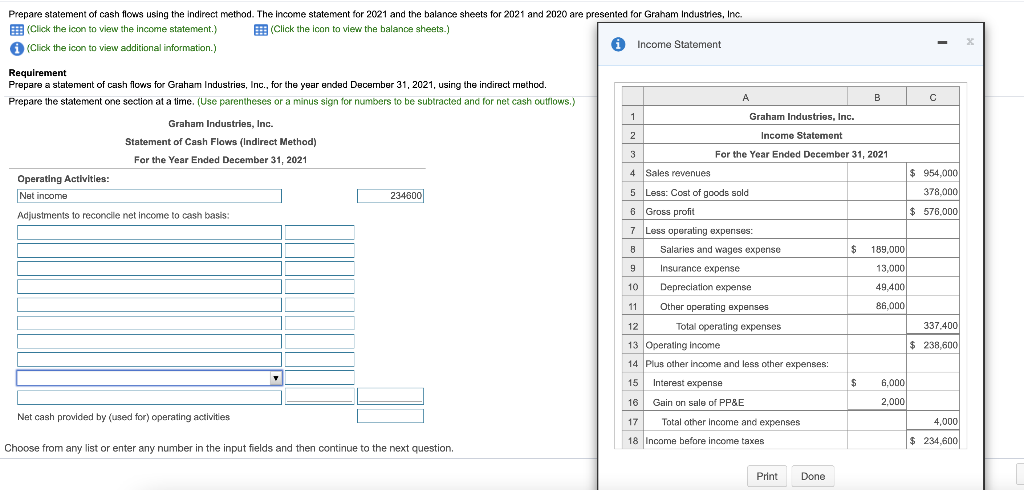

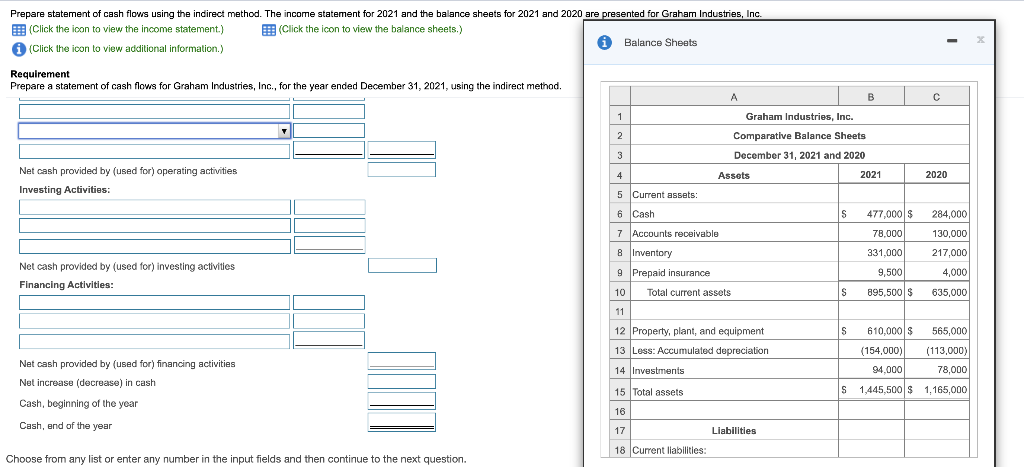

16 17 Liabilities 18 Current liabilities: $ 60,000 $ 33,000 16,500 17,800 19 Accounts payable (inventory purchases) 20 Wages payable 21 Interest payable 22 Income taxes payable 1,800 900 61,380 12,500 23 Other accrued expenses payable 6,000 3,000 24 Total current liablities $ 145,680 $ 67,200 25 26 Long-term liabilities 61,000 20,000 27 Total liabilities $ 206,680 $ 87,200 28 29 Stockholders' equity 30 Common stock $ 608,000 $ 608,000 31 Retained earnings 630,820 469,800 32 Total stockholders' equity $ 1,238,820 $ 1,077,800 33 34 Total liabilities and equity $ 1,445,500 $ 1,165,000 Additional information Additional information follows: a. Sold plant asset for $4,500. The original cost of this plant asset was $10,900 and it had $8,400 of accumulated depreciation associated with it. b. Paid $6,000 on the bonds payable; issued $47,000 of new bonds payable. c. Declared and paid cash dividends of $3,200. d. Purchased new investment for $16,000. Paid cash. e. Purchased new equipment for $55,900. Paid cash. Print Done Prepare statement of cash flows using the indirect method. The income statement for 2021 and the balance sheets for 2021 and 2020 are presented for Graham Industries, Inc (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) (Click the icon to view additional information.) ) A Income Statement Requirement Prepare a statement of cash flows for Graham Industries, Inc., for the year ended December 31, 2021, using the indirect method. B A Prepare the statement one section at a time. (Use parentheses or a minus sign for numbers to be subtracted and for net cash outflows.) 1 1 Graham Industries, Inc. Graham Industries, Inc. , 2 Income Statement Statement of Cash Flows (Indirect Method) 3 For the Year Ended December 31, 2021 For the Year Ended December 31, 2021 , 4 Sales revenues $ 954,000 Operating Activities: Net income 234600 5 Less: Cost of goods sold 378,000 Adjustments to reconcile net income to cash basis: 6 Gross profit $ 576,000 7 Less operating expenses: 8 Salaries and wages expense $ 189,000 9 Insurance expense 13,000 10 Depreciation expense 49.4001 11 Other operating expenses 86,000 12 Total operating expenses 337.400 13 Operating income $ 238,600 14 Plus other income and less other expenses: 15 Interest expense $ 6,000 16 Gain on sale of PP&E 2,000 Net cash provided by used for) operating activities 17 Total other Income and expenses 4,000 18 Income before income taxes $ 234,600 Choose from any list or enter any number in the input fields and then continue to the next question. Print Done Prepare statement of cash flows using the indirect method. The income statement for 2021 and the balance sheets for 2021 and 2020 are presented for Graham Industries, Inc. B (Click the icon to view the income statement.) (Click the icon to view the balance sheets.) (Click the icon to view additional information.) A Balance Sheets Requirement Prepare a statement of cash flows for Graham Industries, Inc., for the year ended December 31, 2021, using the indirect method. A B 1 2 Graham Industries, Inc. Comparative Balance Sheets December 31, 2021 and 2020 3 4 Assets 2021 2020 Net cash provided by (used for) operating activities Investing Activities: 5 Current assets: 6 Cash S 477,000 $ 78,000 7 Accounts receivable 284,000 130,000 217,000 8 Inventory 331,000 Net cash provided by (used for) investing activities Financing Activities: 9,500 4,000 9 Prepaid insurance 10 Total current assets S 895,500 $ 635,000 11 S 610,0001s 565,000 12 Property, plant, and equipment 13 Less: Accumulated depreciation 14 Investments Net cash provided by (used for) financing activities Nel increase (decrease) in cash Cash, beginning of the year Cash, end of the year (154,000) (113,000) 94,000 78,000 S 1,445,500 $ 1,165,000 15 Total assets 16 17 Liabilities 18 Current liabilities: Choose from any list or enter any number in the input fields and then continue to the next