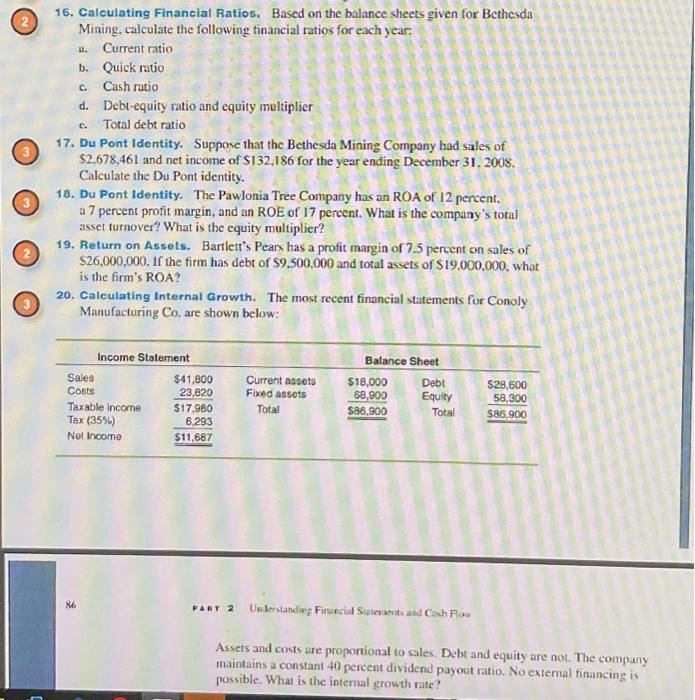

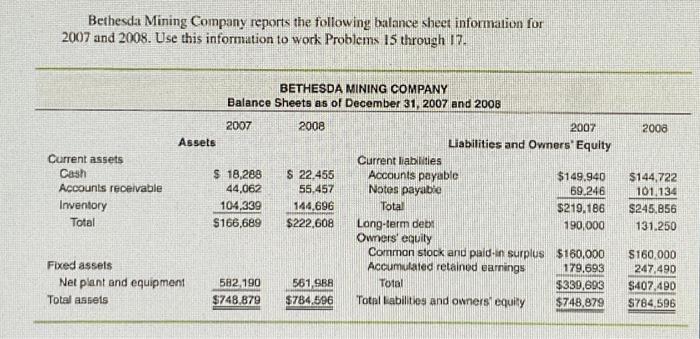

16. Calculating Financial Ratios. Based on the balance sheets given for Bethesda Miaing, calculate the following financial ratios for each year: a. Current ratio b. Quick ratio c. Cash ratio d. Debt-equity ratio and equity multiplier c. Total debt ratio 17. Du Pont Identity. Suppose that the Bethesda Mining Company had sales of $2,678,461 and net income of $132,186 for the year ending December 31, 2008. Calculate the Du Pont identity. 18. Du Pont Identity. The Pawlonia Tree Company has an ROA of 12 percent. a 7 percent profit margin, and an ROE of 17 pereent. What is the company's total asset turnover? What is the equity multiplier? 19. Return on Assets. Bartlett's Pears has a profit margin of 7.5 percent on sales of $26,000,000. If the firm has debt of $9,500,000 and total assets of $19,000,000, what is the firm's ROA? 20. Calculating Internal Growth. The most recent financial statements for Conoly Manufacturing Co. are shown below: 86 PABr 2 Underchanding Firsecial Sutcuachts and Cash Fow Assets and costs are proportional to sales, Debt and equity are not. The company maintains a constant 40 perecnt dividend payout ratio. No extermal financing is possible. Whal is the infermal growth rate? Bethesda Mining Company reports the following balance sheet informalion for 2007 and 2008 . Use this information to work Problems 15 through 17 . 16. Calculating Financial Ratios. Based on the balance sheets given for Bethesda Miaing, calculate the following financial ratios for each year: a. Current ratio b. Quick ratio c. Cash ratio d. Debt-equity ratio and equity multiplier c. Total debt ratio 17. Du Pont Identity. Suppose that the Bethesda Mining Company had sales of $2,678,461 and net income of $132,186 for the year ending December 31, 2008. Calculate the Du Pont identity. 18. Du Pont Identity. The Pawlonia Tree Company has an ROA of 12 percent. a 7 percent profit margin, and an ROE of 17 pereent. What is the company's total asset turnover? What is the equity multiplier? 19. Return on Assets. Bartlett's Pears has a profit margin of 7.5 percent on sales of $26,000,000. If the firm has debt of $9,500,000 and total assets of $19,000,000, what is the firm's ROA? 20. Calculating Internal Growth. The most recent financial statements for Conoly Manufacturing Co. are shown below: 86 PABr 2 Underchanding Firsecial Sutcuachts and Cash Fow Assets and costs are proportional to sales, Debt and equity are not. The company maintains a constant 40 perecnt dividend payout ratio. No extermal financing is possible. Whal is the infermal growth rate? Bethesda Mining Company reports the following balance sheet informalion for 2007 and 2008 . Use this information to work Problems 15 through 17