Answered step by step

Verified Expert Solution

Question

1 Approved Answer

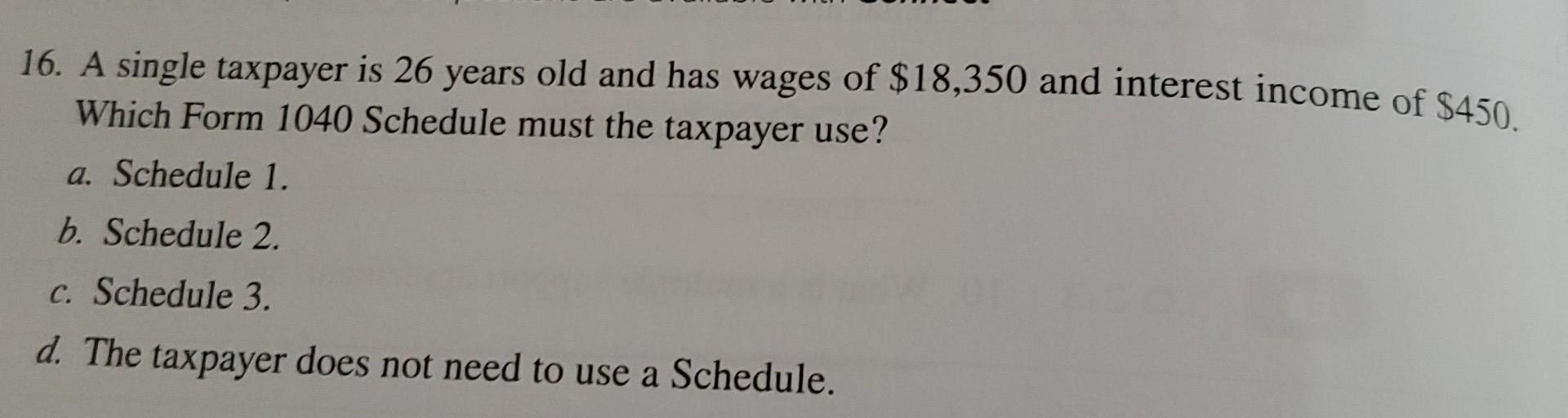

16. A single taxpayer is 26 years old and has wages of $18,350 and interest income of $450 Which Form 1040 Schedule must the taxpayer

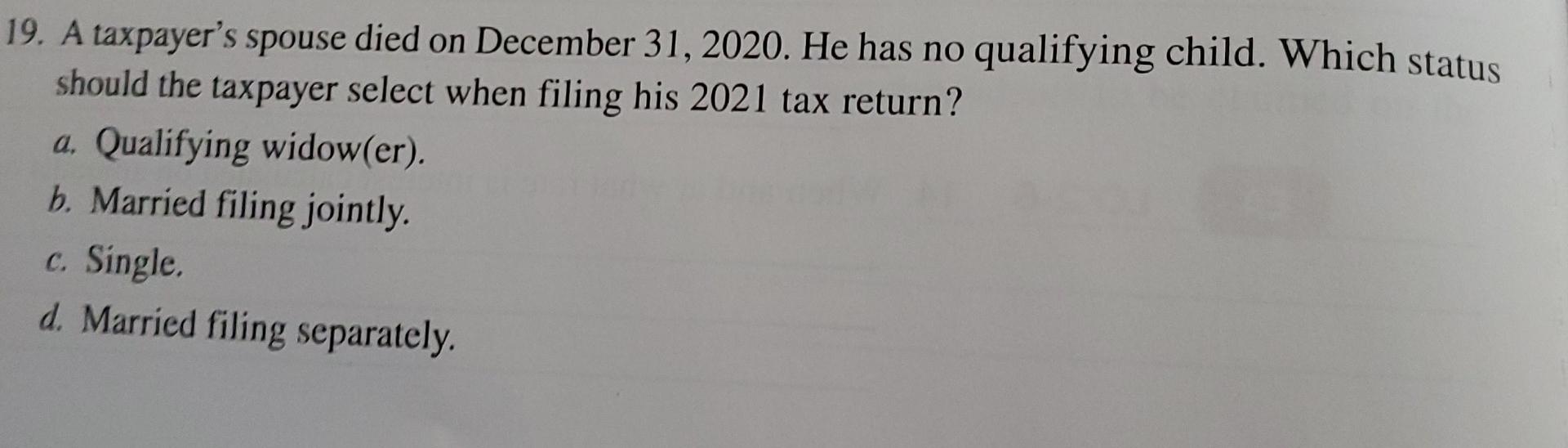

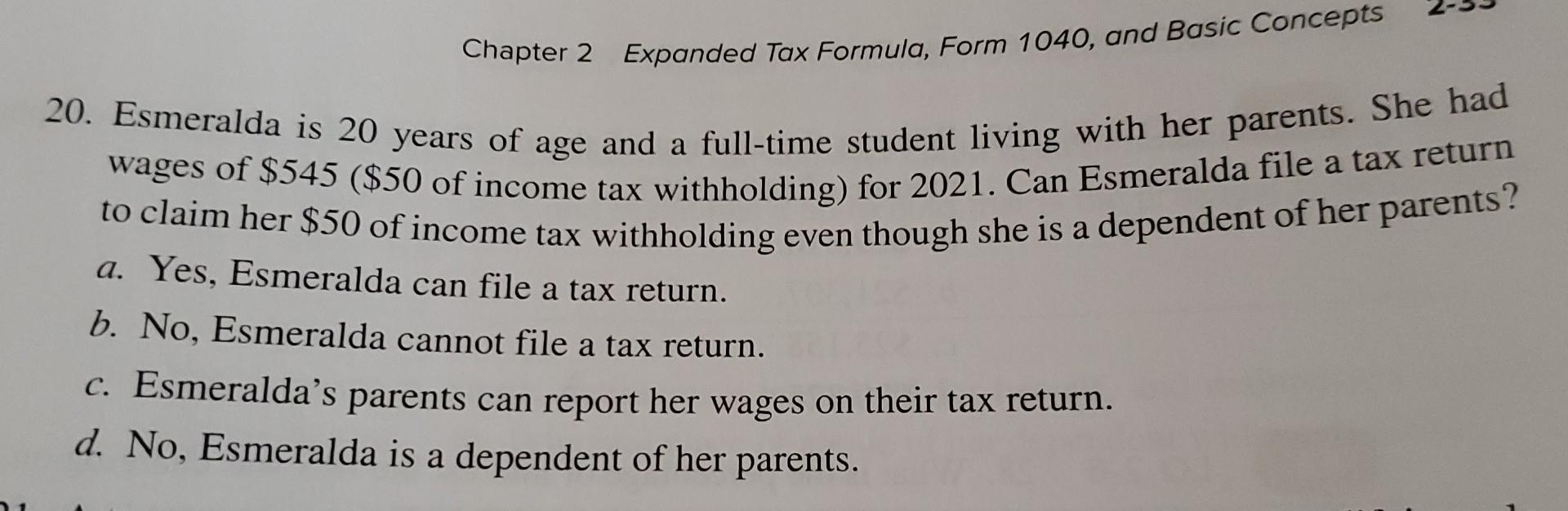

16. A single taxpayer is 26 years old and has wages of $18,350 and interest income of $450 Which Form 1040 Schedule must the taxpayer use? a. Schedule 1. b. Schedule 2. c. Schedule 3. d. The taxpayer does not need to use a Schedule. 19. A taxpayer's spouse died on December 31, 2020. He has no qualifying child. Which status should the taxpayer select when filing his 2021 tax return? a. Qualifying widow(er). b. Married filing jointly. c. Single. d. Married filing separately. Chapter 2 Expanded Tax Formula, Form 1040, and Basic Concepts 20. Esmeralda is 20 years of age and a full-time student living with her parents. She had wages of $545 ($50 of income tax withholding) for 2021. Can Esmeralda file a tax return to claim her $50 of income tax withholding even though she is a dependent of her parents? a. Yes, Esmeralda can file a tax return. b. No, Esmeralda cannot file a tax return. c. Esmeralda's parents can report her wages on their tax return. d. No, Esmeralda is a dependent of her parents

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started