Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16 please help D Question 16 5 pts A firm has a debt/equity ratio of 0.60 and a tax rate of 40.0 percent. Its equity

16 please help

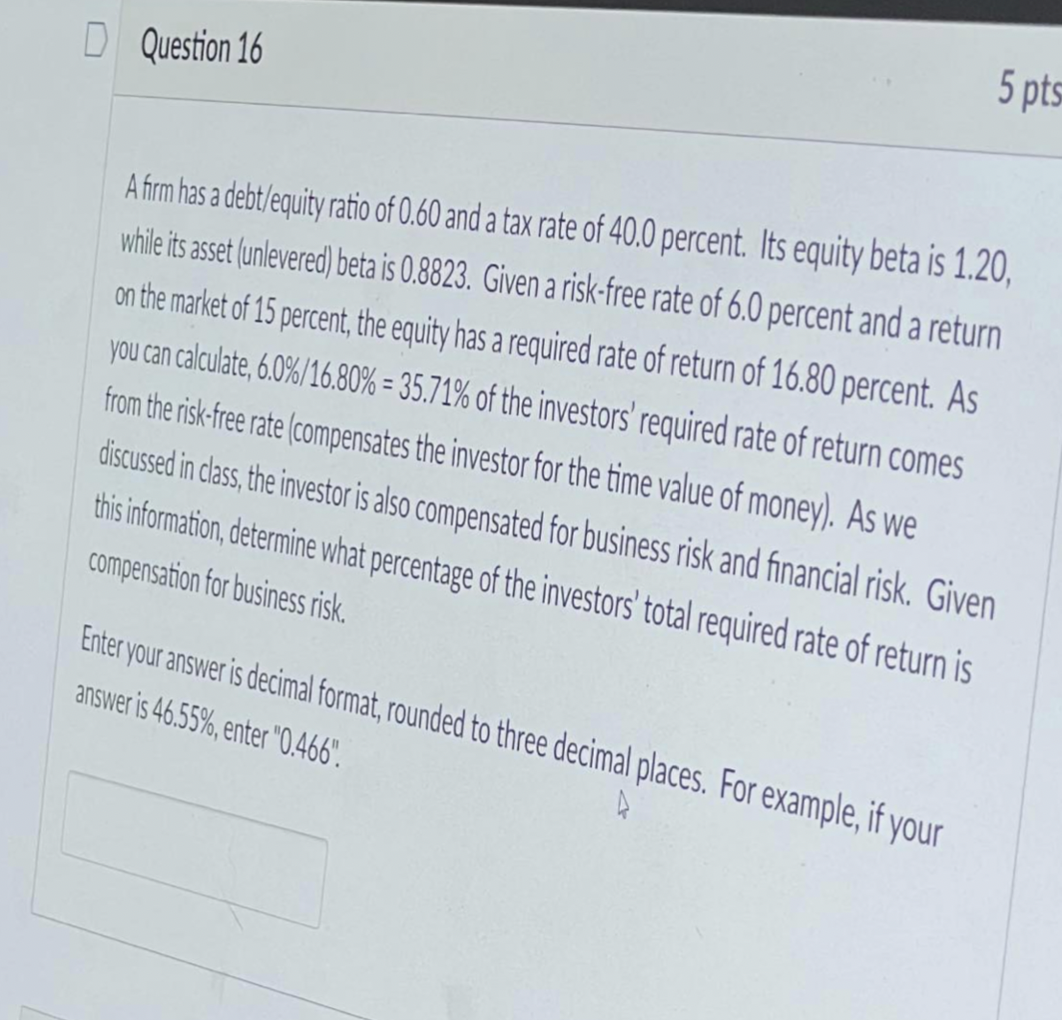

D Question 16 5 pts A firm has a debt/equity ratio of 0.60 and a tax rate of 40.0 percent. Its equity beta is 1.20, while its asset (unlevered) beta is 0.8823. Given a risk-free rate of 6.0 percent and a return on the market of 15 percent, the equity has a required rate of return of 16.80 percent. As you can calculate, 6.0%/16.80% = 35.71% of the investors' required rate of return comes from the risk-free rate (compensates the investor for the time value of money). As we discussed in class, the investor is also compensated for business risk and financial risk. Given this information, determine what percentage of the investors' total required rate of return is compensation for business risk. Enter your answer is decimal format, rounded to three decimal places. For example, if your answer is 46.55%, enter "0.466Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started