Answered step by step

Verified Expert Solution

Question

1 Approved Answer

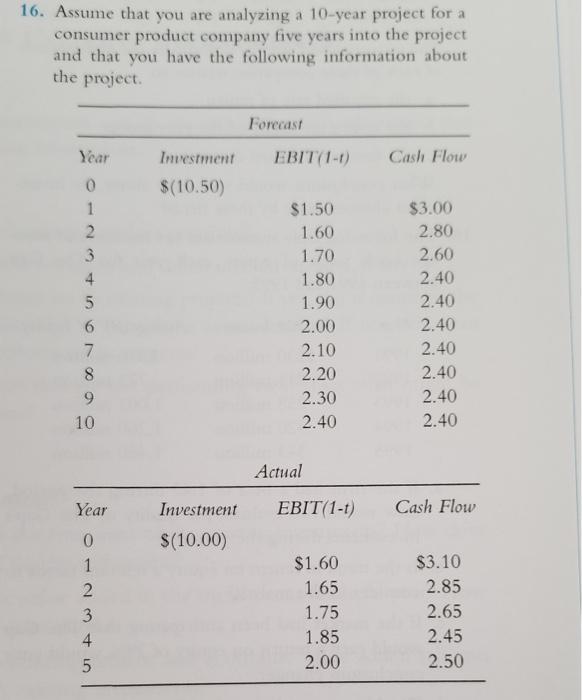

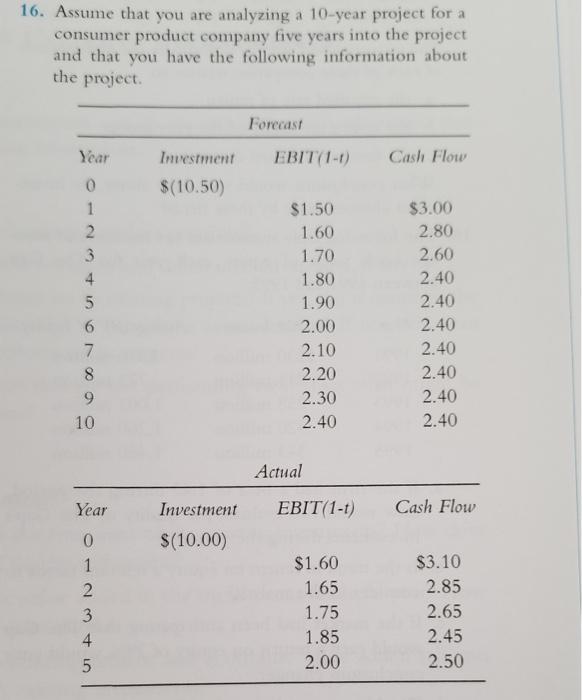

16. Assume that you are analyzing a 10-year project for a consumer product company five years into the project and that you have the following

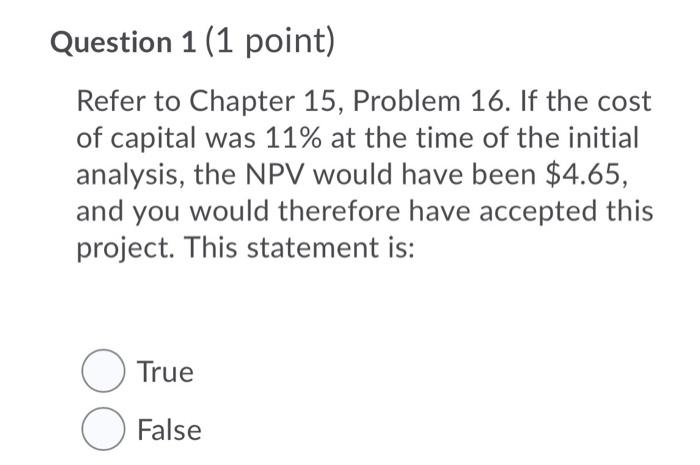

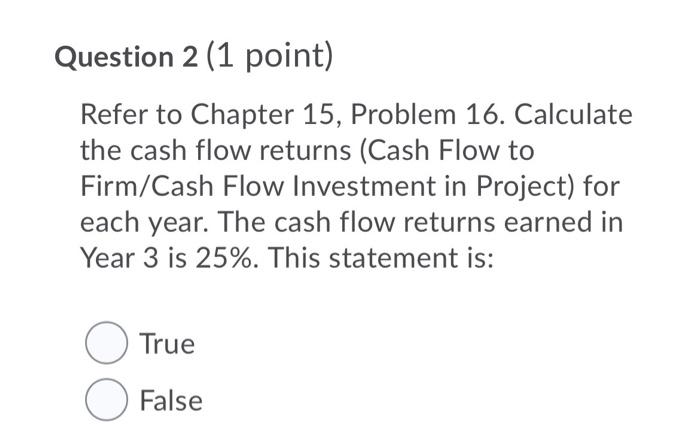

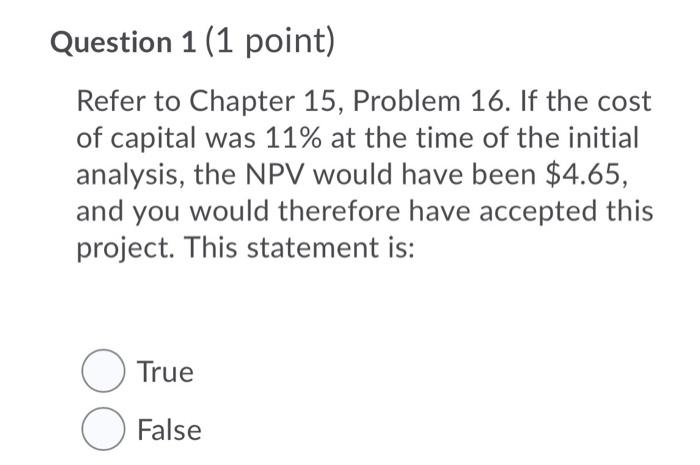

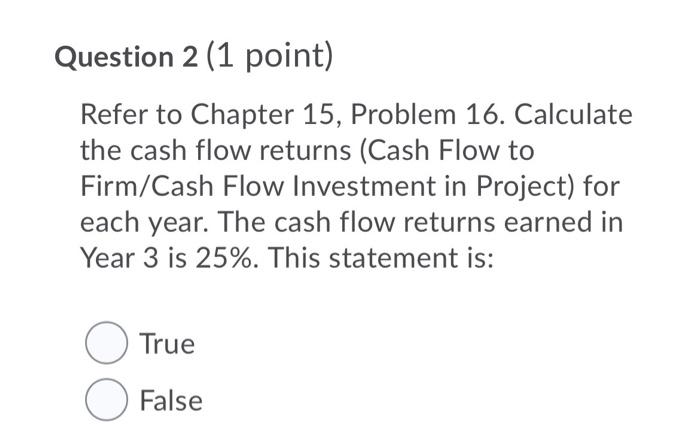

16. Assume that you are analyzing a 10-year project for a consumer product company five years into the project and that you have the following information about the project Forecast Year Investment EBIT(1-1) Cash Flow $(10.50) 0 1 2 3 4 5 6 7 8 9 10 $1.50 1.60 1.70 1.80 1.90 2.00 2.10 2.20 2.30 2.40 $3.00 2.80 2.60 2.40 2.40 2.40 2.40 2.40 2.40 2.40 Actual Year Investment EBIT (1-1) Cash Flow $(10.00) 0 1 2 3 4. 5 $1.60 1.65 1.75 1.85 2.00 $3.10 2.85 2.65 2.45 2.50 Question 1 (1 point) Refer to Chapter 15, Problem 16. If the cost of capital was 11% at the time of the initial analysis, the NPV would have been $4.65, and you would therefore have accepted this project. This statement is: True O False Question 2 (1 point) Refer to Chapter 15, Problem 16. Calculate the cash flow returns (Cash Flow to Firm/Cash Flow Investment in Project) for each year. The cash flow returns earned in Year 3 is 25%. This statement is: True False

16. Assume that you are analyzing a 10-year project for a consumer product company five years into the project and that you have the following information about the project Forecast Year Investment EBIT(1-1) Cash Flow $(10.50) 0 1 2 3 4 5 6 7 8 9 10 $1.50 1.60 1.70 1.80 1.90 2.00 2.10 2.20 2.30 2.40 $3.00 2.80 2.60 2.40 2.40 2.40 2.40 2.40 2.40 2.40 Actual Year Investment EBIT (1-1) Cash Flow $(10.00) 0 1 2 3 4. 5 $1.60 1.65 1.75 1.85 2.00 $3.10 2.85 2.65 2.45 2.50 Question 1 (1 point) Refer to Chapter 15, Problem 16. If the cost of capital was 11% at the time of the initial analysis, the NPV would have been $4.65, and you would therefore have accepted this project. This statement is: True O False Question 2 (1 point) Refer to Chapter 15, Problem 16. Calculate the cash flow returns (Cash Flow to Firm/Cash Flow Investment in Project) for each year. The cash flow returns earned in Year 3 is 25%. This statement is: True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started