Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16. Equivalent annual annuities Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method

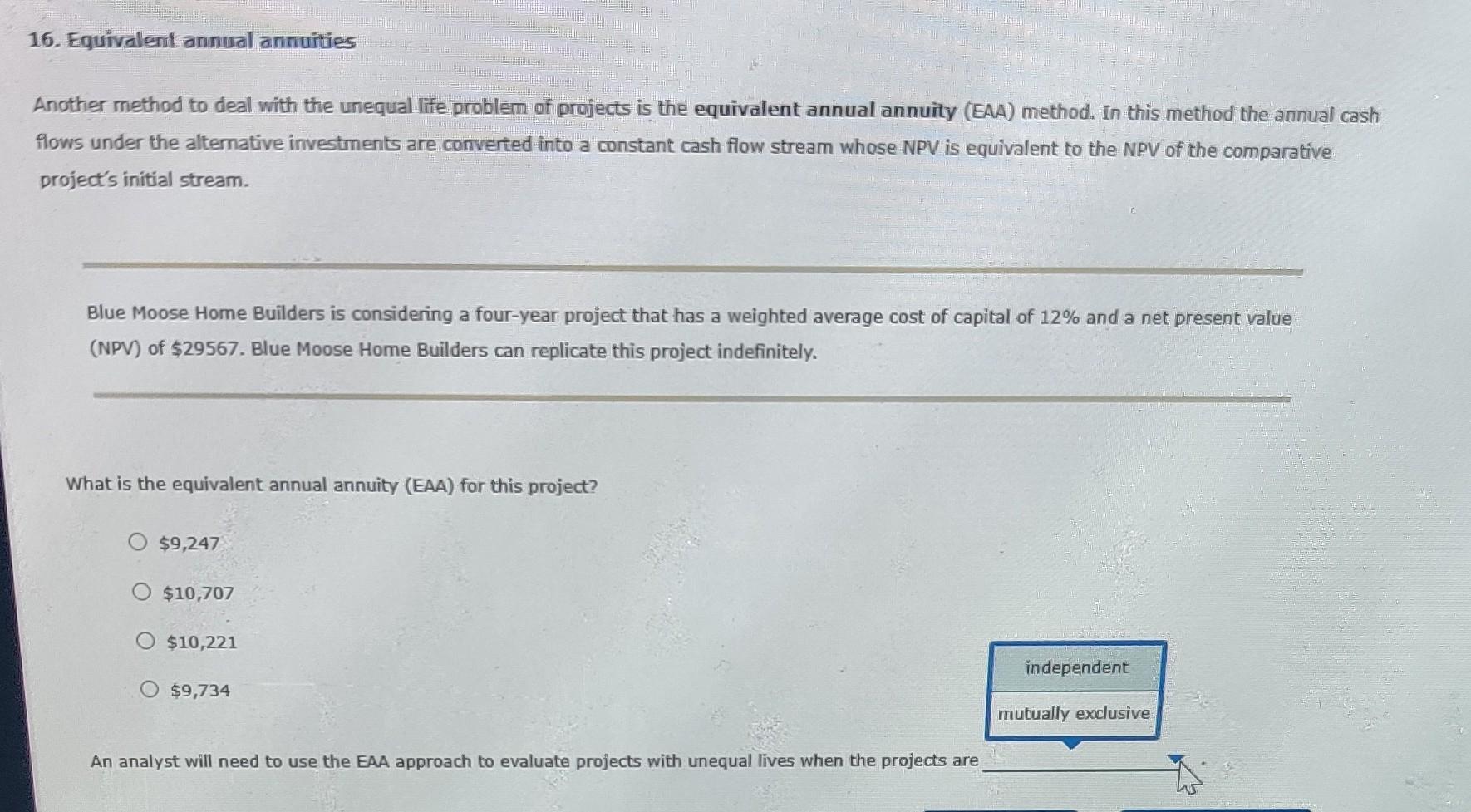

16. Equivalent annual annuities Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative project's initial stream. Blue Moose Home Builders is considering a four-year project that has a weighted average cost of capital of 12% and a net present value (NPV) of $29567. Blue Moose Home Builders can replicate this project indefinitely. What is the equivalent annual annuity (EAA) for this project? $9,247 O $10,707 O $10,221 independent $9,734 mutually exclusive An analyst will need to use the EAA approach to evaluate projects with unequal lives when the projects are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started