Answered step by step

Verified Expert Solution

Question

1 Approved Answer

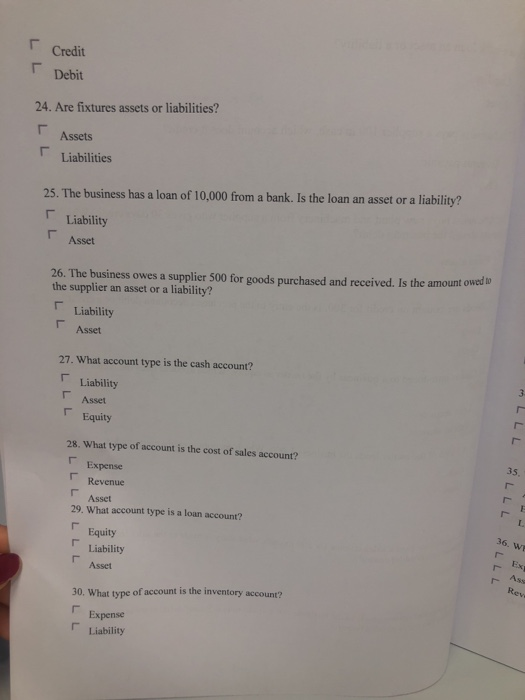

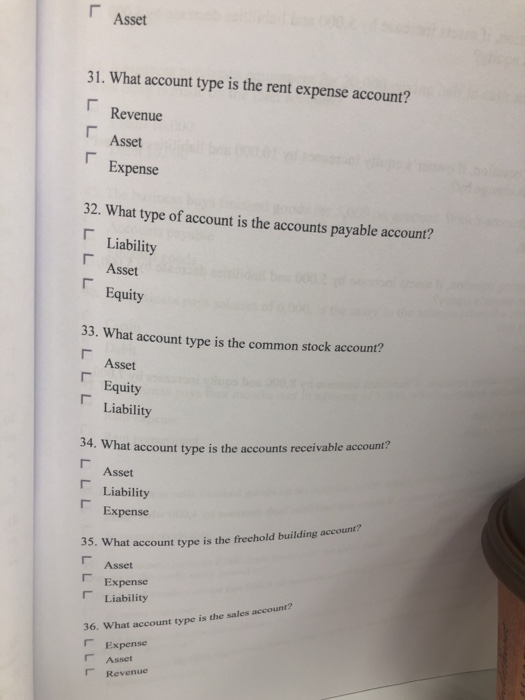

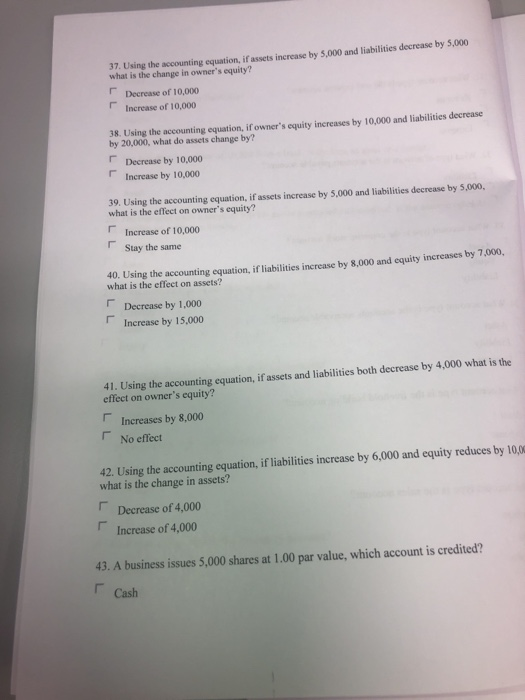

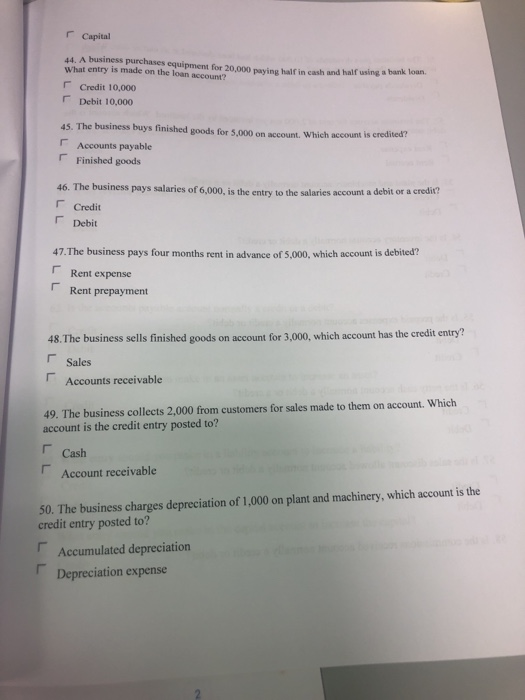

16. Is a bank loan an asset or a liability? Liability Asset 17. A business pays a supplier 100 in cash, which account does it

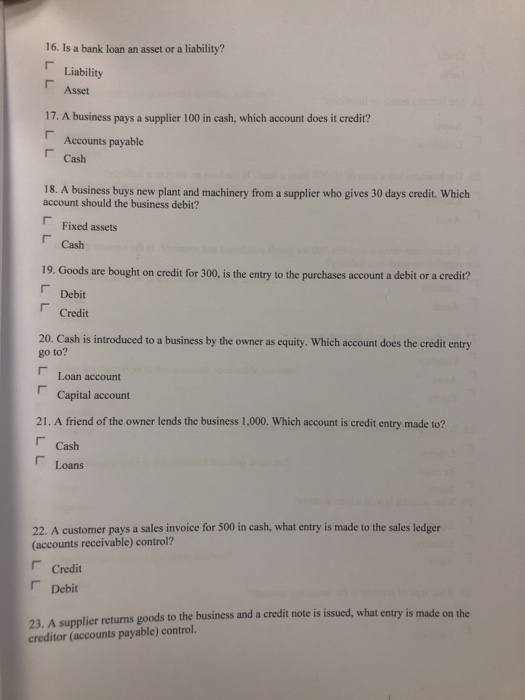

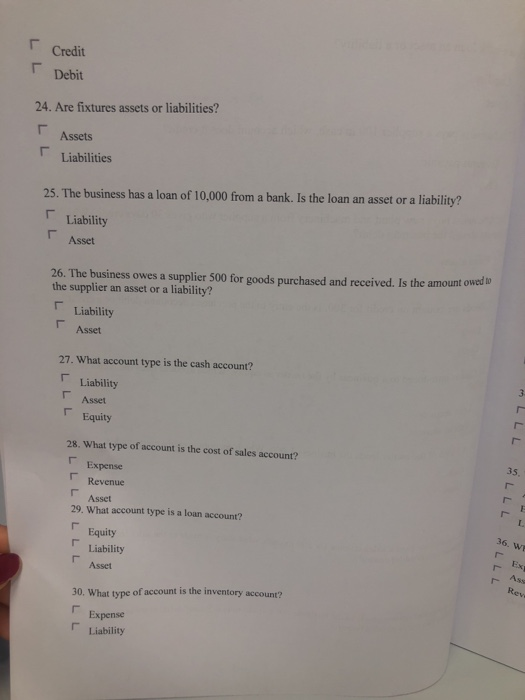

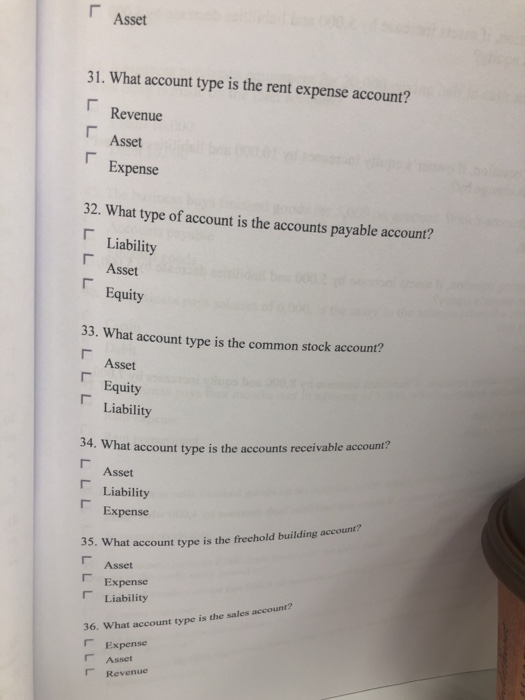

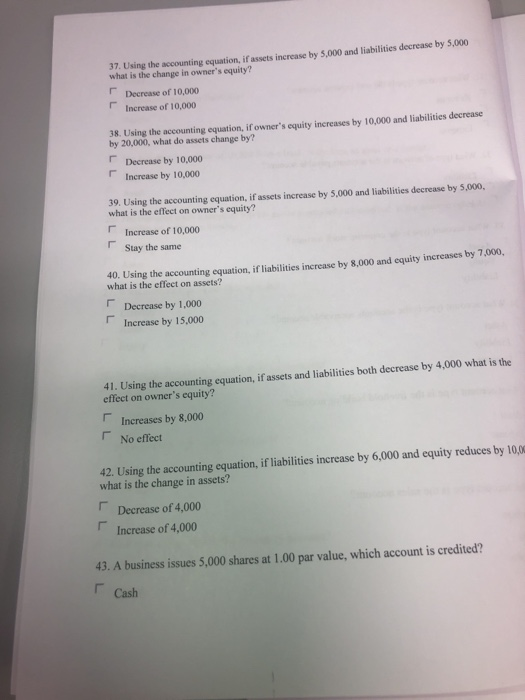

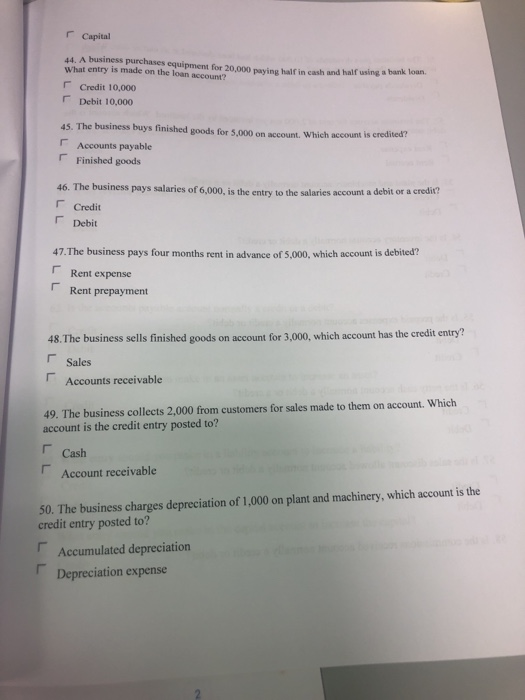

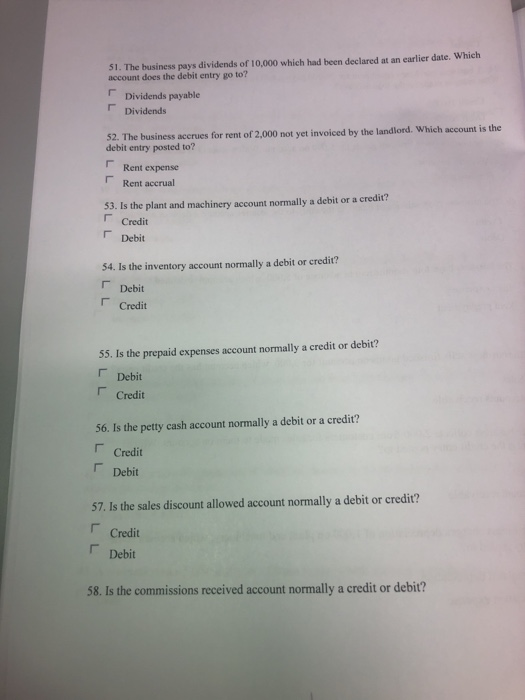

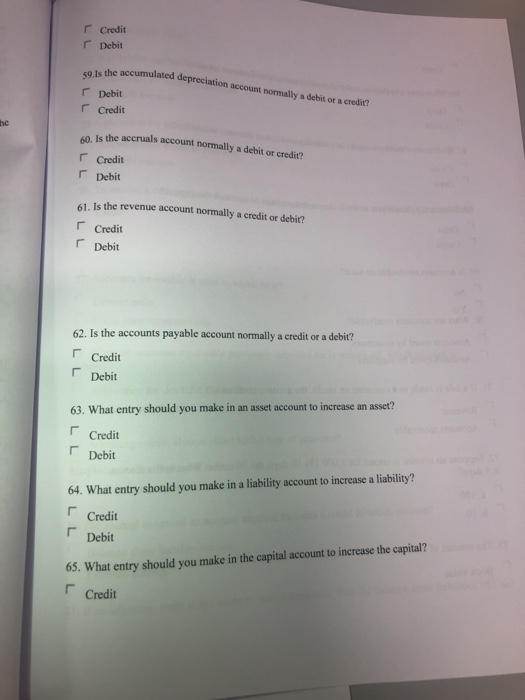

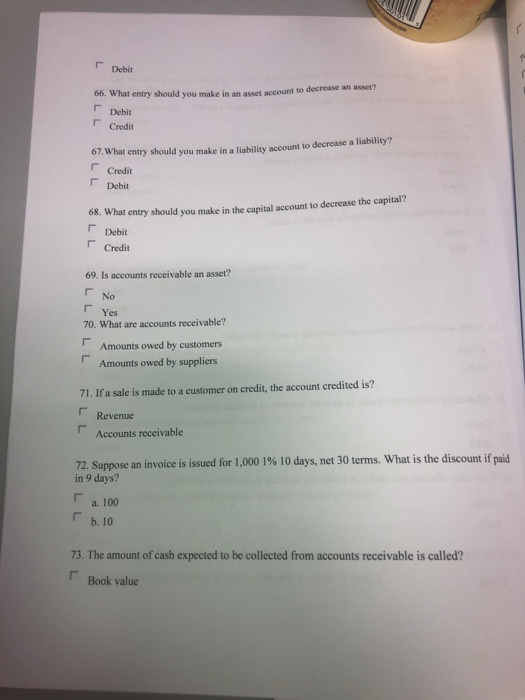

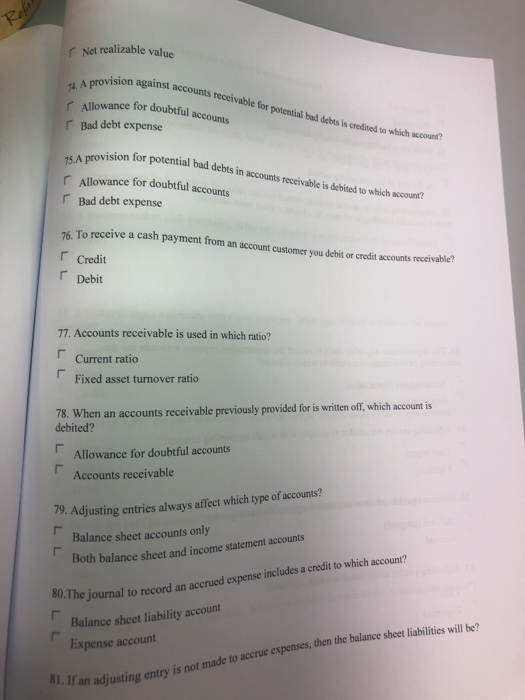

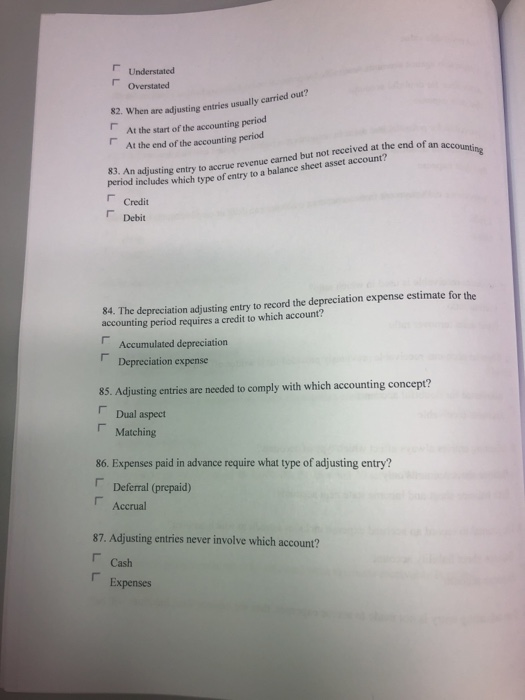

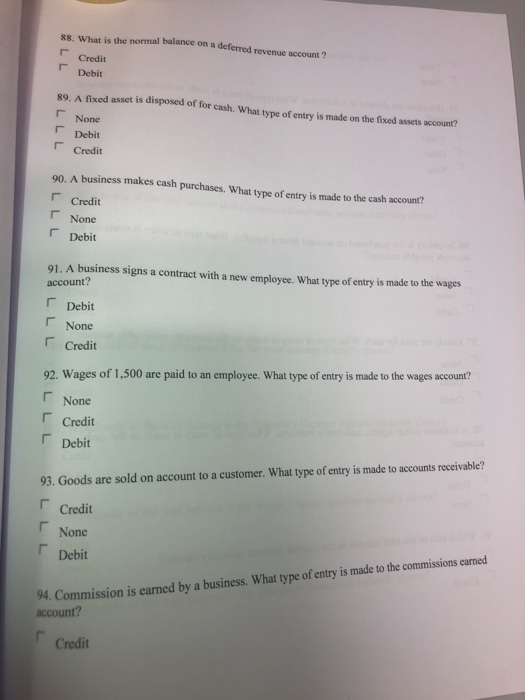

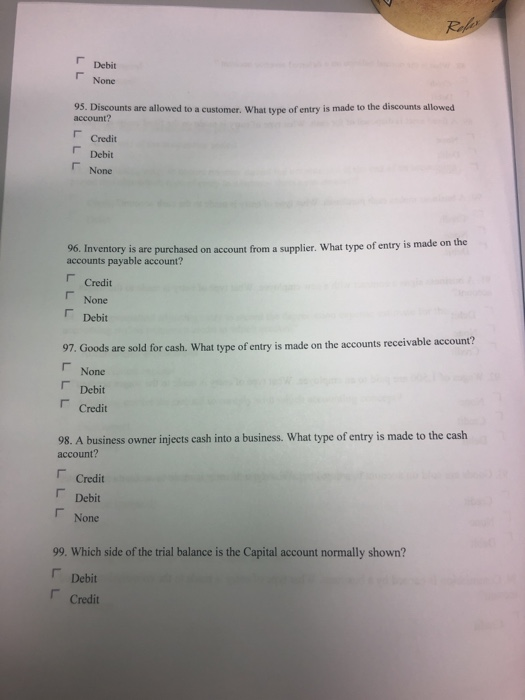

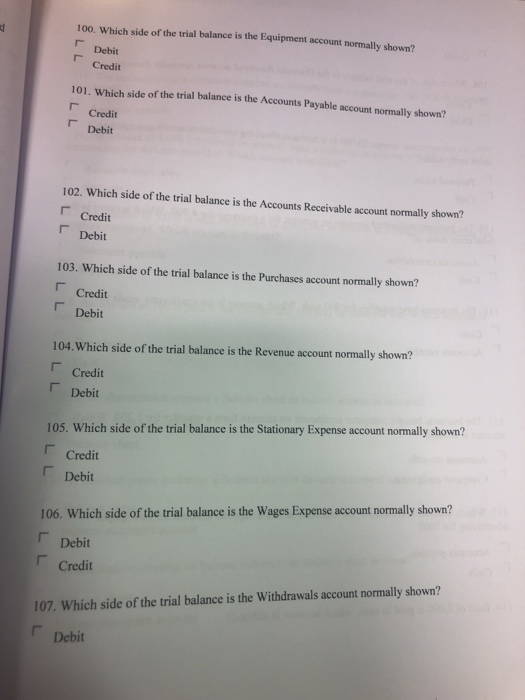

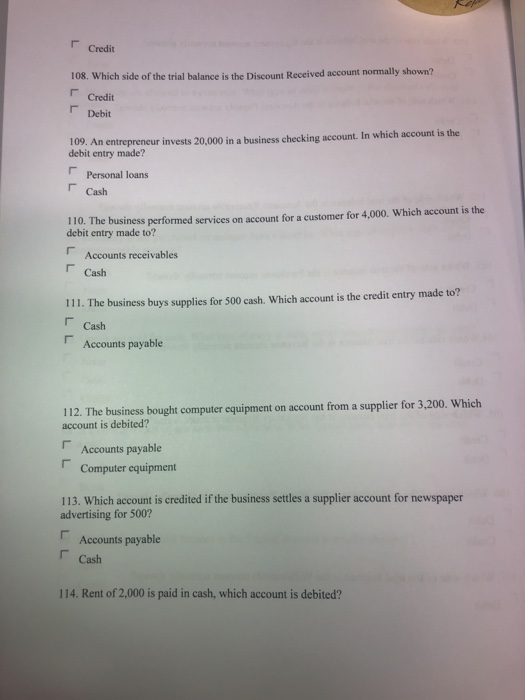

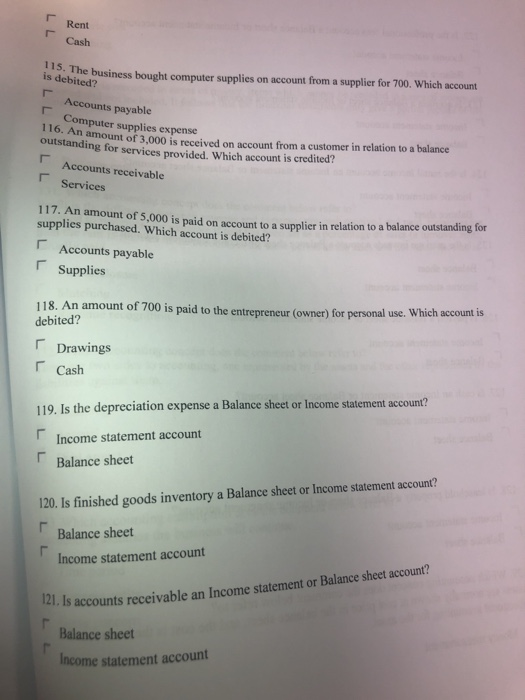

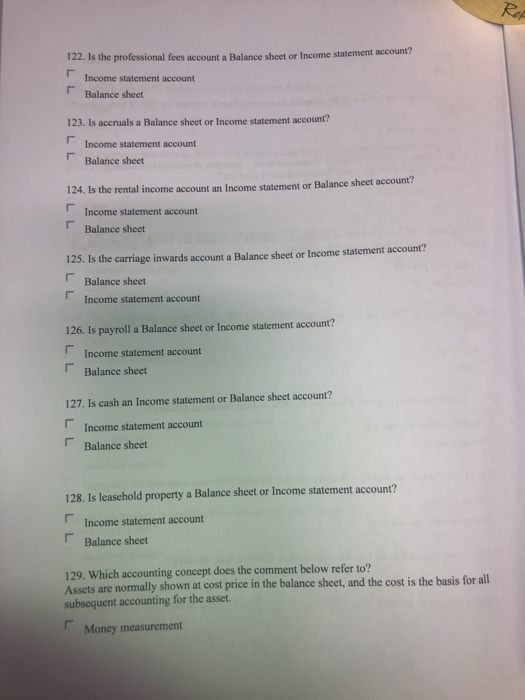

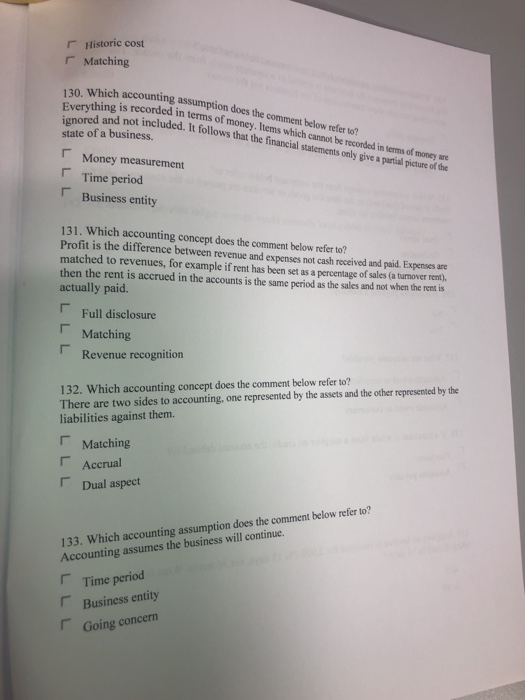

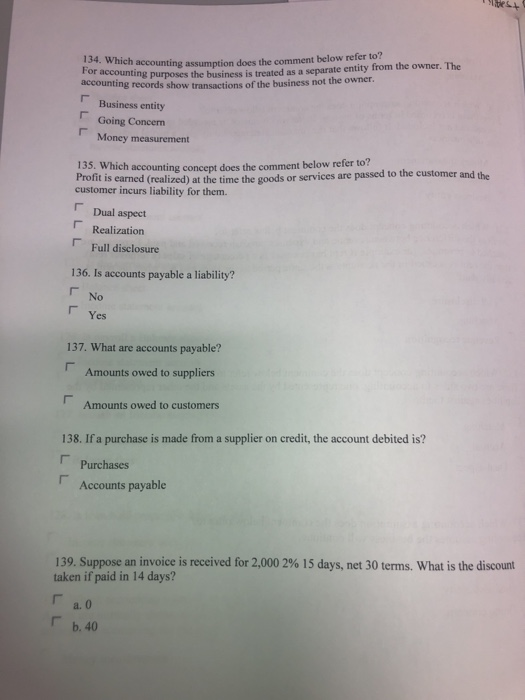

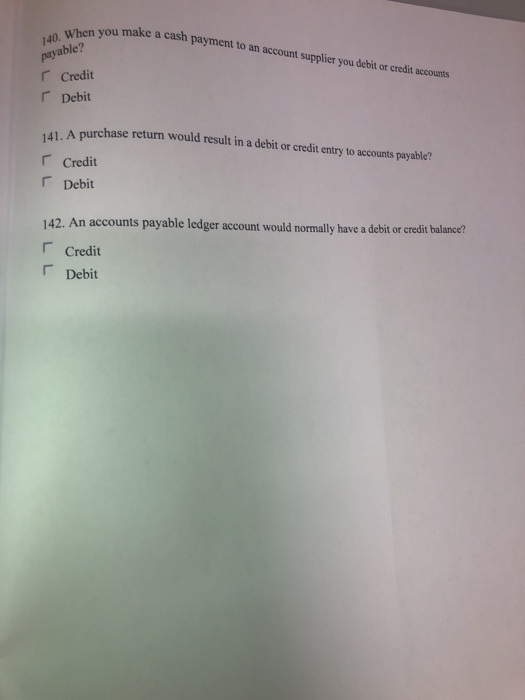

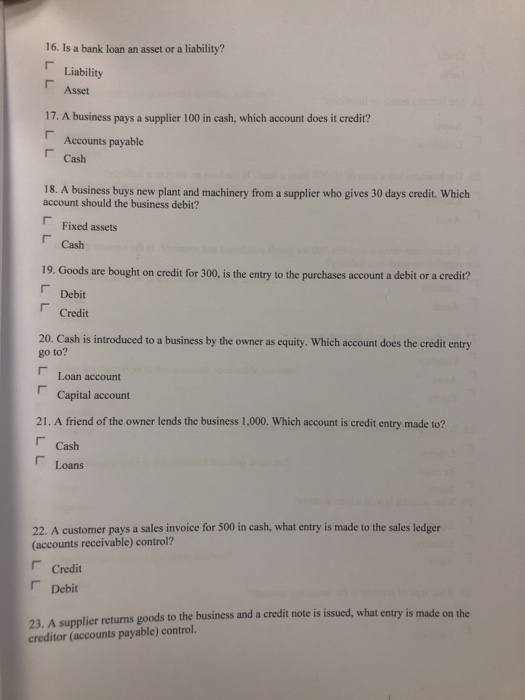

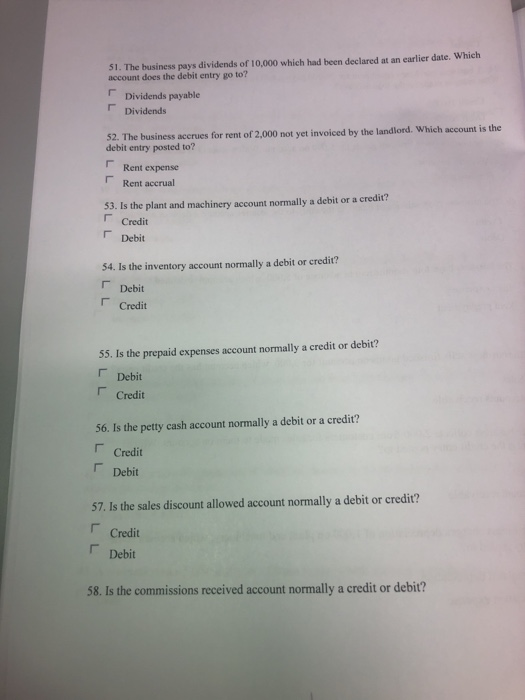

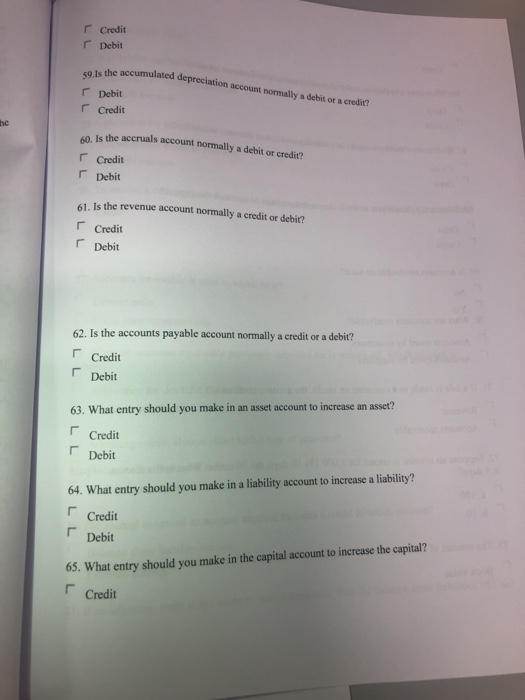

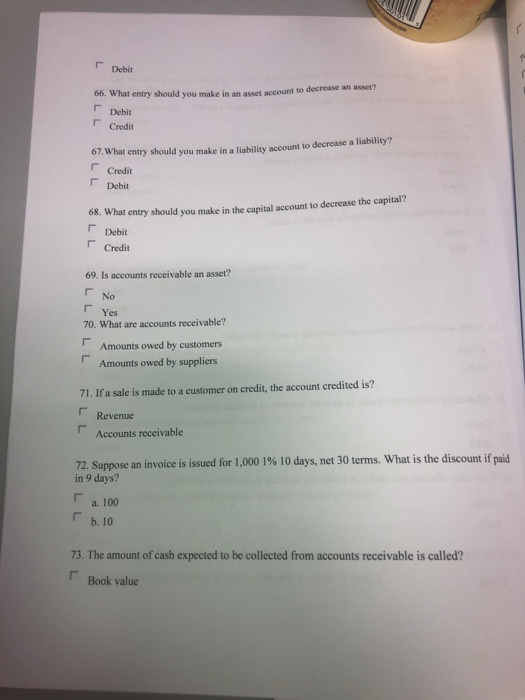

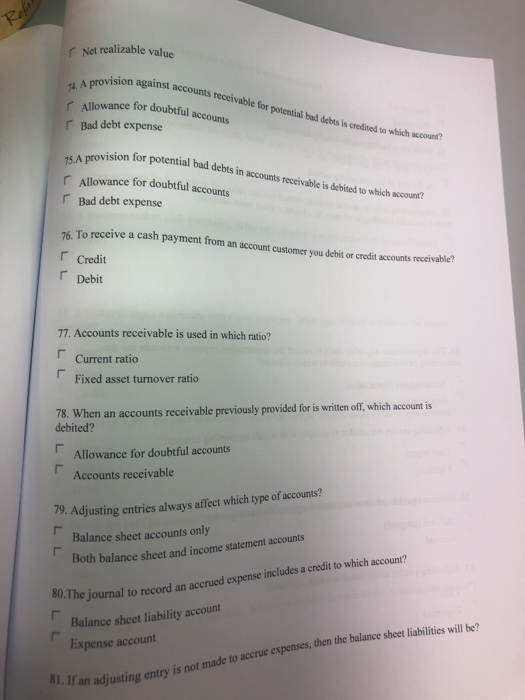

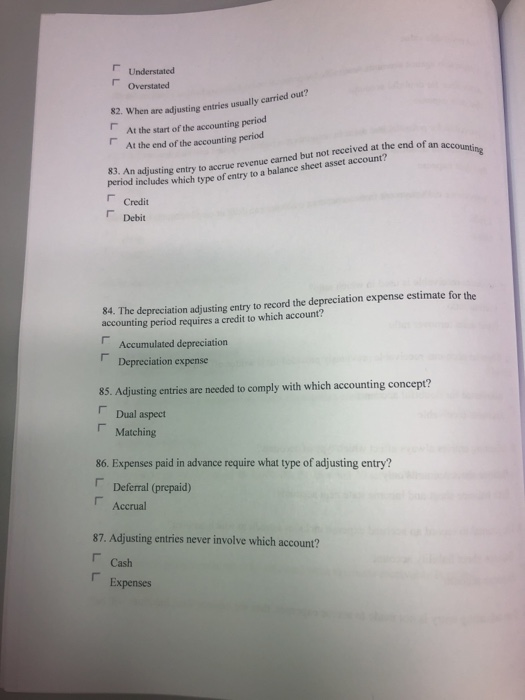

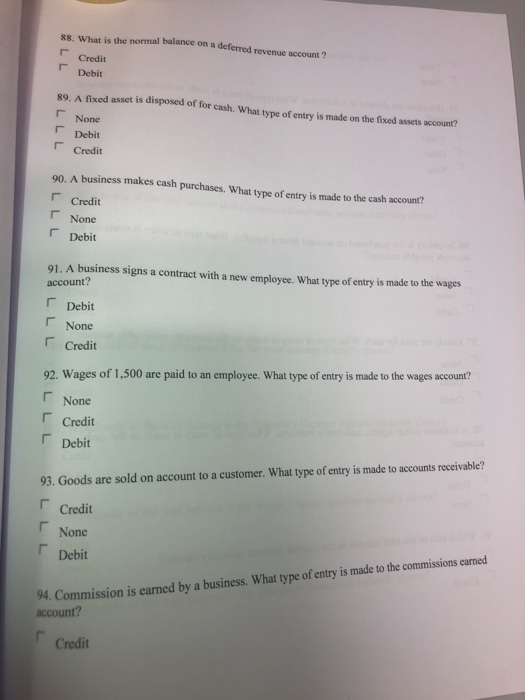

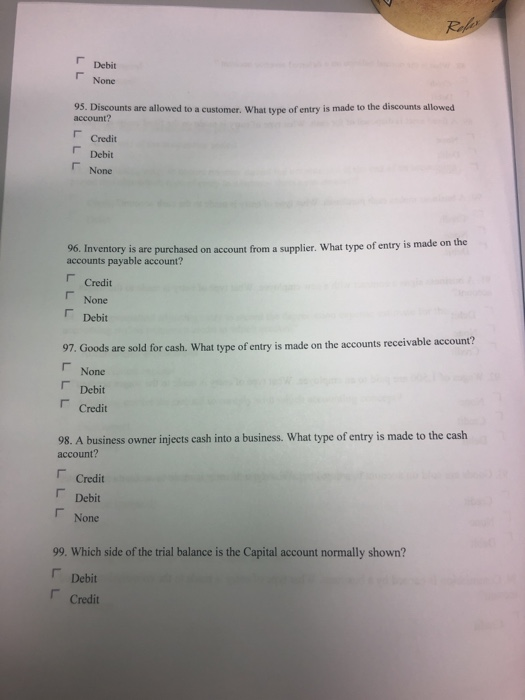

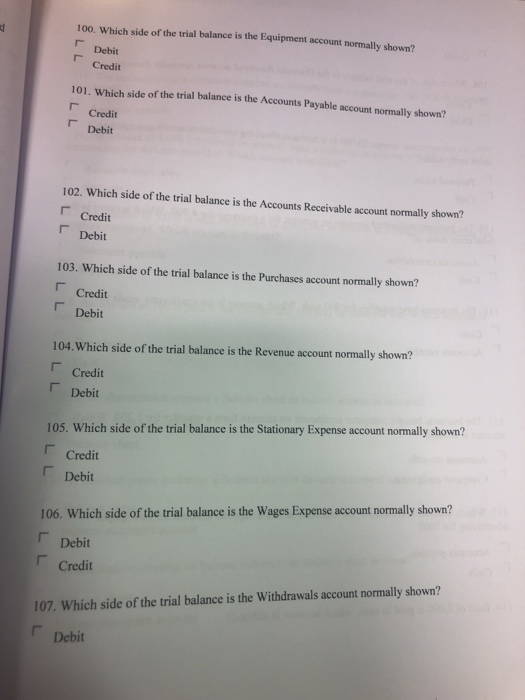

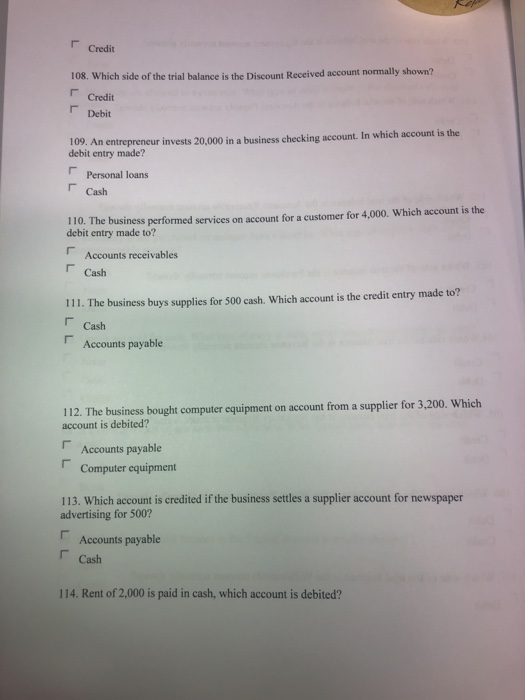

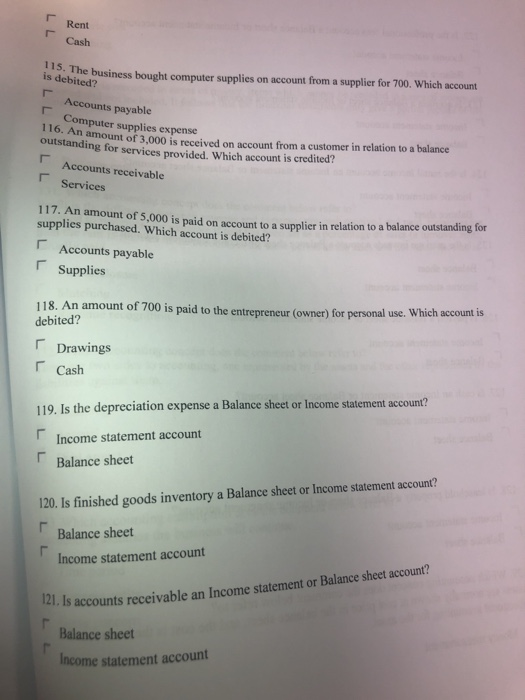

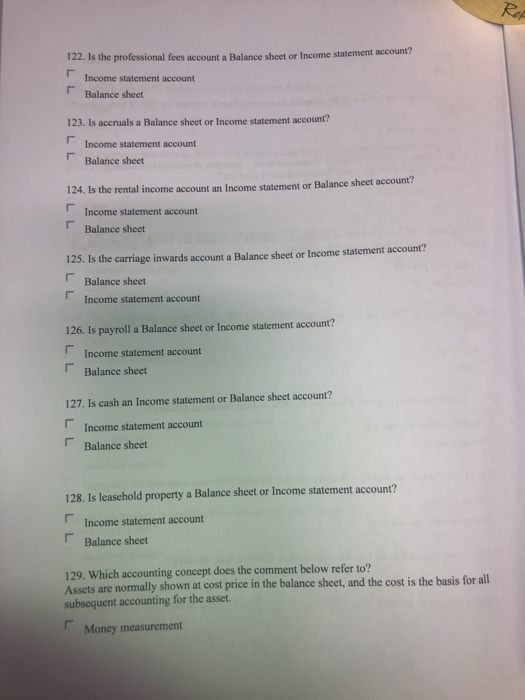

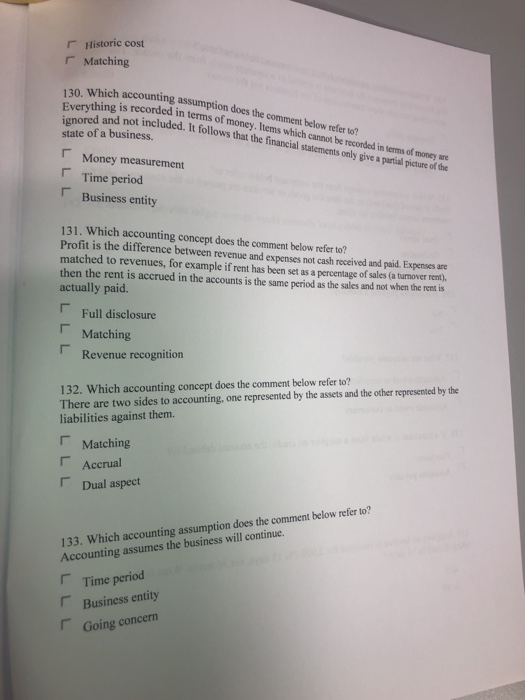

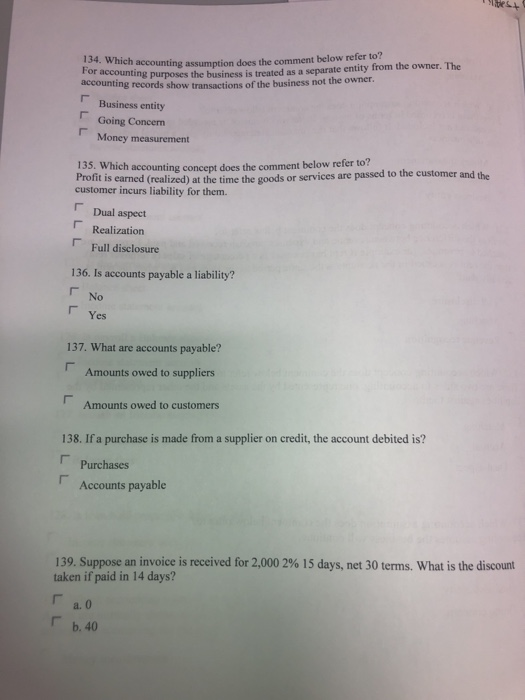

16. Is a bank loan an asset or a liability? Liability Asset 17. A business pays a supplier 100 in cash, which account does it credit? Accounts payable Cash 18. A business buys new plant and machinery from a supplier who gives 30 days credit. Which account should the business debit? Fixed assets Cash 19. Goods are bought on credit for 300, is the entry to the purchases account a debit or a credit? Debit Credit 20. Cash is introduced to a business by the owner as equity. Which account does the credit entry Loan account Capital account 21. A friend of the owner lends the business 1,000. Which account is credit entry made to? Cash Loans 22. A customer pays a sales invoice for 500 in cash, what entry is made to the sales ledger (accounts receivable) control? Credit Debit 23. A supplier returns goods to the business and a credit note is issued, what entry is made on the creditor (accounts payable) control. Credit Debit 24. Are fixtures assets or liabilities? Assets Liabilities 25. The business has a loan of 10,000 from a bank. Is the loan an asset or a liability? Liability Asset to 26. The business owes a supplier 500 for goods purchased and received. Is the amount owed the supplier an asset or a liability? Liability r Asset 3 27. What account type is the cash account? Liability r Asset Equity 35 28. What type of account is the cost of sales account? Revenue Asset 29. What account type is a loan account? 36. w Equity Liability r Asset Rev 30. What type of account is the inventory account? Expense Liability Asset 31. What account type is the rent expense account? Revenue Asset Expense 32. What type of account is the accounts payable account? Liability Asset Equity . What account type is the common stock account? Asset Equity Liability 34. What account type is the accounts receivable account? Asset Liability Expense 35. What account type is the frechold building account? Asset Expense Liability 36. What account type is the sales account? r Asset Revenue 37. Using the accounting equation, if assets increase by 5,000 and liabilities decrease by 5,.000 what is the change in owner's equity? Decrease of 10,000 Increase of 10,000 38. Using the accounting equation, if owner's equity increases by 10,000 and liabilities decrease by 20,000, what do assets change by? Decrease by 10,000 Increase by 10,000 39. Using the accounting equation, if assets increase by 5,000 and liabilities decrease by 5,000, what is the effect on owner's equity? r- increase of 10,000 Stay the same by 7,000, 40. Using the accounting equation, if liabilities increase by 8,000 and equity increases what is the effect on assets? Decrease by 1,000 Increase by 15,000 41. Using the accounting equation, if assets and liabilities both decrease by 4,000 what is the effect on owner's equity? Increases by 8,000 No effect 42. Using the accounting equation, if liabilities increase by 6,000 and equity reduces by 10,00 what is the change in assets? Decrease of 4,000 Increase of 4,000 43. A business issues 5,000 shares at 1.00 par value, which account is credited? Cash Capital 44. A business purchases equipment for 20,000 paying half in cash and half using a bank loan. What entry is made on the loan account? Credit 10,000 Debit 10,000 45. The business buys finished goods for 5,000 on account. Which account is credited? Accounts payable Finished goods 46. The business pays salaries of 6,000, is the entry to the salaries accoo Credit Debit 47.The business pays four months rent in advance of 5,000, which account is debited? Rent expense Rent prepayment 48. The business sells finished goods on account for 3,000, which account has the credit entry? Sales Accounts receivable 49. The business collects 2,000 from customers for sales made to them on account. Which account is the credit entry posted to? Cash r- Account receivable 50. The business charges depreciation of 1,000 on plant and machinery, which account is the credit entry posted to? Accumulated depreciation Depreciation expense 51. The business pays dividends of 10,000 which had been declared at an earlier date. Which account does the debit entry go to? Dividends payable Dividends $2. The business accrues for rent of 2,000 not yet invoiced by the landlord. Which account is the debit entry posted to? Rent expense Rent accrual 53. Is the plant and machinery account normally a debit or a credit? Credit Debit 54. Is the inventory account normally a debit or credit? Debit Credit 55. Is the prepaid expenses account normally a credit or debit? Debit Credit 56. Is the petty cash account normally a debit or a credit? Credit Debit 57, Is the sales discount allowed account normally a debit or credit? Credit Debit 58. Is the commissions received account normally a credit or debit? r Credit r Debit 59.1s the accumulated r Debit Credit depreciation account normally a debit or a credit? he accruals account normally a debit or credit? 60. Is the Credit r Debit 1. Is the revenue account normally a credit or debit? Credit r Debit 62. Is the accounts payable account normally a credit or a debit? Credit r Debit 63. What entry should you make in an asset account to increase an asset? Credit Debit 64. What entry should you make in a liability account to increase a liability? Credit Debit 65. What entry should you make in the capital account to increase the capital? Credit Debit 66. What Debit Credit entry should you make in an asset account to decrease an asset? 67 What entry should you make in a liability account to decrease a liability? Credit Debit 68. What entry should you make in the capital account to decrease the capital? Debit Credit 69. Is accounts receivable an asser? No r Yes 70. What are accounts receivable? Amounts owed by customers Amounts owed by suppliers r- 71. If a sale is made to a customer on credit, the account credited is? Revenue Accounts receivable 72. Suppose an invoice is issued for 1,000 1% 10 days, net 30 terms, what is the discount if paid in 9 days? a. 100 b. 10 73. The amount of cash expected to be collected from accounts receivable is called? Book value Net realizable value vision against accounts receivable for potential bad debts is credited to which accoun? 74. A r Allowance for doubtful accounts rBad debt expense for potential bad debts in accounts receivable is debited t rAllowance for doubtful accounts r Bad debt expense which account? To receive a cash payment from an account customer you debit or credit accounts receivablae? Credit r Debit 77. Accounts receivable is used in which ratio? Current ratio Fixed asset turnover ratio 78. When an accounts receivable previously provided for is written off, which account is debited? Allowance for doubtful accounts Accounts receivable 79. Adjusting entries always affect which type of accounts? Balance sheet accounts only Both balance sheet and income statement accounts includes a credit to which account? 80. The journal to record an accrued expense incl Balance sheet liability account Expense account expenses, then the balance sheet liabilities will be? BI. If an adjusting entry is not Understated overstated 82. When are adjusting entries usually carried out? At the start of the accounting period At the end of the accounting period revenue earned but not received at the end of an sheet asset account to a balance period includes which type of entry credit Debit 84. The depreciation adjusting entry to record the depreciation expense estimate for the accounting period requires a credit to which account? Depreciation expense 85. Adjusting entries are needed to comply with which accounting concept? Dual aspect Matching 86. Expenses paid in advance require what type of adjusting entry? Deferral (prepaid) Accrual 87. Adjusting entries never involve which account? Cash Expenses 88. What is the normal balance on a deferred revenue account Credit Debit 89. A fixed asset is disposed of for cash. What type of entry is made on the fixed assets account? None Debit Credit 90. A business makes cash purchases. What type of entry is made to the cash accoumr? Credit r None Debit 91. A business signs a contract with a new employee. What type of entry is made to the wages account? Debit None Credit 92. Wages of 1,500 are paid to an employee. What type of entry is made to the wages account? None r Credit Debit 93. Goods are sold on account to a customer. What type of entry is made to accounts receivable? Credit None Debit 94. Commission is earned by a business. What type of entry is made to the commissions ecarmed account? Credit Debit None 95. Discounts are allowed to a customer. What type of entry is made to the discounts allowed account? Credit Debit None 96. Inventory is are purchased on account from a supplier. What type of entry is made on accounts payable account? Credit None Debit 97. Goods are sold for cash. What type of entry is made on the accounts receivable account? None Debit Credit 98. A business owner injects cash into a business. account? What type of entry is made to the cash Credit Debit None 99. Which side of the trial balance is the Capital account normally shown? Debit Credit 100. Which side of the trial balance is the Equipment account normally shown? Debit Credit 101. Which side of the trial balance is the Accounts Payable account normally shown? Credit Debit 102. Which side of the trial balance is the Accounts Receivable account normally shown? Credit Debit 103. Which side of the trial balance is the Purchases account normally shown? Credit Debit 104. Which side of the trial balance is the Revenue account normally shown? Credit Debit 105. Which side of the trial balance is the Stationary Expense account normally shown? Credit Debit 106. Which side of the trial balance is the Wages Expense account normally shown? Debit Credit 107. Which side of the trial balance is the Withdrawals account normally shown? Debit Credit 108. Which side of the trial balance is the Discount Received account normally shown? r Credit r Debit 109. An debit entry made? entrepreneur invests 20,000 in a business checking account. In which account is the Personal loans Cash 110. debit entry made to? The business performed services on account for a customer for 4,000. Which account is the Accounts receivables r Cash 111. The business buys supplies for 500 cash. Which account is the credit entry made to? Cash Accounts payable 112. The business bought computer equipment on account from a supplier for 3,200. Which account is debited? r- Accounts payable Computer equipment 113. Which account is credited if the business settles a supplier account for newspaper advertising for 500? Accounts payable Cash 114. Rent of 2,000 is paid in cash, which account is debited? r Kent Cash ss. The busines bought computer supplies on account from a supplier for 700. Which accourt is debited? Accounts payable Computer supplies expense nd imount of 3,000 is received on account from a customer in relation to a balance Accounts receivable Services outstanding for services provided. Which account is credited? 117. An amount of 5,000 is paid on account to a supplier in relation to a balance outstanding for supplies purchased. Which account is debited? Accounts payable Supplies account is 118. An amount of 700 is paid to the entrepreneur (owner) for personal use. Which debited? Drawings Cash 119. Is the depreciation expense a Balance sheet or Income statement account? Income statement account Balance sheet Balance sheet accounts receivable an Income statement or Balance sheet account? Balance sheet Income statement account Income statement account 122. Is the professional fees account a Balance sheet or Income statement account? Income statement account Balance sheet 123. Is accruals a Balance sheet or Income statement account? Income statement account Balance sheet 4. Is the rental income account an Income statement or Balance sheet account? 12 Income statement account Balance sheet 125. Is the carriage inwards account a Balance sheet or Income statement account? Balance sheet Income statement account 126. Is payroll a Balance sheet or Income statement account? Income statement account Balance sheet 127. Is cash an Income statement or Balance sheet account? Inconne statennent account Balance sheet 128. Is leasehold property a Balance sheet or Income statement account? Income statement account Balance sheet 129. Which accounting concept does the comment below refer to? Assets are normally shown at cost price in the balance sheet, and the cost is the basis for all subsequent accounting for the asset. Money measurement Historic cost Matching 130. Which ignored and not accounting assumption does the comment below refer to? is recorded in terms of money. Items which cannot be recorded in terms of money are included. It follows that the financial statements only give a partial picture of the state of a business. Money measurement Time period Business entity 131. Which accounting concept does the comment below refer to? Profit is the difference between revenue an matched to revenues, for example if rent has been set as a percentage of sales (a turnover rent) then the rent is accrued in the accounts is the same period as the sales and not when the rent is actually paid. d expenses not cash received and paid. Expenses are Full disclosure Matching Revenue recognition 132. Which accounting concept does the comment below refer to? There are two sides to accounting, one represented by the assets and the other represented by the liabilities against them. Matching Accrual Dual aspect 133. Which accounting assumption does the comment below refer to? Accounting assumes the business will continue. Time period Business entity Going concern ting assumption does the comment below refer to? ing purposes the business is treated as a separate entity from the owner. The 134. Which accounting accounting records show Business entity Going Concern transactions of the business not the owner Money measurement 135. Whic Protit is earn customer incurs liability for them. h accounting concept does the comment below refer to? ed (realized) at the time the goods or services are passed to the customer and the Dual aspect Realization Full disclosure 136. Is accounts payable a liability? No Yes 137. What are accounts payable? Amounts owed to suppliers Amounts owed to customers 138. If a purchase is made from a supplier on credit, the account debited is? Purchases Accounts payable 139. Suppose an invoice is received for 2,000 2% 15 days, net 30 terms. What is the discount taken if paid in 14 days? a. 0 b, 40 40. When you make e a cash payment to an account supplier you debit or credit accounts 140. cash ble? r Credit Debit rchase return would result in a debit or credit entry to accounts payable? 141. A puro Credit Debit 142. An accounts payable ledger account would normally have a debit or credit balance? Credit Debit

16. Is a bank loan an asset or a liability? Liability Asset 17. A business pays a supplier 100 in cash, which account does it credit? Accounts payable Cash 18. A business buys new plant and machinery from a supplier who gives 30 days credit. Which account should the business debit? Fixed assets Cash 19. Goods are bought on credit for 300, is the entry to the purchases account a debit or a credit? Debit Credit 20. Cash is introduced to a business by the owner as equity. Which account does the credit entry Loan account Capital account 21. A friend of the owner lends the business 1,000. Which account is credit entry made to? Cash Loans 22. A customer pays a sales invoice for 500 in cash, what entry is made to the sales ledger (accounts receivable) control? Credit Debit 23. A supplier returns goods to the business and a credit note is issued, what entry is made on the creditor (accounts payable) control. Credit Debit 24. Are fixtures assets or liabilities? Assets Liabilities 25. The business has a loan of 10,000 from a bank. Is the loan an asset or a liability? Liability Asset to 26. The business owes a supplier 500 for goods purchased and received. Is the amount owed the supplier an asset or a liability? Liability r Asset 3 27. What account type is the cash account? Liability r Asset Equity 35 28. What type of account is the cost of sales account? Revenue Asset 29. What account type is a loan account? 36. w Equity Liability r Asset Rev 30. What type of account is the inventory account? Expense Liability Asset 31. What account type is the rent expense account? Revenue Asset Expense 32. What type of account is the accounts payable account? Liability Asset Equity . What account type is the common stock account? Asset Equity Liability 34. What account type is the accounts receivable account? Asset Liability Expense 35. What account type is the frechold building account? Asset Expense Liability 36. What account type is the sales account? r Asset Revenue 37. Using the accounting equation, if assets increase by 5,000 and liabilities decrease by 5,.000 what is the change in owner's equity? Decrease of 10,000 Increase of 10,000 38. Using the accounting equation, if owner's equity increases by 10,000 and liabilities decrease by 20,000, what do assets change by? Decrease by 10,000 Increase by 10,000 39. Using the accounting equation, if assets increase by 5,000 and liabilities decrease by 5,000, what is the effect on owner's equity? r- increase of 10,000 Stay the same by 7,000, 40. Using the accounting equation, if liabilities increase by 8,000 and equity increases what is the effect on assets? Decrease by 1,000 Increase by 15,000 41. Using the accounting equation, if assets and liabilities both decrease by 4,000 what is the effect on owner's equity? Increases by 8,000 No effect 42. Using the accounting equation, if liabilities increase by 6,000 and equity reduces by 10,00 what is the change in assets? Decrease of 4,000 Increase of 4,000 43. A business issues 5,000 shares at 1.00 par value, which account is credited? Cash Capital 44. A business purchases equipment for 20,000 paying half in cash and half using a bank loan. What entry is made on the loan account? Credit 10,000 Debit 10,000 45. The business buys finished goods for 5,000 on account. Which account is credited? Accounts payable Finished goods 46. The business pays salaries of 6,000, is the entry to the salaries accoo Credit Debit 47.The business pays four months rent in advance of 5,000, which account is debited? Rent expense Rent prepayment 48. The business sells finished goods on account for 3,000, which account has the credit entry? Sales Accounts receivable 49. The business collects 2,000 from customers for sales made to them on account. Which account is the credit entry posted to? Cash r- Account receivable 50. The business charges depreciation of 1,000 on plant and machinery, which account is the credit entry posted to? Accumulated depreciation Depreciation expense 51. The business pays dividends of 10,000 which had been declared at an earlier date. Which account does the debit entry go to? Dividends payable Dividends $2. The business accrues for rent of 2,000 not yet invoiced by the landlord. Which account is the debit entry posted to? Rent expense Rent accrual 53. Is the plant and machinery account normally a debit or a credit? Credit Debit 54. Is the inventory account normally a debit or credit? Debit Credit 55. Is the prepaid expenses account normally a credit or debit? Debit Credit 56. Is the petty cash account normally a debit or a credit? Credit Debit 57, Is the sales discount allowed account normally a debit or credit? Credit Debit 58. Is the commissions received account normally a credit or debit? r Credit r Debit 59.1s the accumulated r Debit Credit depreciation account normally a debit or a credit? he accruals account normally a debit or credit? 60. Is the Credit r Debit 1. Is the revenue account normally a credit or debit? Credit r Debit 62. Is the accounts payable account normally a credit or a debit? Credit r Debit 63. What entry should you make in an asset account to increase an asset? Credit Debit 64. What entry should you make in a liability account to increase a liability? Credit Debit 65. What entry should you make in the capital account to increase the capital? Credit Debit 66. What Debit Credit entry should you make in an asset account to decrease an asset? 67 What entry should you make in a liability account to decrease a liability? Credit Debit 68. What entry should you make in the capital account to decrease the capital? Debit Credit 69. Is accounts receivable an asser? No r Yes 70. What are accounts receivable? Amounts owed by customers Amounts owed by suppliers r- 71. If a sale is made to a customer on credit, the account credited is? Revenue Accounts receivable 72. Suppose an invoice is issued for 1,000 1% 10 days, net 30 terms, what is the discount if paid in 9 days? a. 100 b. 10 73. The amount of cash expected to be collected from accounts receivable is called? Book value Net realizable value vision against accounts receivable for potential bad debts is credited to which accoun? 74. A r Allowance for doubtful accounts rBad debt expense for potential bad debts in accounts receivable is debited t rAllowance for doubtful accounts r Bad debt expense which account? To receive a cash payment from an account customer you debit or credit accounts receivablae? Credit r Debit 77. Accounts receivable is used in which ratio? Current ratio Fixed asset turnover ratio 78. When an accounts receivable previously provided for is written off, which account is debited? Allowance for doubtful accounts Accounts receivable 79. Adjusting entries always affect which type of accounts? Balance sheet accounts only Both balance sheet and income statement accounts includes a credit to which account? 80. The journal to record an accrued expense incl Balance sheet liability account Expense account expenses, then the balance sheet liabilities will be? BI. If an adjusting entry is not Understated overstated 82. When are adjusting entries usually carried out? At the start of the accounting period At the end of the accounting period revenue earned but not received at the end of an sheet asset account to a balance period includes which type of entry credit Debit 84. The depreciation adjusting entry to record the depreciation expense estimate for the accounting period requires a credit to which account? Depreciation expense 85. Adjusting entries are needed to comply with which accounting concept? Dual aspect Matching 86. Expenses paid in advance require what type of adjusting entry? Deferral (prepaid) Accrual 87. Adjusting entries never involve which account? Cash Expenses 88. What is the normal balance on a deferred revenue account Credit Debit 89. A fixed asset is disposed of for cash. What type of entry is made on the fixed assets account? None Debit Credit 90. A business makes cash purchases. What type of entry is made to the cash accoumr? Credit r None Debit 91. A business signs a contract with a new employee. What type of entry is made to the wages account? Debit None Credit 92. Wages of 1,500 are paid to an employee. What type of entry is made to the wages account? None r Credit Debit 93. Goods are sold on account to a customer. What type of entry is made to accounts receivable? Credit None Debit 94. Commission is earned by a business. What type of entry is made to the commissions ecarmed account? Credit Debit None 95. Discounts are allowed to a customer. What type of entry is made to the discounts allowed account? Credit Debit None 96. Inventory is are purchased on account from a supplier. What type of entry is made on accounts payable account? Credit None Debit 97. Goods are sold for cash. What type of entry is made on the accounts receivable account? None Debit Credit 98. A business owner injects cash into a business. account? What type of entry is made to the cash Credit Debit None 99. Which side of the trial balance is the Capital account normally shown? Debit Credit 100. Which side of the trial balance is the Equipment account normally shown? Debit Credit 101. Which side of the trial balance is the Accounts Payable account normally shown? Credit Debit 102. Which side of the trial balance is the Accounts Receivable account normally shown? Credit Debit 103. Which side of the trial balance is the Purchases account normally shown? Credit Debit 104. Which side of the trial balance is the Revenue account normally shown? Credit Debit 105. Which side of the trial balance is the Stationary Expense account normally shown? Credit Debit 106. Which side of the trial balance is the Wages Expense account normally shown? Debit Credit 107. Which side of the trial balance is the Withdrawals account normally shown? Debit Credit 108. Which side of the trial balance is the Discount Received account normally shown? r Credit r Debit 109. An debit entry made? entrepreneur invests 20,000 in a business checking account. In which account is the Personal loans Cash 110. debit entry made to? The business performed services on account for a customer for 4,000. Which account is the Accounts receivables r Cash 111. The business buys supplies for 500 cash. Which account is the credit entry made to? Cash Accounts payable 112. The business bought computer equipment on account from a supplier for 3,200. Which account is debited? r- Accounts payable Computer equipment 113. Which account is credited if the business settles a supplier account for newspaper advertising for 500? Accounts payable Cash 114. Rent of 2,000 is paid in cash, which account is debited? r Kent Cash ss. The busines bought computer supplies on account from a supplier for 700. Which accourt is debited? Accounts payable Computer supplies expense nd imount of 3,000 is received on account from a customer in relation to a balance Accounts receivable Services outstanding for services provided. Which account is credited? 117. An amount of 5,000 is paid on account to a supplier in relation to a balance outstanding for supplies purchased. Which account is debited? Accounts payable Supplies account is 118. An amount of 700 is paid to the entrepreneur (owner) for personal use. Which debited? Drawings Cash 119. Is the depreciation expense a Balance sheet or Income statement account? Income statement account Balance sheet Balance sheet accounts receivable an Income statement or Balance sheet account? Balance sheet Income statement account Income statement account 122. Is the professional fees account a Balance sheet or Income statement account? Income statement account Balance sheet 123. Is accruals a Balance sheet or Income statement account? Income statement account Balance sheet 4. Is the rental income account an Income statement or Balance sheet account? 12 Income statement account Balance sheet 125. Is the carriage inwards account a Balance sheet or Income statement account? Balance sheet Income statement account 126. Is payroll a Balance sheet or Income statement account? Income statement account Balance sheet 127. Is cash an Income statement or Balance sheet account? Inconne statennent account Balance sheet 128. Is leasehold property a Balance sheet or Income statement account? Income statement account Balance sheet 129. Which accounting concept does the comment below refer to? Assets are normally shown at cost price in the balance sheet, and the cost is the basis for all subsequent accounting for the asset. Money measurement Historic cost Matching 130. Which ignored and not accounting assumption does the comment below refer to? is recorded in terms of money. Items which cannot be recorded in terms of money are included. It follows that the financial statements only give a partial picture of the state of a business. Money measurement Time period Business entity 131. Which accounting concept does the comment below refer to? Profit is the difference between revenue an matched to revenues, for example if rent has been set as a percentage of sales (a turnover rent) then the rent is accrued in the accounts is the same period as the sales and not when the rent is actually paid. d expenses not cash received and paid. Expenses are Full disclosure Matching Revenue recognition 132. Which accounting concept does the comment below refer to? There are two sides to accounting, one represented by the assets and the other represented by the liabilities against them. Matching Accrual Dual aspect 133. Which accounting assumption does the comment below refer to? Accounting assumes the business will continue. Time period Business entity Going concern ting assumption does the comment below refer to? ing purposes the business is treated as a separate entity from the owner. The 134. Which accounting accounting records show Business entity Going Concern transactions of the business not the owner Money measurement 135. Whic Protit is earn customer incurs liability for them. h accounting concept does the comment below refer to? ed (realized) at the time the goods or services are passed to the customer and the Dual aspect Realization Full disclosure 136. Is accounts payable a liability? No Yes 137. What are accounts payable? Amounts owed to suppliers Amounts owed to customers 138. If a purchase is made from a supplier on credit, the account debited is? Purchases Accounts payable 139. Suppose an invoice is received for 2,000 2% 15 days, net 30 terms. What is the discount taken if paid in 14 days? a. 0 b, 40 40. When you make e a cash payment to an account supplier you debit or credit accounts 140. cash ble? r Credit Debit rchase return would result in a debit or credit entry to accounts payable? 141. A puro Credit Debit 142. An accounts payable ledger account would normally have a debit or credit balance? Credit Debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started