Answered step by step

Verified Expert Solution

Question

1 Approved Answer

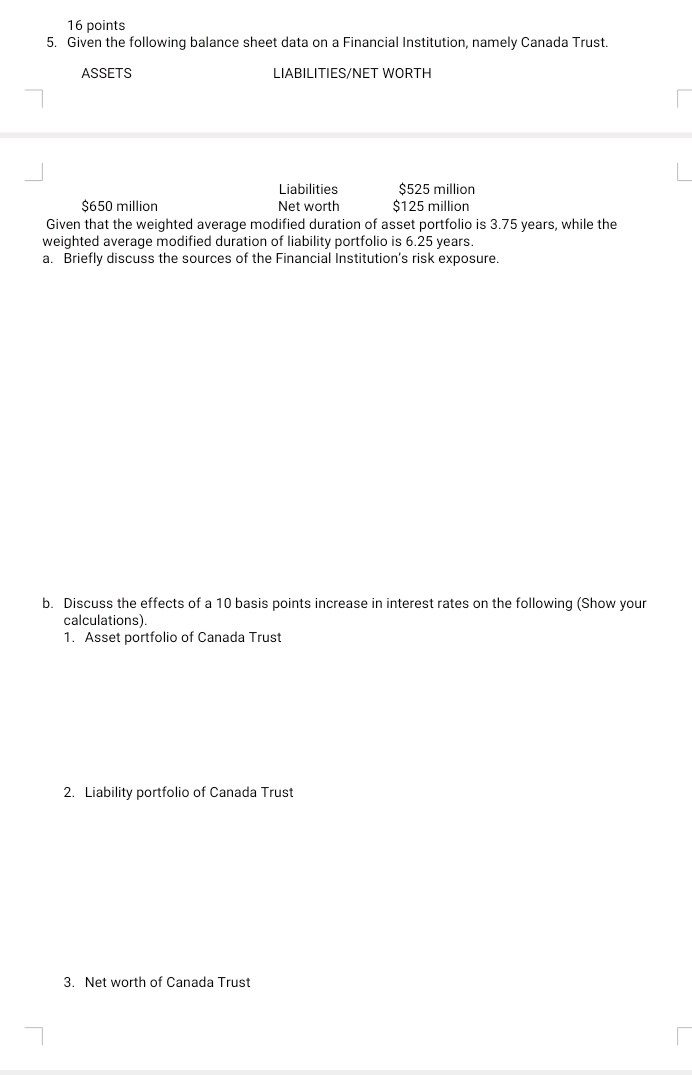

16 points 5. Given the following balance sheet data on a Financial Institution, namely Canada Trust. ASSETS LIABILITIES/NET WORTH Liabilities $525 million $650 million Net

16 points 5. Given the following balance sheet data on a Financial Institution, namely Canada Trust. ASSETS LIABILITIES/NET WORTH Liabilities $525 million $650 million Net worth $125 million Given that the weighted average modified duration of asset portfolio is 3.75 years, while the weighted average modified duration of liability portfolio is 6.25 years. a. Briefly discuss the sources of the Financial Institution's risk exposure. b. Discuss the effects of a 10 basis points increase in interest rates on the following (Show your calculations) 1. Asset portfolio of Canada Trust 2. Liability portfolio of Canada Trust 3. Net worth of Canada Trust

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started