Answered step by step

Verified Expert Solution

Question

1 Approved Answer

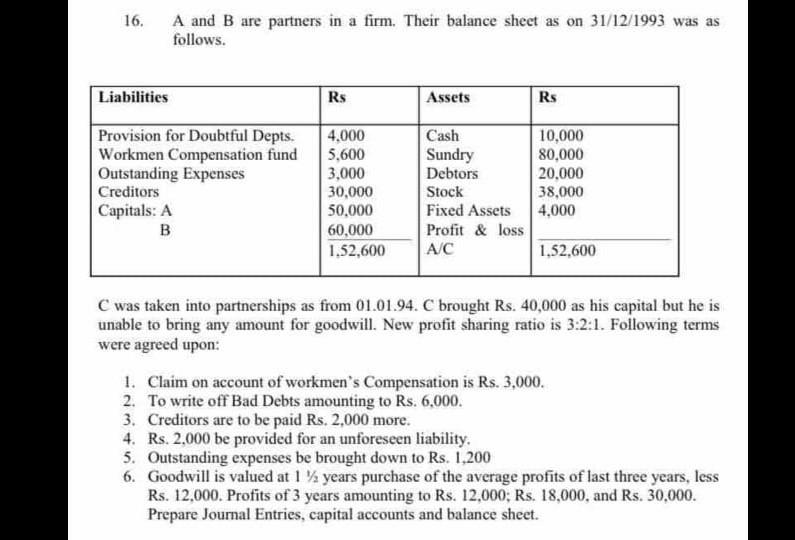

16. A and B are partners in a firm. Their balance sheet as on 31/12/1993 was as follows. Liabilities Rs Assets Rs Provision for Doubtful

16. A and B are partners in a firm. Their balance sheet as on 31/12/1993 was as follows. Liabilities Rs Assets Rs Provision for Doubtful Depts. Workmen Compensation fund Outstanding Expenses Creditors Capitals: A B 4,000 5,600 3,000 30,000 50,000 60,000 1.52,600 Cash Sundry Debtors Stock Fixed Assets Profit & loss 10,000 80,000 20,000 38,000 4,000 A/C 1,52,600 C was taken into partnerships as from 01.01.94. C brought Rs. 40,000 as his capital but he is unable to bring any amount for goodwill. New profit sharing ratio is 3:2:1. Following terms were agreed upon: 1. Claim on account of workmen's Compensation is Rs. 3,000. 2. To write off Bad Debts amounting to Rs. 6.000. 3. Creditors are to be paid Rs. 2,000 more. 4. Rs. 2,000 be provided for an unforeseen liability. 5. Outstanding expenses be brought down to Rs. 1,200 6. Goodwill is valued at 1% years purchase of the average profits of last three years, less Rs. 12,000. Profits of 3 years amounting to Rs. 12,000; Rs. 18,000, and Rs. 30,000. Prepare Journal Entries, capital accounts and balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started