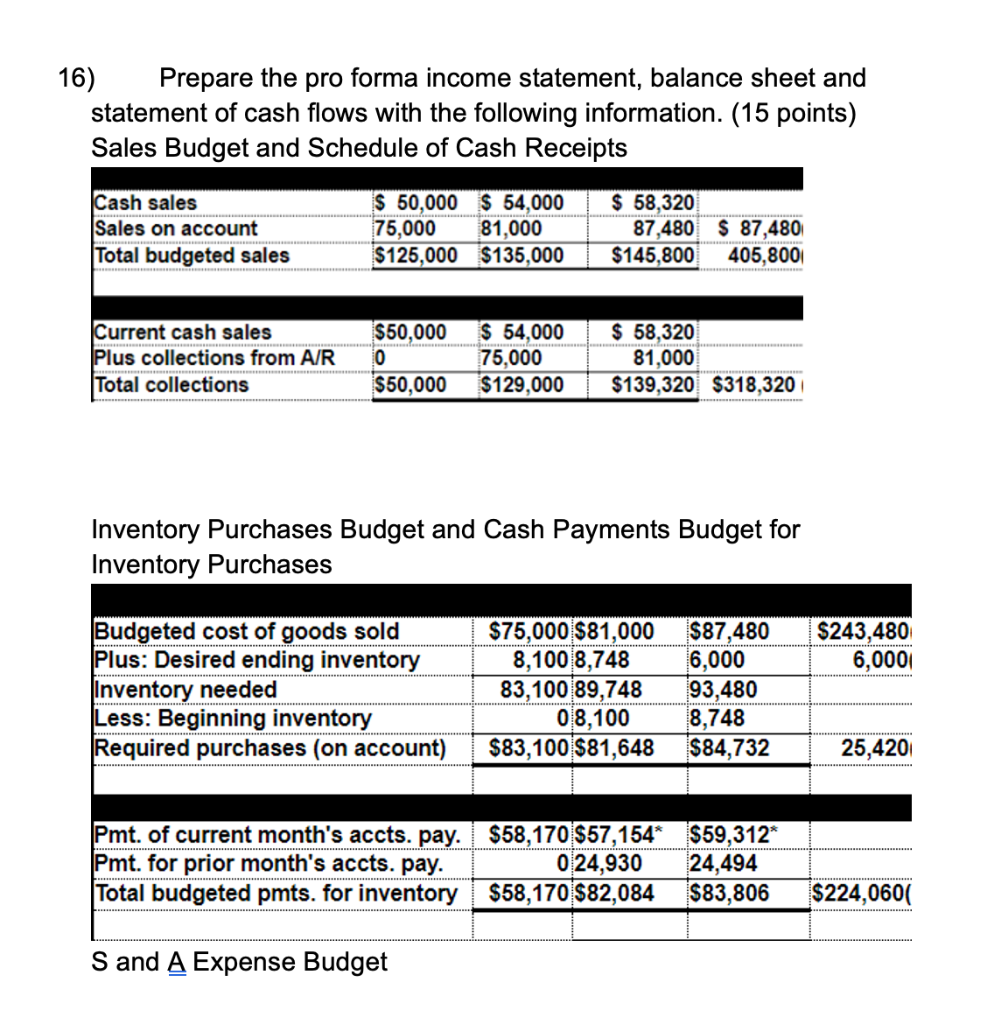

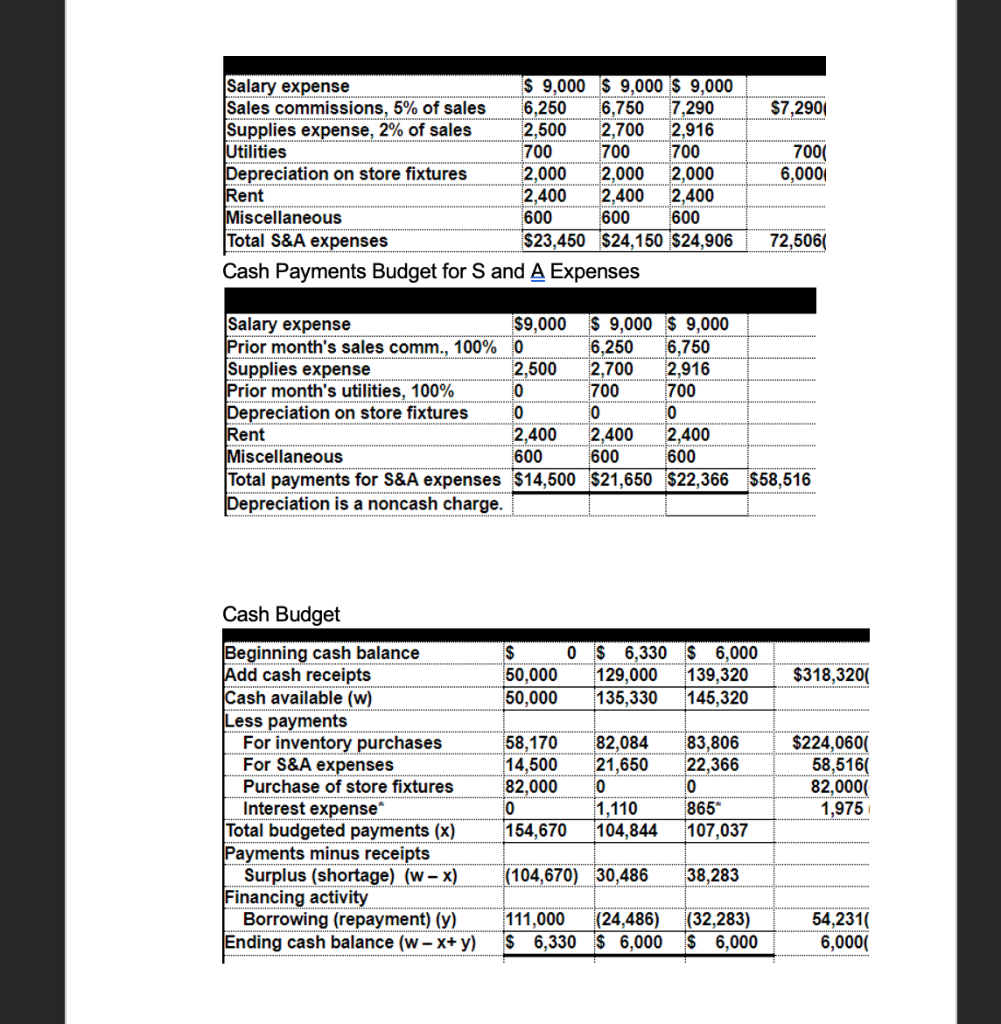

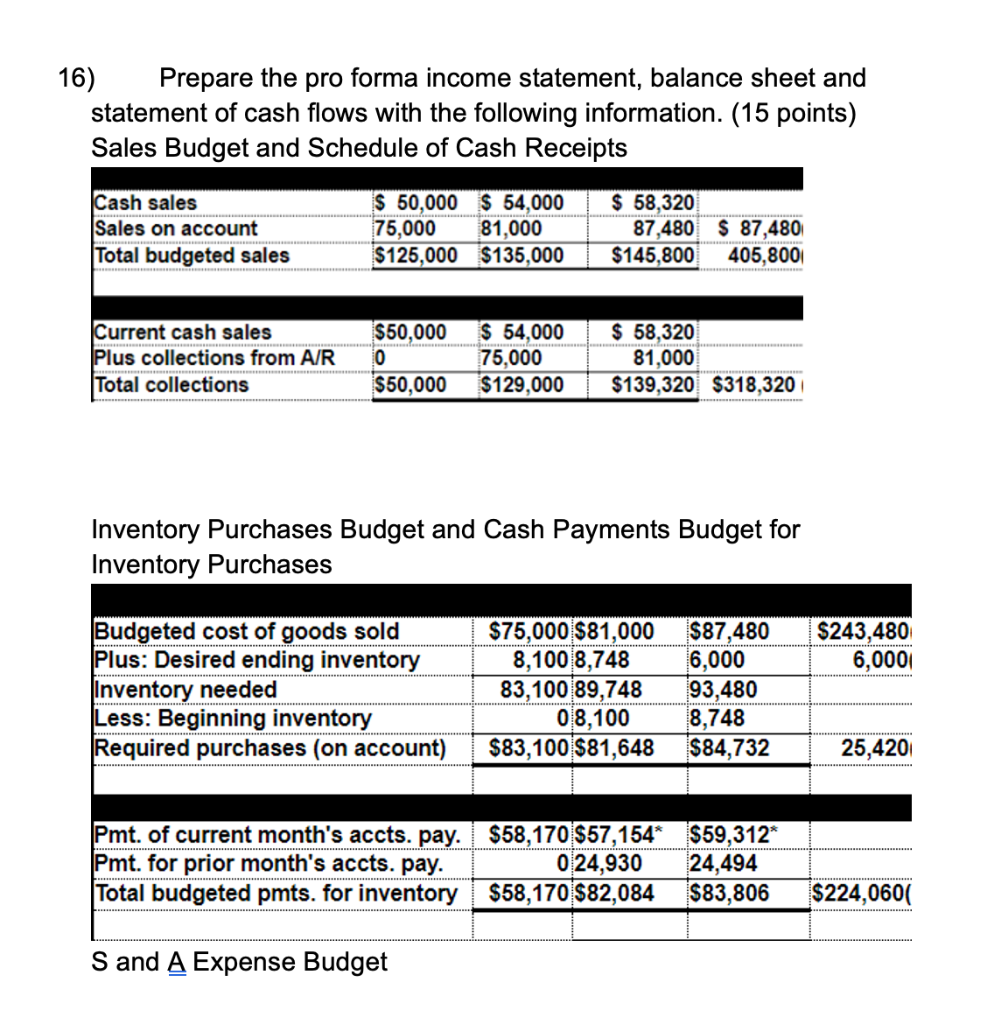

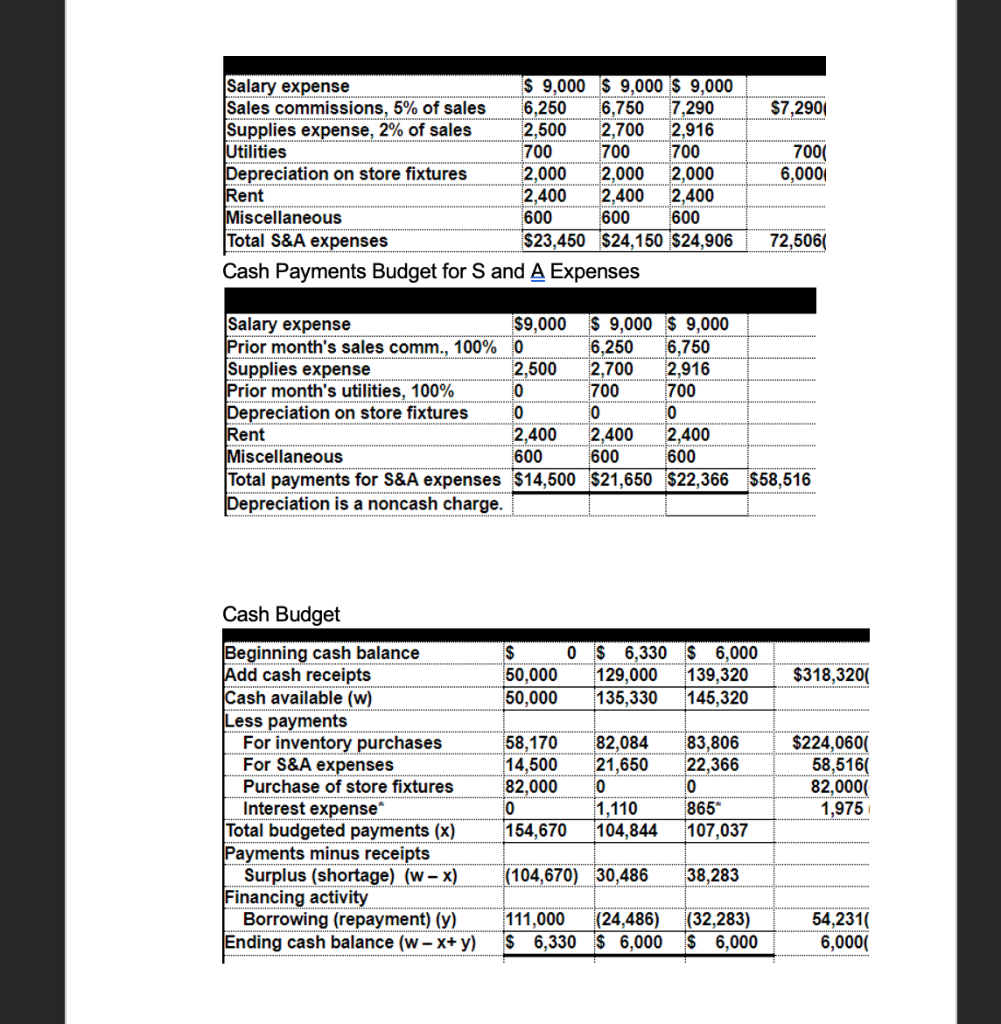

16) Prepare the pro forma income statement, balance sheet and statement of cash flows with the following information. (15 points) Sales Budget and Schedule of Cash Receipts Cash sales Sales on account Total budgeted sales $ 50,000 $ 54,000 75,000 81,000 $125,000 $135,000 $ 58,320 87,480 $ 87,480 $145,800 405,800 Current cash sales Plus collections from A/R Total collections $50,000 0 $50,000 $ 54,000 75,000 $129,000 $ 58,320 81,000 $139,320 $318,320 Inventory Purchases Budget and Cash Payments Budget for Inventory Purchases $243,480 6,0001 Budgeted cost of goods sold Plus: Desired ending inventory Inventory needed Less: Beginning inventory Required purchases (on account) $75,000 $81,000 8,100 8,748 83,100 89,748 0 8,100 $83,100 $81,648 $87,480 6,000 93,480 8,748 $84,732 25,420 Pmt. of current month's accts. pay. $58,170 $57,154* $59,312* Pmt. for prior month's accts. pay. 0 24,930 24,494 Total budgeted pmts. for inventory $58,170 $82,084 $83,806 $224,0600 S and A Expense Budget $7,2901 Salary expense $ 9,000 $ 9,000 $ 9,000 Sales commissions, 5% of sales 6.250 6,750 7,290 Supplies expense, 2% of sales 2,500 2.700 2.916 Utilities 700 700 700 Depreciation on store fixtures 2,000 2,000 2.000 Rent 2,400 2,400 2,400 Miscellaneous Total S&A expenses $23,450 $24,150 $24,906 Cash Payments Budget for S and A Expenses 7000 6,0001 600 600 600 72,5061 Salary expense $9,000 $ 9,000 $ 9,000 Prior month's sales comm., 100% 0 6,250 6,750 Supplies expense 2,500 2,700 2,916 Prior month's utilities, 100% 0 700 700 Depreciation on store fixtures 0 0 0 Rent 2,400 2,400 2,400 Miscellaneous 600 600 600 Total payments for S&A expenses $14,500 $21,650 $22,366 $58,516 Depreciation is a noncash charge. $ 0 $ 6,330 $ 6,000 50,000 129,000 139,320 50,000 135,330 145,320 $318,320 Cash Budget Beginning cash balance Add cash receipts Cash available (w) Less payments For inventory purchases For S&A expenses Purchase of store fixtures Interest expense Total budgeted payments (x) Payments minus receipts Surplus (shortage) (W x) Financing activity Borrowing (repayment) (y) Ending cash balance (w - X+ y) 58,170 14,500 82,000 0 154,670 82,084 21,650 0 1,110 104,844 83,806 22,366 0 865" 107,037 $224,0600 58,516( 82,000( 1,975 (104,670) 30,486 38,283 111,000 (24,486) $ 6,330 $ 6,000 (32,283) $ 6,000 54,231 6,000( 16) Prepare the pro forma income statement, balance sheet and statement of cash flows with the following information. (15 points) Sales Budget and Schedule of Cash Receipts Cash sales Sales on account Total budgeted sales $ 50,000 $ 54,000 75,000 81,000 $125,000 $135,000 $ 58,320 87,480 $ 87,480 $145,800 405,800 Current cash sales Plus collections from A/R Total collections $50,000 0 $50,000 $ 54,000 75,000 $129,000 $ 58,320 81,000 $139,320 $318,320 Inventory Purchases Budget and Cash Payments Budget for Inventory Purchases $243,480 6,0001 Budgeted cost of goods sold Plus: Desired ending inventory Inventory needed Less: Beginning inventory Required purchases (on account) $75,000 $81,000 8,100 8,748 83,100 89,748 0 8,100 $83,100 $81,648 $87,480 6,000 93,480 8,748 $84,732 25,420 Pmt. of current month's accts. pay. $58,170 $57,154* $59,312* Pmt. for prior month's accts. pay. 0 24,930 24,494 Total budgeted pmts. for inventory $58,170 $82,084 $83,806 $224,0600 S and A Expense Budget $7,2901 Salary expense $ 9,000 $ 9,000 $ 9,000 Sales commissions, 5% of sales 6.250 6,750 7,290 Supplies expense, 2% of sales 2,500 2.700 2.916 Utilities 700 700 700 Depreciation on store fixtures 2,000 2,000 2.000 Rent 2,400 2,400 2,400 Miscellaneous Total S&A expenses $23,450 $24,150 $24,906 Cash Payments Budget for S and A Expenses 7000 6,0001 600 600 600 72,5061 Salary expense $9,000 $ 9,000 $ 9,000 Prior month's sales comm., 100% 0 6,250 6,750 Supplies expense 2,500 2,700 2,916 Prior month's utilities, 100% 0 700 700 Depreciation on store fixtures 0 0 0 Rent 2,400 2,400 2,400 Miscellaneous 600 600 600 Total payments for S&A expenses $14,500 $21,650 $22,366 $58,516 Depreciation is a noncash charge. $ 0 $ 6,330 $ 6,000 50,000 129,000 139,320 50,000 135,330 145,320 $318,320 Cash Budget Beginning cash balance Add cash receipts Cash available (w) Less payments For inventory purchases For S&A expenses Purchase of store fixtures Interest expense Total budgeted payments (x) Payments minus receipts Surplus (shortage) (W x) Financing activity Borrowing (repayment) (y) Ending cash balance (w - X+ y) 58,170 14,500 82,000 0 154,670 82,084 21,650 0 1,110 104,844 83,806 22,366 0 865" 107,037 $224,0600 58,516( 82,000( 1,975 (104,670) 30,486 38,283 111,000 (24,486) $ 6,330 $ 6,000 (32,283) $ 6,000 54,231 6,000(