Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16) If a company's retained earnings increased $120,000 and its profit was $140,000, the financing activities section of the cash flow statement would show; a)

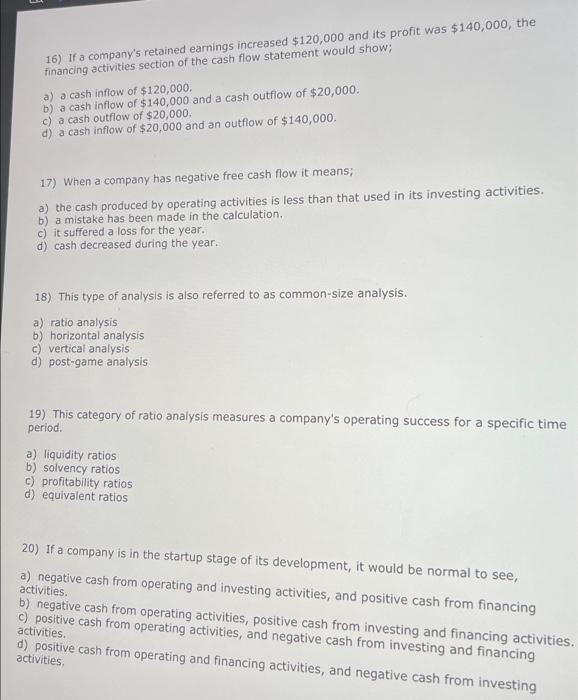

16) If a company's retained earnings increased $120,000 and its profit was $140,000, the financing activities section of the cash flow statement would show; a) a cash inflow of $120,000. b) a cash inflow of $140,000 and a cash outflow of $20,000. c) a cash outflow of $20,000. d) a cash inflow of $20,000 and an outflow of $140,000. 17) When a company has negative free cash flow it means; a) the cash produced by operating activities is less than that used in its investing activities. b) a mistake has been made in the calculation. c) it suffered a loss for the year. d) cash decreased during the year. 18) This type of analysis is also referred to as common-size analysis. a) ratio analysis b) horizontal analysis c) vertical analysis d) post-game analysis 19) This category of ratio analysis measures a company's operating success for a specific time period. a) liquidity ratios b) solvency ratios c) profitability ratios d) equivalent ratios 20) If a company is in the startup stage of its development, it would be normal to see, a) negative cash from operating and investing activities, and positive cash from financing activities. b) negative cash from operating activities, positive cash from investing and financing activities. c) positive cash from operating activities, and negative cash from investing and financing activities. d) positive cash from operating and financing activities, and negative cash from investing activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started