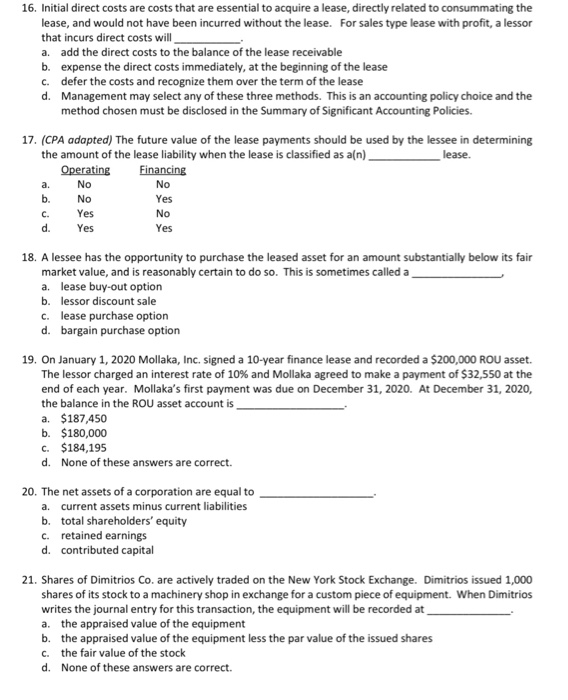

16. Initial direct costs are costs that are essential to acquire a lease, directly related to consummating the lease, and would not have been incurred without the lease. For sales type lease with profit, a lessor that incurs direct costs will a. add the direct costs to the balance of the lease receivable b. expense the direct costs immediately, at the beginning of the lease C. defer the costs and recognize them over the term of the lease d. Management may select any of these three methods. This is an accounting policy choice and the method chosen must be disclosed in the Summary of Significant Accounting Policies 17. (CPA adapted) The future value of the lease payments should be used by the lessee in determining the amount of the lease liability when the lease is classified as a(n) lease. Operating Financing a. No No b. No Yes Yes No d. Yes Yes 18. A lessee has the opportunity to purchase the leased asset for an amount substantially below its fair market value, and is reasonably certain to do so. This is sometimes called a a. lease buy-out option b. lessor discount sale C. lease purchase option d. bargain purchase option 19. On January 1, 2020 Mollaka, Inc. signed a 10-year finance lease and recorded a $200,000 ROU asset. The lessor charged an interest rate of 10% and Mollaka agreed to make a payment of $32,550 at the end of each year. Mollaka's first payment was due on December 31, 2020. At December 31, 2020, the balance in the ROU asset account is a. $187,450 b. $180,000 C. $184,195 d. None of these answers are correct. 20. The net assets of a corporation are equal to a. current assets minus current liabilities b. total shareholders' equity C. retained earnings d. contributed capital 21. Shares of Dimitrios Co. are actively traded on the New York Stock Exchange. Dimitrios issued 1,000 shares of its stock to a machinery shop in exchange for a custom piece of equipment. When Dimitrios writes the journal entry for this transaction, the equipment will be recorded at a. the appraised value of the equipment b. the appraised value of the equipment less the par value of the issued shares c. the fair value of the stock d. None of these answers are correct