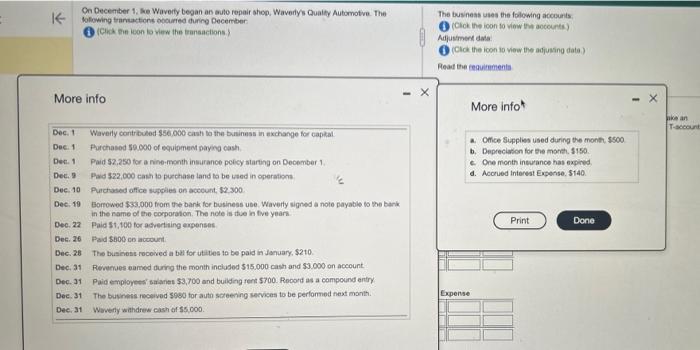

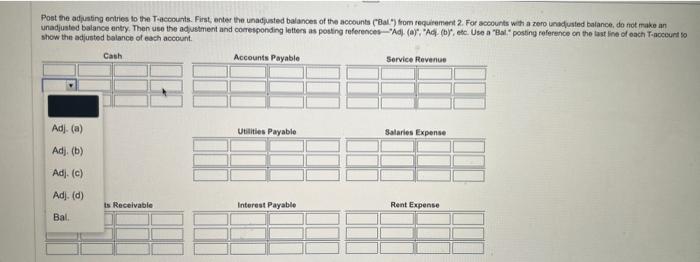

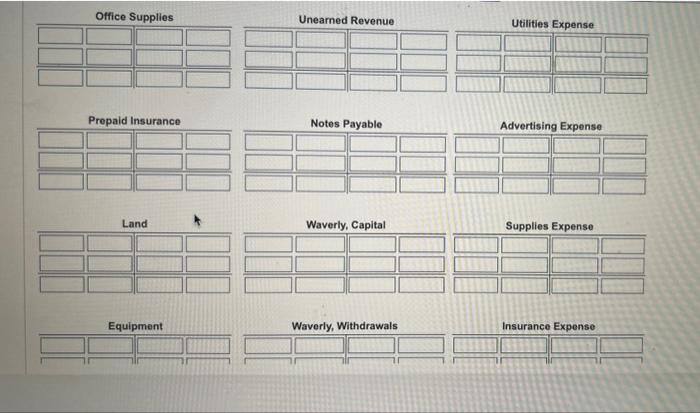

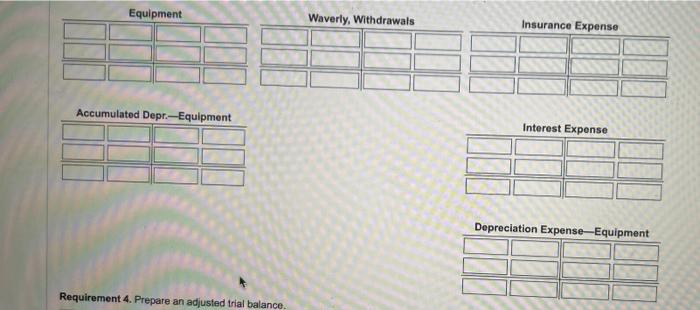

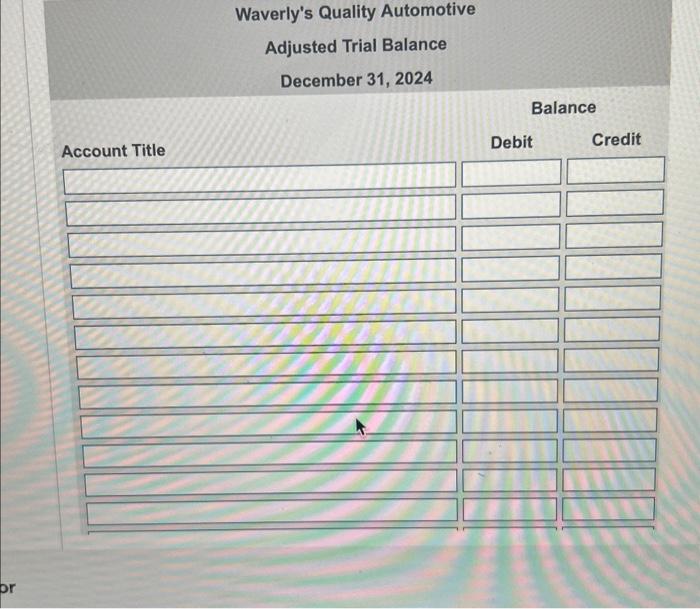

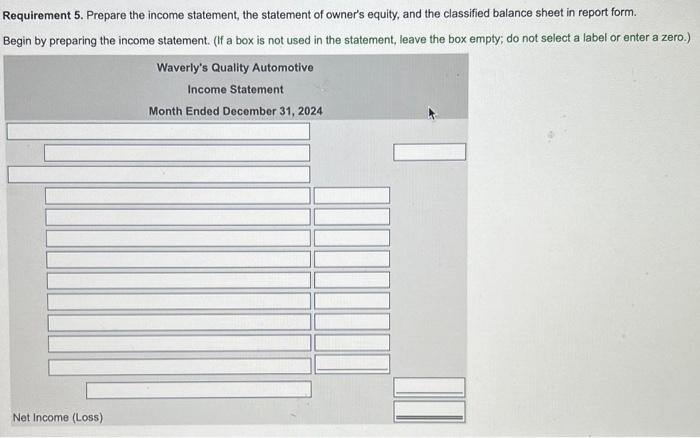

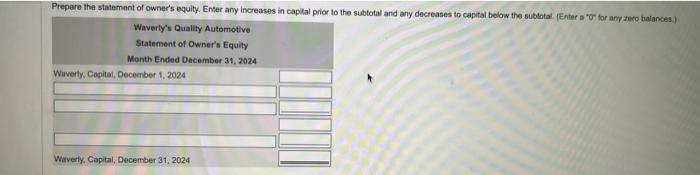

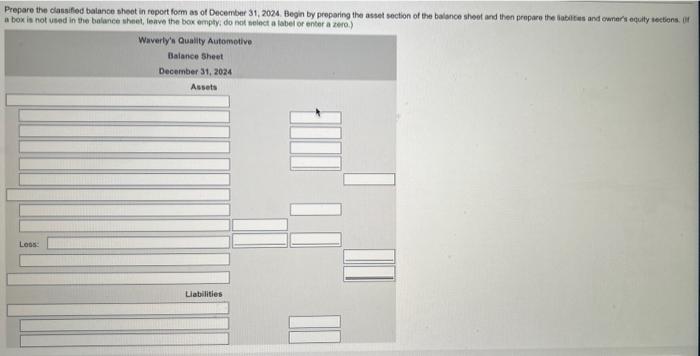

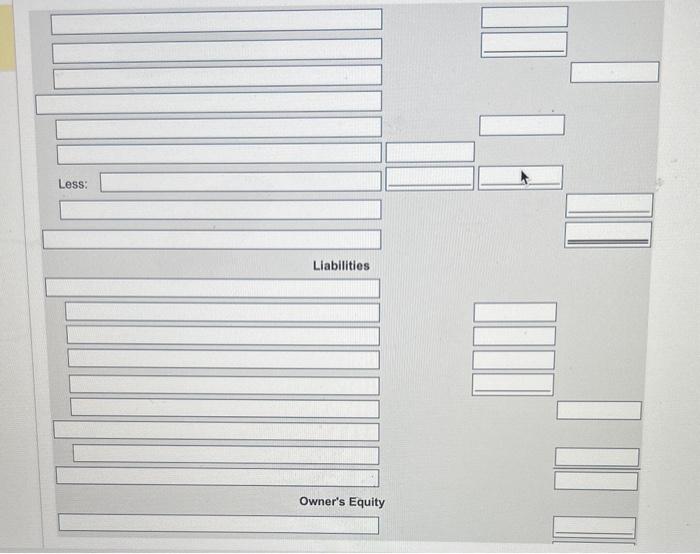

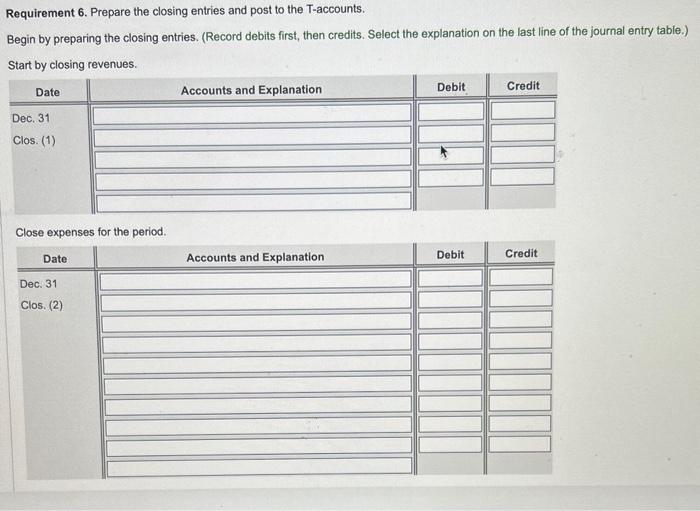

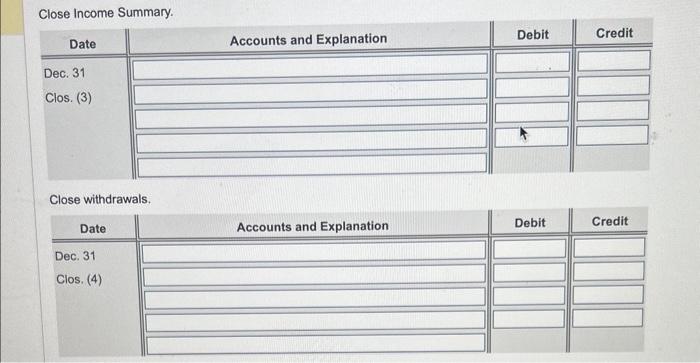

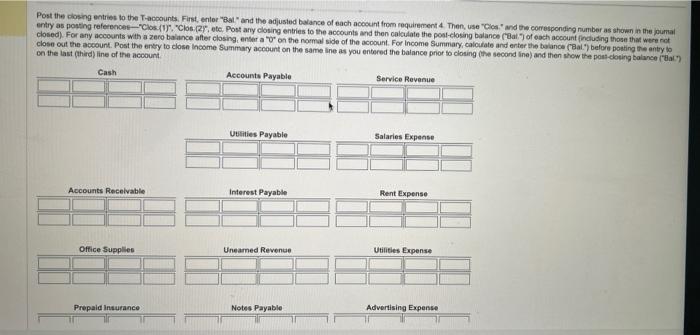

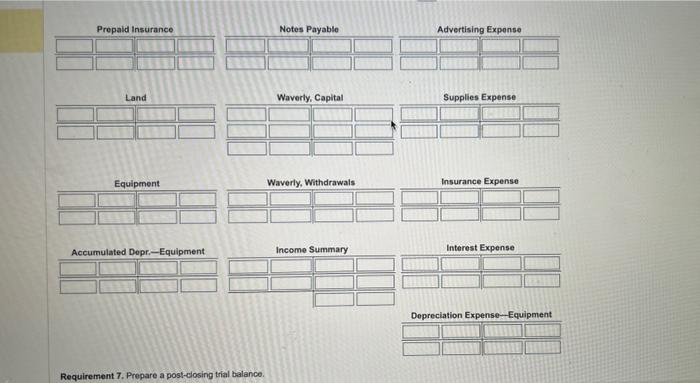

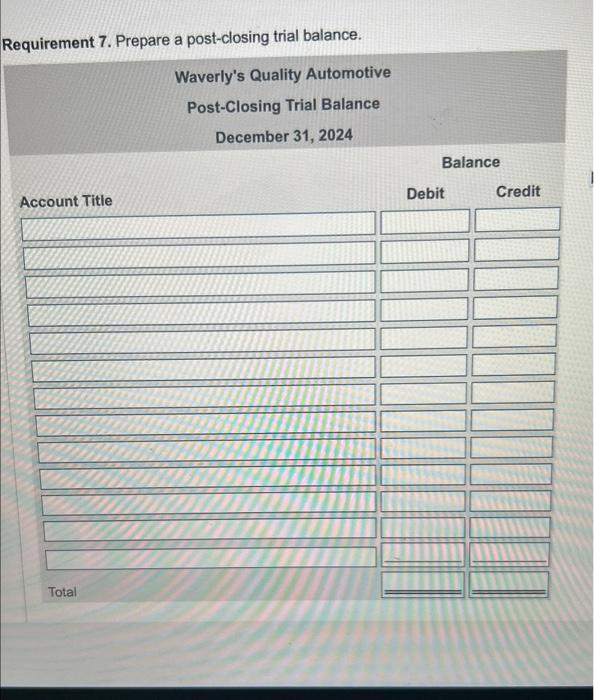

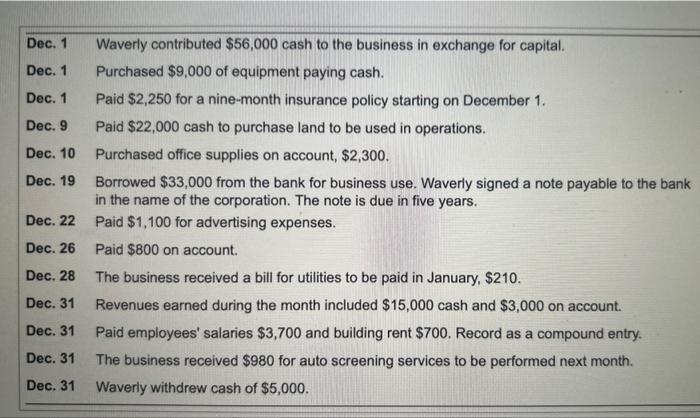

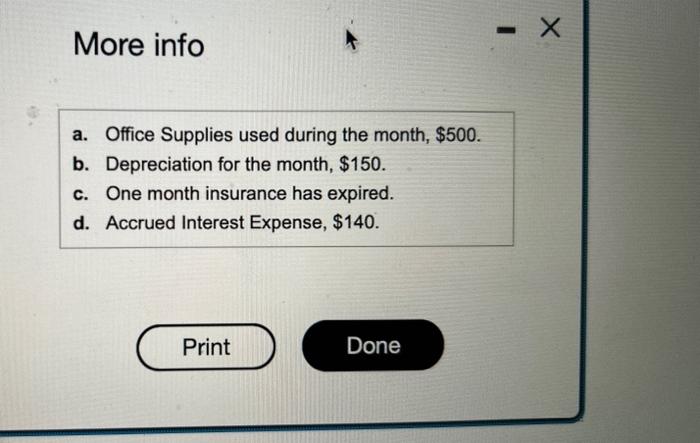

16 - Cn Decenter 1, ke Wavery began an aulo repair shop, Waverly's Qualty Automotve. The The busneas usea the folowng accourits. folowing transactions oociured durre Decen the (Click the ioon to viow itha aoccurti) Rifjuement data. (Click the icon io vew the adfusing date) Reat the iequitimenis More info More infot a. Ofice Simpliss used during the month $900 b. Depreciasion for the morth. 1150 . c. One month ineurance has expired. d. Aconed Interest Expense. $140. Post the adpating ontries to the Teaccounts. First, enter the unadpsted balances of the accounts ("Bal ") from requiremart 2 . For accounts with a zero inidusied balance, de not rake an. unadiusted balance entry, Then use the adustment and comeiponding letters as postng references - "Ad). (a)", "Ack. (b)", etc. Use a "Bal" posting reference on the tast Ine of each Troceurt so show the adjusted balance of each account. Office Supplies Unearned Revenue Utilities Expense Notes Payable Advertising Expense Waverly, Capital Supplies Expense Equipment Waverly, Withdrawals Insurance Expense Equipment Waverly, Withdrawals Insurance Expense Depreciation Expense-Equipment Requirement 4. Prepare an adjusted trial balance. Waverly's Quality Automotive Adjusted Trial Balance December 31,2024 Balance Account Title Debit Credit Account Title Requirement 5. Prepare the income statement, the statement of owner's equity, and the classified balance sheet in report form. Begin by preparing the income statement. (If a box is not used in the statement, leave the box empty; do not select a label or enter a zero.) Prepare the statement of owner's equity. Enter any increases in capital prior to the subtotal and any decreases to capital below the sublotal (Enter a "or for any zero balances ) Waverly's Quality Automotive Statement of Owner's Equity Month Ended December 31, 2024 Waverty Capital, December 1, 2024 Wavetly, Capital, December 31,2024 Prepare the classifed balance sheot in report form as of December 31, 2024. Begin by preparing the asset section of the balunce sheot and then prepare the iabilies and owners equity iectiens. if a box is not used in the balance sheet, leave the bok empty, do not select a label or entor a zero.) Less: Liabilities Owner's Equity Requirement 6. Prepare the closing entries and post to the T-accounts. Begin by preparing the closing entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Start by closing revenues. Close expenses for the period. Close Income Summary. Close withdrawals. Post the closing entries to the T-acoounts, First, enter "Bat" and the adjusted balance of each acoount from requirement 4 . Then, use "Cios," and tre corresponding number as shiown n the pumal closed). For any accounts with a zero balince after closing, enser a "O" on the nomal side of the acoount. For income Summary, calculate and enter the belance ("Bal.") before bosting the entry bo close out the account. Post the enty to close income Summary account on the same ine as you entered the balance prior to ciosing (The second ine) and then show the poat doeing bolance ("al.) on the last (third) line of the acoount Requirement 7. Prepare a post-elosing trial balance. Requirement 7. Prepare a post-closing trial balance. Dec. 1 Waverly contributed $56,000 cash to the business in exchange for capital. Dec. 1 Purchased $9,000 of equipment paying cash. Dec. 1 Paid $2,250 for a nine-month insurance policy starting on December 1. Dec. 9 Paid $22,000 cash to purchase land to be used in operations. Dec. 10 Purchased office supplies on account, $2,300. Dec. 19 Borrowed $33,000 from the bank for business use. Waverly signed a note payable to the bank in the name of the corporation. The note is due in five years. Dec. 22 Paid $1,100 for advertising expenses. Dec. 26 Paid $800 on account. Dec. 28 The business received a bill for utilities to be paid in January, $210. Dec. 31 Revenues earned during the month included $15,000 cash and $3,000 on account. Dec. 31 Paid employees' salaries $3,700 and building rent $700. Record as a compound entry. Dec. 31 The business received $980 for auto screening services to be performed next month. Dec. 31 Waverly withdrew cash of $5,000. a. Office Supplies used during the month, $500. b. Depreciation for the month, $150. c. One month insurance has expired. d. Accrued Interest Expense, $140