Answered step by step

Verified Expert Solution

Question

1 Approved Answer

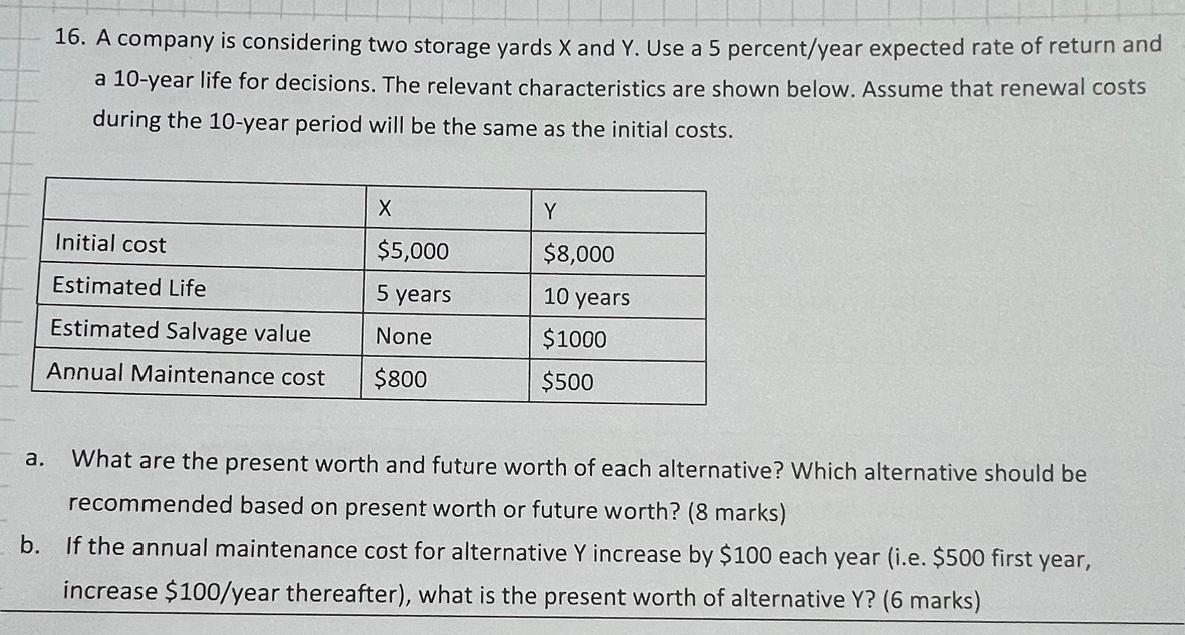

16. A company is considering two storage yards X and Y. Use a 5 percent/year expected rate of return and a 10-year life for

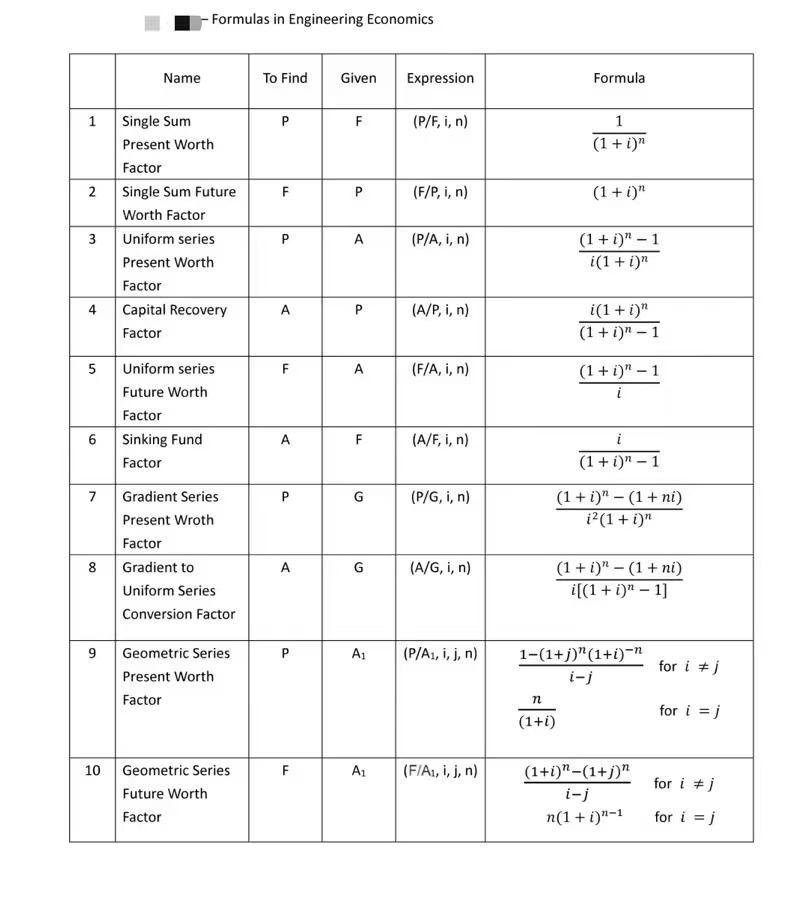

16. A company is considering two storage yards X and Y. Use a 5 percent/year expected rate of return and a 10-year life for decisions. The relevant characteristics are shown below. Assume that renewal costs during the 10-year period will be the same as the initial costs. X Initial cost $5,000 Estimated Life 5 years Estimated Salvage value None Annual Maintenance cost $800 Y $8,000 10 years $1000 $500 a. What are the present worth and future worth of each alternative? Which alternative should be recommended based on present worth or future worth? (8 marks) b. If the annual maintenance cost for alternative Y increase by $100 each year (i.e. $500 first year, increase $100/year thereafter), what is the present worth of alternative Y? (6 marks) 1 2 3 4 5 6 7 8 9 - Formulas in Engineering Economics Name Single Sum Present Worth Factor Single Sum Future Worth Factor Uniform series Present Worth Factor Capital Recovery Factor Uniform series Future Worth Factor Sinking Fund Factor Gradient Series Present Wroth Factor Gradient to Uniform Series Conversion Factor Geometric Series Present Worth Factor 10 Geometric Series Future Worth Factor To Find Given P LL P A F A A P F LL F P A P A F G G A A Expression (P/F, I, n) (F/P, i, n) (P/A, i, n) (A/P, i, n) (F/A, i, n) (A/F, I, n) (P/G, i, n) (A/G, i, n) (P/A, i, j, n) (F/A, i, j, n) Formula n (1+i) 1 (1 + i)n (1 + i)" (1 + i)" - 1 i(1 + i)" i(1 + i)" (1+i)n-1 (1 + i)" - 1 i i (1+i)n-1 (1+i)" (1 + ni) i(1 + i)n (1 + i)" - (1 + ni) i[(1 + i)" - 1] 1-(1+j)(1+i)-n i-j (1+i)"-(1+j)" i-j n(1+i)"-1 for i #j for i = j for i #j for i= j

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To solve this problem well use the present worth PW and future worth FW calculations a Present Worth and Future Worth of each alternative For ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started