Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1-6 Part Question. Please explain in detail. I will give a rating. Internal rate of return and modified internal rate of return Quark Industries has

1-6 Part Question. Please explain in detail. I will give a rating.

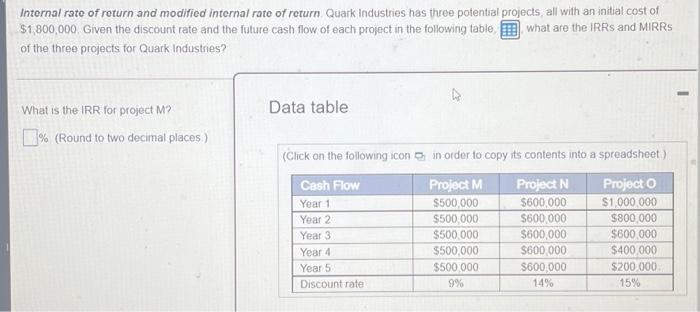

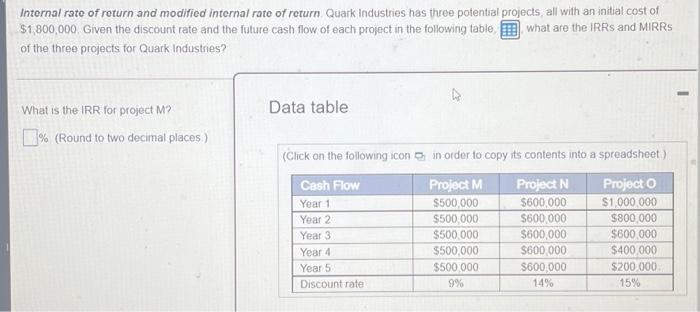

Internal rate of return and modified internal rate of return Quark Industries has three potential projects, all with an initial cost of $1,800,000. Given the discount rate and the future cash flow of each project in the following table, what are the IRRs and MIRRS of the three projects for Quark Industries? Data table What is the IRR for project M? % (Round to two decimal places) (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flow Project M Project N Projecto Year 1 $500,000 $600,000 $1,000,000 Year 2 $500,000 $600,000 $800,000 Year 3 $500,000 $600,000 $600,000 Year 4 $500,000 $600,000 $400,000 Year 5 $500 000 S600,000 $200,000 Discount rate 9% 14% 15%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started