16. I provide you with a pre-sale report from January 2019 written by S&P on a floating rate CMBS transaction. Provide me with short answers (1 line or less) to each of the questions below. a. What is the total size of the loan(s) b. What type of loan(s) are supporting the tranches (Fixed Rate or ARM) c. How many loans are there supporting the tranches d. What is the margin spread on the loan(s) e. What is the maturity date on the loan(s) f. How many classes (aka tranches) are there in the transaction. g. What is the collateral securing the loan(s). h. Which of the classes offered do you think is the riskiest and why?

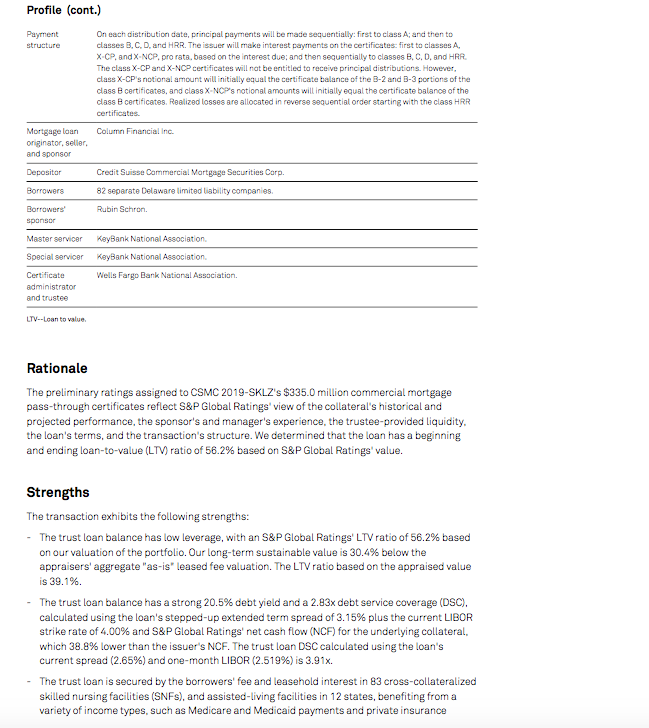

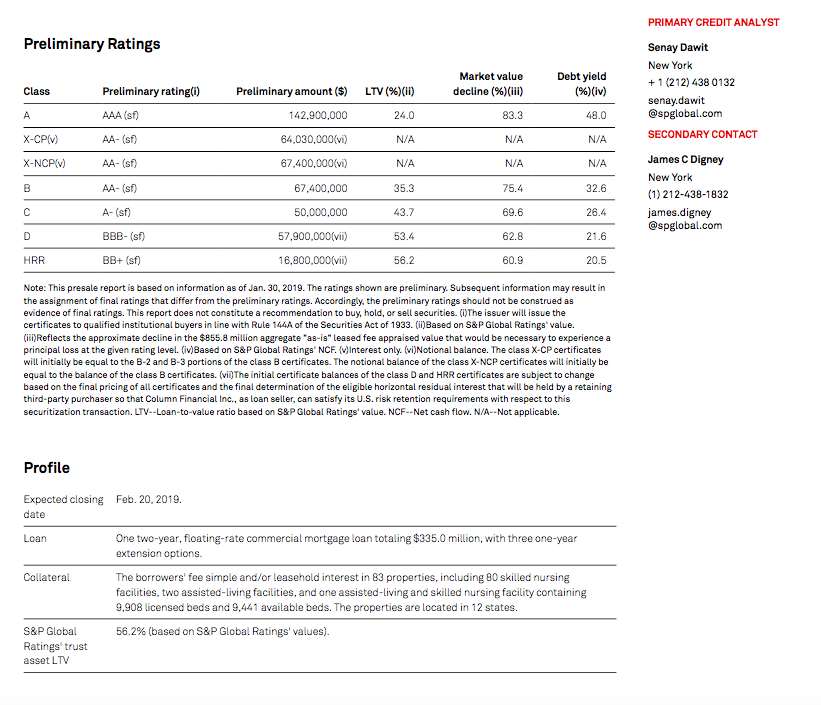

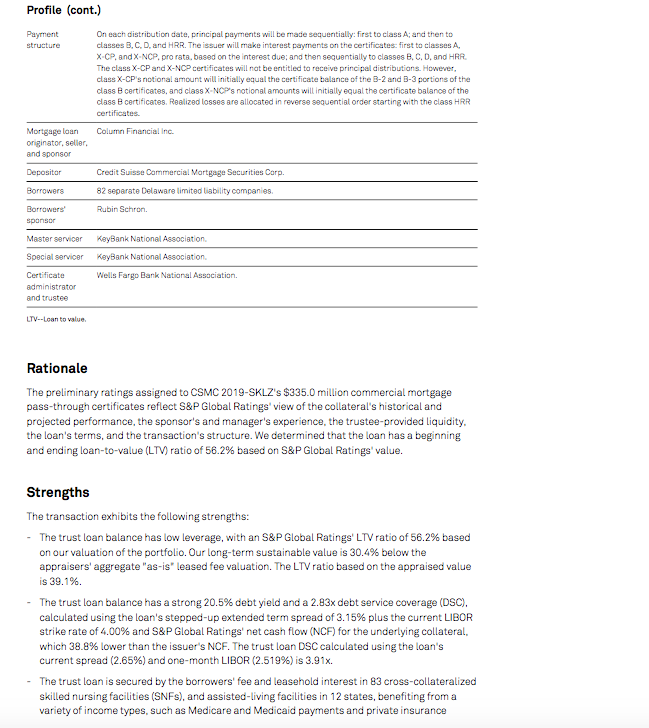

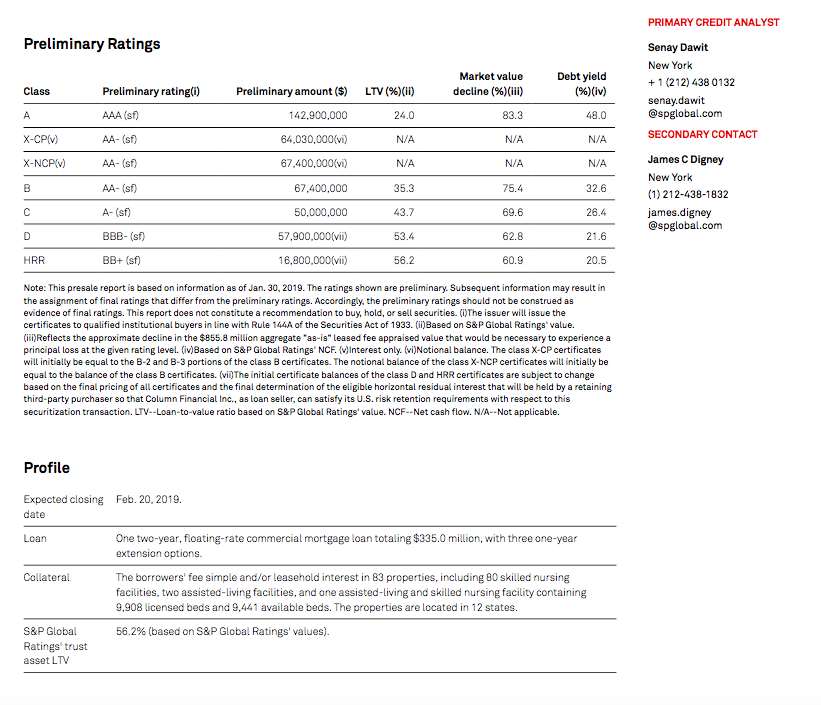

Profile (cont.) Payment structure On each distribution date, principal paymenits will be made sequentially: first to class A; and then to classes B, C, D, and HRR. The issuer will make interest payments on the certificates:first to classes A, X CP, andX NCP, pro rata, based on the interest due: and then sequentially to classes B, C, D, and HRR The class X-CP andX-NCP certificates will nat be entitled to receive principal distributions. However class X-CP's notional amount will initially equal the certificate balance of the B-2 and B-3 portions of the class B certificates, and class X-NCP's notional amounts will initially equal the certificate balance of the class B certificates. Realized losses are allocated in reverse sequential order starting with the class HRiR Mortgage loan Column Financial Inc onginator, seller and sponsor Depositor Credit Suisse Cammercial Martgage Securities Corp. 82 separate Delaware limited liability companies. Rubin Schron. Borrowers Master servicer KeyBank National Association Special servicer KeyBank National Association Certificate Wells Fargo Bank National Associatian. and trustee LTV--Loan to value Rationale The preliminary ratings assigned to CSMC 2019-SKLZ's $335.0 million commercial mortgage pass-through certificates reflect S&P Global Ratings' view of the collateral's historical and projected performance, the sponsor's and manager's experience, the trustee-provided liquidity the loan's terms, and the transaction's structure. We determined that the loan has a beginning and ending loan-to-value (LTV) ratio of 56.2% based on S&P Global Ratings value. Strengths The transaction exhibits the following strengths: The trust loan balance has low leverage, with an S&P Global Ratings, LTV ratio of 56.2% based on our valuation of the portfolio. Our long-term sustainable value is 30.4% below the appraisers' aggregate "as-is leased fee valuation. The LTV ratio based on the appraised value is 39.1 %. The trust loan balance has a strong 20.5% debt yield and a 2.83x debt service coverage (DSC). calculated using the loan's stepped-up extended term spread of 3.15% plus the current LIBOR strike rate of 4.00% and S&P Global Ratings, net cash flow (NCF) for the underlying collateral. which 38.8% lower than the issuer's NCF. The trust loan DSC calculated using the loan's current spread (2.65%) and one-month LIBOR (2.519%) is 3.91x. The trust loan is secured by the borrowers' fee and leasehold interest in 83 cross-collateralized skilled nursing facilities (SNFs), and assisted-living facilities in 12 states, benefiting from a variety of income types, such as Medicare and Medicaid payments and private insurance - PRIMARY CREDIT ANALYST Preliminary Ratings Senay Dawit New York + 1 (212) 438 0132 senay.dawit @spglobal.com SECONDARY CONTACT Market value decline (%)(iii) 83.3 N/A N/A 75.4 69.6 62.8 60.9 Debt yield (96)(iv) 48.0 N/A N/A 32.6 26.4 21.6 20.5 Class Preliminary rating(i) AAA (sf) AA- (sf) AA- (sf) AA- (sf) A- (sf) Preliminary amount($) 142,900,000 64,030,000(vi) 67.400,000(vi) 67,400,000 50,000,000 57,900,000lvi) 16,800,000(vii) LTV (%)(ii) 24.0 N/A N/A 35.3 43.7 53.4 56.2 James C Digney New York (1) 212-438-1832 james.digney @spglobal.com X-NCPv) HRR BB+ (sf) Note: This presale report is based on information as of Jan. 30, 2019. The ratings shown are preliminary. Subsequent information may result in the assignment of final ratings that differ from the preliminary ratings. Accordingly, the preliminary ratings should not be construed as evidence of final ratings. This report does not constitute a recommendation to buy, hold, or sell securities. ()The issuer will issue the certificates to qualified institutional buyers in line with Rule 144A of the Securities Act of 1933. (i)Based on S&P Global Ratings' value. ii) Reflects the approximate decline in the $855.8 million aggregate as-is" leased fee appraised value that would be necessary to experience a will initially be equal to the B-2 and B-3 portions of the class B certificates. The notional balance of the class X-NCP certificates will initially be based on the final pricing of all certificates and the final determination of the eligible horizontal residual interest that will be held by a retaining principal loss at the given rating level. (iv)Based on S&P Global Ratings NCF. (Interest only. (vi)Notional balance. The class X-CP certificates equal to the balance of the class B certificates. (viThe initial certificate balances of the class Dand HRR certificates are subject to change third-party purchaser so that Column Financial Inc., as loan seller, can satisfy its U.S. risk retention requirements with respect to this securitization transaction. LTV-Loan-to-value ratio based on S&P Global Ratings' value. NCF-Net cash flow. N/A--Not applicable. Profile Expected closing Feb. 20. 201!9 date One two-year, floating-rate commercial mortgage loan totaling $335.0 million, with three one-year extension options. Loan Collateral The borrowers' fee simple and/or leasehold interest in 83 properties, including 80 skilled nursing facilities, two assisted-living facilities, and one assisted-living and skilled nursing facility containing 9,908 licensed beds and 9,441 available beds. The properties are located in 12 states. S&P Global Ratings' trust asset LTV 56.2% (based on S&P Global Ratings' values) Profile (cont.) Payment structure On each distribution date, principal paymenits will be made sequentially: first to class A; and then to classes B, C, D, and HRR. The issuer will make interest payments on the certificates:first to classes A, X CP, andX NCP, pro rata, based on the interest due: and then sequentially to classes B, C, D, and HRR The class X-CP andX-NCP certificates will nat be entitled to receive principal distributions. However class X-CP's notional amount will initially equal the certificate balance of the B-2 and B-3 portions of the class B certificates, and class X-NCP's notional amounts will initially equal the certificate balance of the class B certificates. Realized losses are allocated in reverse sequential order starting with the class HRiR Mortgage loan Column Financial Inc onginator, seller and sponsor Depositor Credit Suisse Cammercial Martgage Securities Corp. 82 separate Delaware limited liability companies. Rubin Schron. Borrowers Master servicer KeyBank National Association Special servicer KeyBank National Association Certificate Wells Fargo Bank National Associatian. and trustee LTV--Loan to value Rationale The preliminary ratings assigned to CSMC 2019-SKLZ's $335.0 million commercial mortgage pass-through certificates reflect S&P Global Ratings' view of the collateral's historical and projected performance, the sponsor's and manager's experience, the trustee-provided liquidity the loan's terms, and the transaction's structure. We determined that the loan has a beginning and ending loan-to-value (LTV) ratio of 56.2% based on S&P Global Ratings value. Strengths The transaction exhibits the following strengths: The trust loan balance has low leverage, with an S&P Global Ratings, LTV ratio of 56.2% based on our valuation of the portfolio. Our long-term sustainable value is 30.4% below the appraisers' aggregate "as-is leased fee valuation. The LTV ratio based on the appraised value is 39.1 %. The trust loan balance has a strong 20.5% debt yield and a 2.83x debt service coverage (DSC). calculated using the loan's stepped-up extended term spread of 3.15% plus the current LIBOR strike rate of 4.00% and S&P Global Ratings, net cash flow (NCF) for the underlying collateral. which 38.8% lower than the issuer's NCF. The trust loan DSC calculated using the loan's current spread (2.65%) and one-month LIBOR (2.519%) is 3.91x. The trust loan is secured by the borrowers' fee and leasehold interest in 83 cross-collateralized skilled nursing facilities (SNFs), and assisted-living facilities in 12 states, benefiting from a variety of income types, such as Medicare and Medicaid payments and private insurance - PRIMARY CREDIT ANALYST Preliminary Ratings Senay Dawit New York + 1 (212) 438 0132 senay.dawit @spglobal.com SECONDARY CONTACT Market value decline (%)(iii) 83.3 N/A N/A 75.4 69.6 62.8 60.9 Debt yield (96)(iv) 48.0 N/A N/A 32.6 26.4 21.6 20.5 Class Preliminary rating(i) AAA (sf) AA- (sf) AA- (sf) AA- (sf) A- (sf) Preliminary amount($) 142,900,000 64,030,000(vi) 67.400,000(vi) 67,400,000 50,000,000 57,900,000lvi) 16,800,000(vii) LTV (%)(ii) 24.0 N/A N/A 35.3 43.7 53.4 56.2 James C Digney New York (1) 212-438-1832 james.digney @spglobal.com X-NCPv) HRR BB+ (sf) Note: This presale report is based on information as of Jan. 30, 2019. The ratings shown are preliminary. Subsequent information may result in the assignment of final ratings that differ from the preliminary ratings. Accordingly, the preliminary ratings should not be construed as evidence of final ratings. This report does not constitute a recommendation to buy, hold, or sell securities. ()The issuer will issue the certificates to qualified institutional buyers in line with Rule 144A of the Securities Act of 1933. (i)Based on S&P Global Ratings' value. ii) Reflects the approximate decline in the $855.8 million aggregate as-is" leased fee appraised value that would be necessary to experience a will initially be equal to the B-2 and B-3 portions of the class B certificates. The notional balance of the class X-NCP certificates will initially be based on the final pricing of all certificates and the final determination of the eligible horizontal residual interest that will be held by a retaining principal loss at the given rating level. (iv)Based on S&P Global Ratings NCF. (Interest only. (vi)Notional balance. The class X-CP certificates equal to the balance of the class B certificates. (viThe initial certificate balances of the class Dand HRR certificates are subject to change third-party purchaser so that Column Financial Inc., as loan seller, can satisfy its U.S. risk retention requirements with respect to this securitization transaction. LTV-Loan-to-value ratio based on S&P Global Ratings' value. NCF-Net cash flow. N/A--Not applicable. Profile Expected closing Feb. 20. 201!9 date One two-year, floating-rate commercial mortgage loan totaling $335.0 million, with three one-year extension options. Loan Collateral The borrowers' fee simple and/or leasehold interest in 83 properties, including 80 skilled nursing facilities, two assisted-living facilities, and one assisted-living and skilled nursing facility containing 9,908 licensed beds and 9,441 available beds. The properties are located in 12 states. S&P Global Ratings' trust asset LTV 56.2% (based on S&P Global Ratings' values)