Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16 & 18 W2021 (i Saved On 1 January 20X2. Supergrocery Inc. sold its major distribution facility, with a 22-year remaining life, to a real

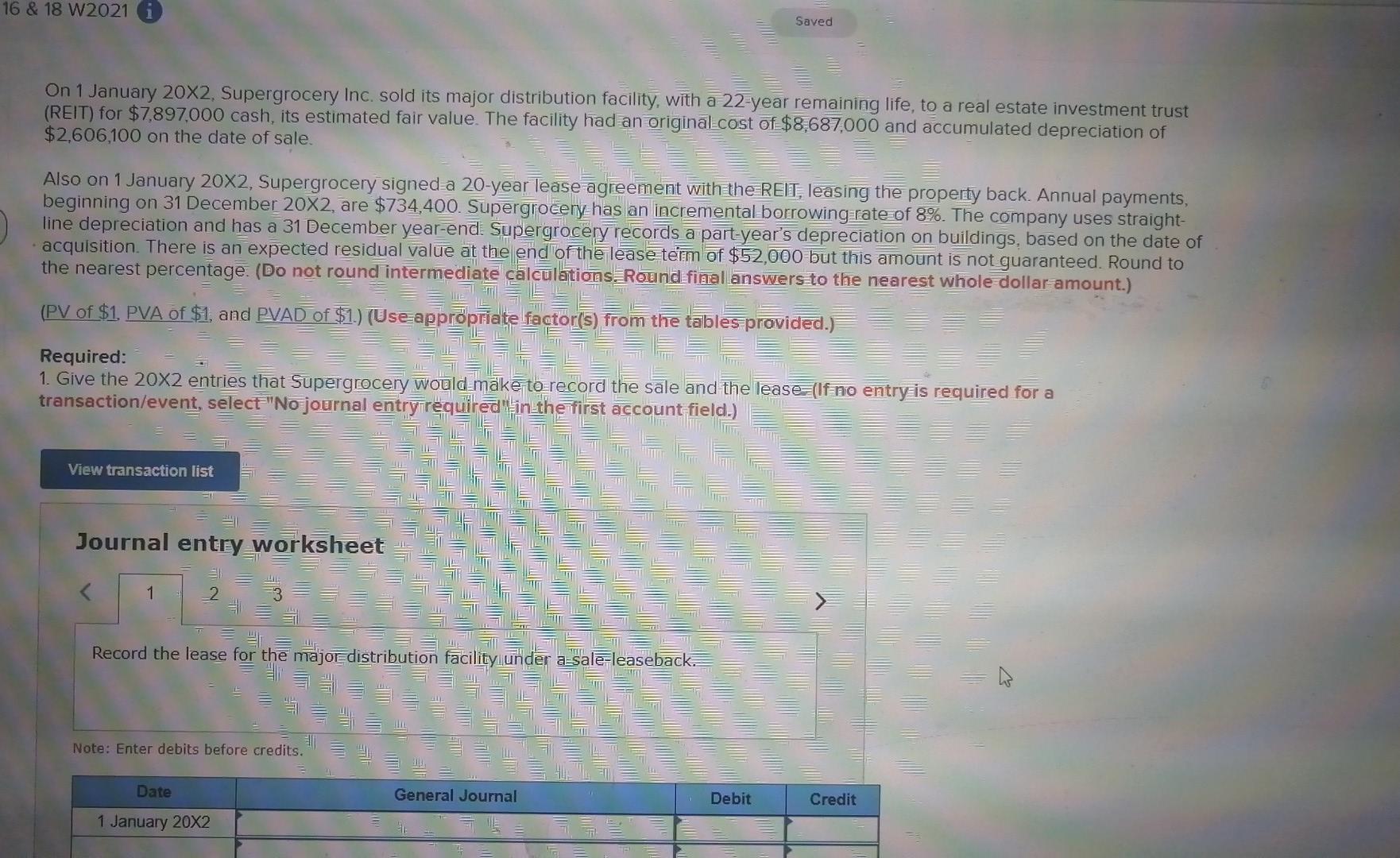

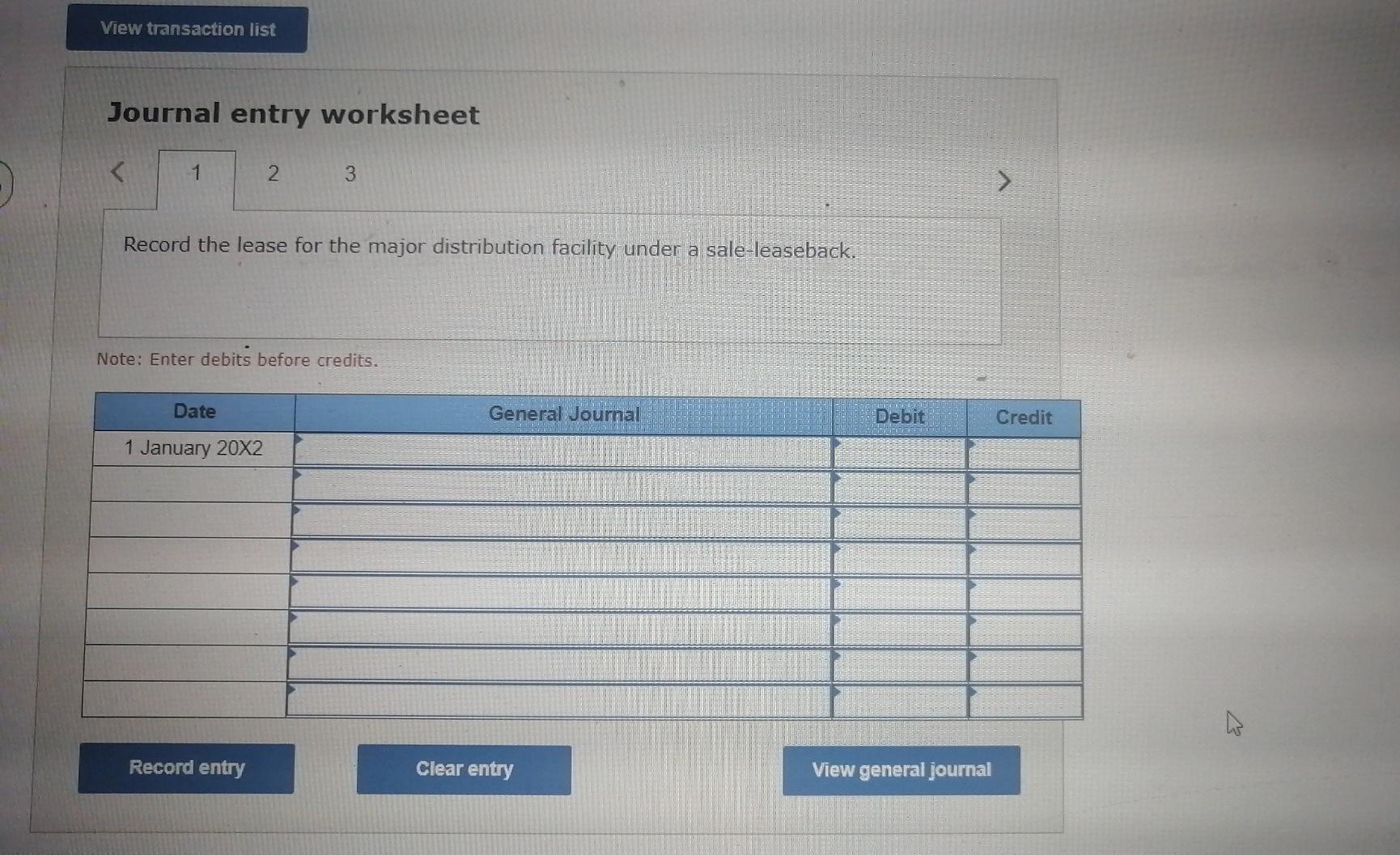

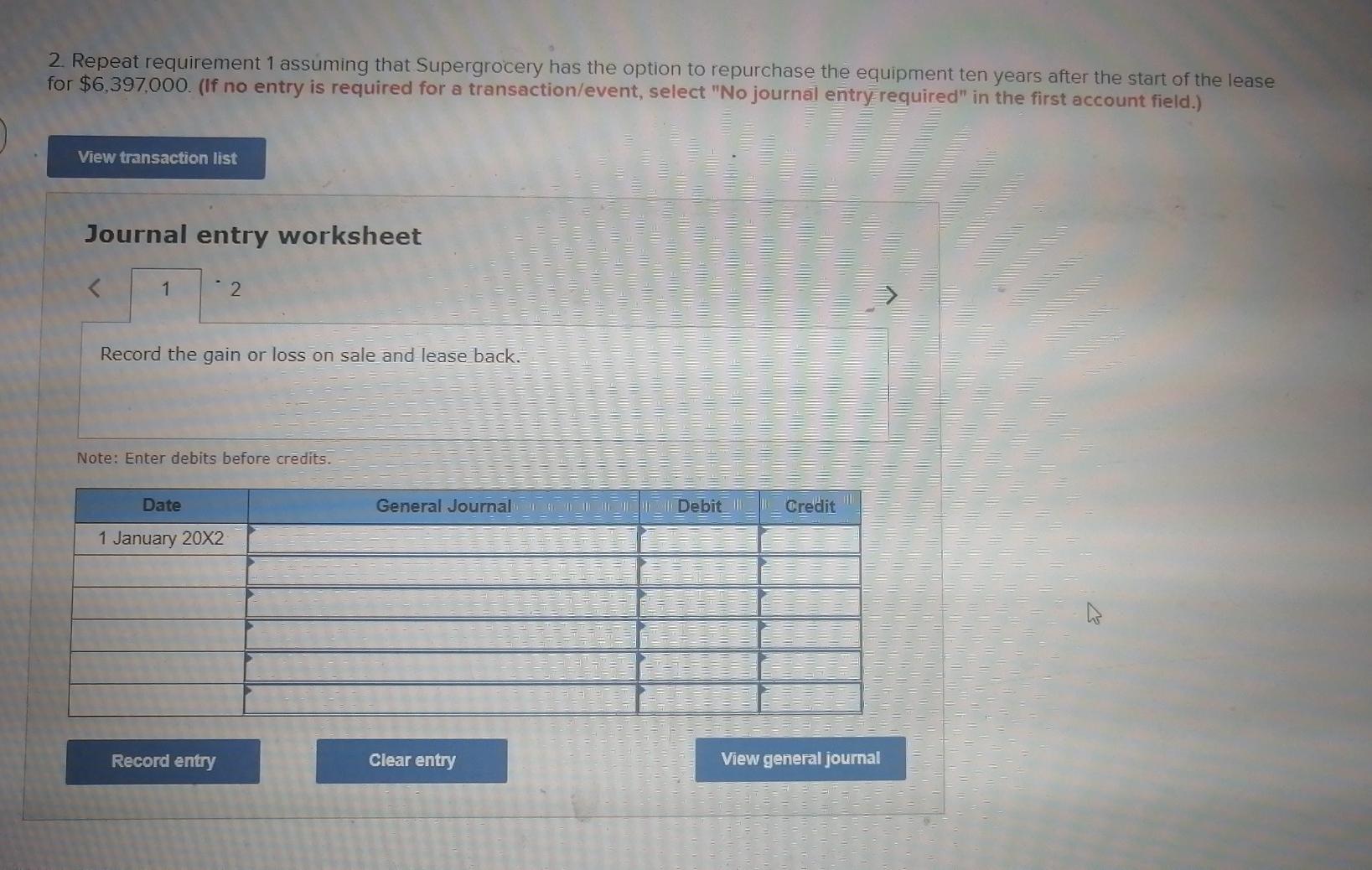

16 & 18 W2021 (i Saved On 1 January 20X2. Supergrocery Inc. sold its major distribution facility, with a 22-year remaining life, to a real estate investment trust (REIT) for $7,897,000 cash, its estimated fair value. The facility had an original cost of $8,687,000 and accumulated depreciation of $2,606,100 on the date of sale. Also on 1 January 20X2, Supergrocery signed a 20-year lease agreement with the REIT, leasing the property back. Annual payments, beginning on 31 December 20X2, are $734,400. Supergrocery has an incremental borrowing rate of 8%. The company uses straight- line depreciation and has a 31 December year-end Supergrocery records a part-year's depreciation on buildings, based on the date of acquisition. There is an expected residual value at the end of the lease term of $52,000 but this amount is not guaranteed. Round to the nearest percentage. (Do not round intermediate calculations. Round final answers to the nearest whole dollar amount.) (PV of $1. PVA of $1, and PVAD of $1.) (Use appropriate factor(s) from the tables provided.) Required: 1. Give the 20x2 entries that Supergrocery would make to record the sale and the lease (if no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the lease for the major distribution facility under a sale-leaseback. Note: Enter debits before credits. Date General Journal Debit Credit 1 January 20X2 View transaction list Journal entry worksheet .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started