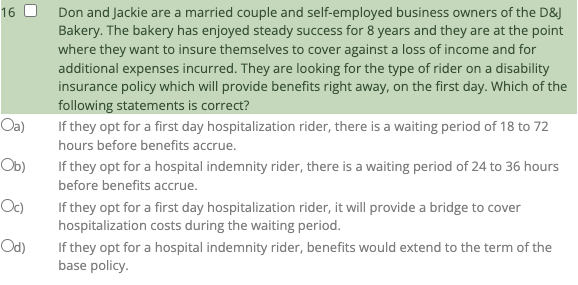

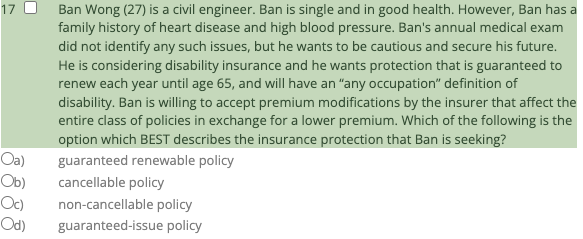

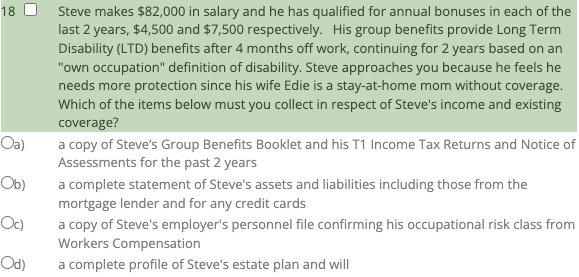

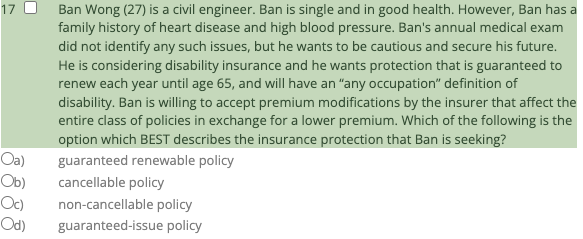

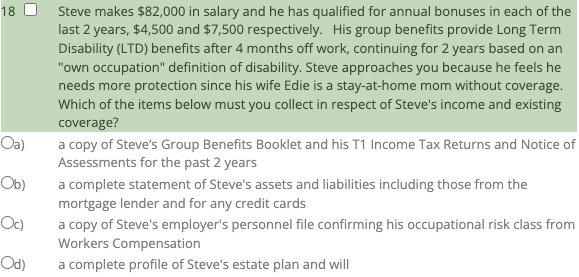

16 Oa) Don and Jackie are a married couple and self-employed business owners of the D&J Bakery. The bakery has enjoyed steady success for 8 years and they are at the point where they want to insure themselves to cover against a loss of income and for additional expenses incurred. They are looking for the type of rider on a disability insurance policy which will provide benefits right away, on the first day. Which of the following statements is correct? If they opt for a first day hospitalization rider, there is a waiting period of 18 to 72 hours before benefits accrue. If they opt for a hospital indemnity rider, there is a waiting period of 24 to 36 hours before benefits accrue. If they opt for a first day hospitalization rider, it will provide a bridge to cover hospitalization costs during the waiting period. If they opt for a hospital indemnity rider, benefits would extend to the term of the base policy. Ob) Oc) Od) Ban Wong (27) is a civil engineer. Ban is single and in good health. However, Ban has a family history of heart disease and high blood pressure. Ban's annual medical exam did not identify any such issues, but he wants to be cautious and secure his future. He is considering disability insurance and he wants protection that is guaranteed to renew each year until age 65, and will have an "any occupation" definition of disability. Ban is willing to accept premium modifications by the insurer that affect the entire class of policies in exchange for a lower premium. Which of the following is the option which BEST describes the insurance protection that Ban is seeking? guaranteed renewable policy cancellable policy non-cancellable policy guaranteed-issue policy Oa) Ob) Oc) Od) 18 Oa) Steve makes $82,000 in salary and he has qualified for annual bonuses in each of the last 2 years, $4,500 and $7,500 respectively. His group benefits provide Long Term Disability (LTD) benefits after 4 months off work, continuing for 2 years based on an "own occupation" definition of disability. Steve approaches you because he feels he needs more protection since his wife Edie is a stay-at-home mom without coverage. Which of the items below must you collect in respect of Steve's income and existing coverage? a copy of Steve's Group Benefits Booklet and his T1 Income Tax Returns and Notice of Assessments for the past 2 years a complete statement of Steve's assets and liabilities including those from the mortgage lender and for any credit cards a copy of Steve's employer's personnel file confirming his occupational risk class from Workers Compensation a complete profile of Steve's estate plan and will Ob) Oc) Od)