Answered step by step

Verified Expert Solution

Question

1 Approved Answer

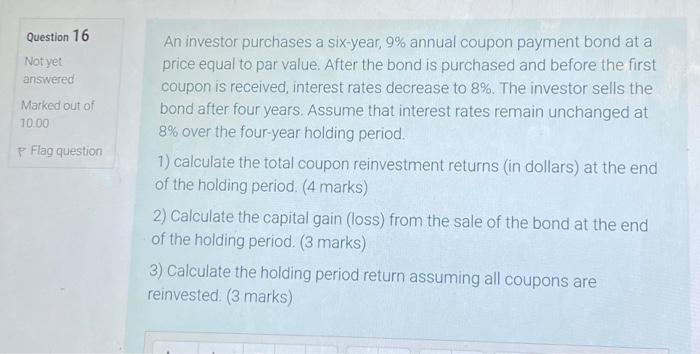

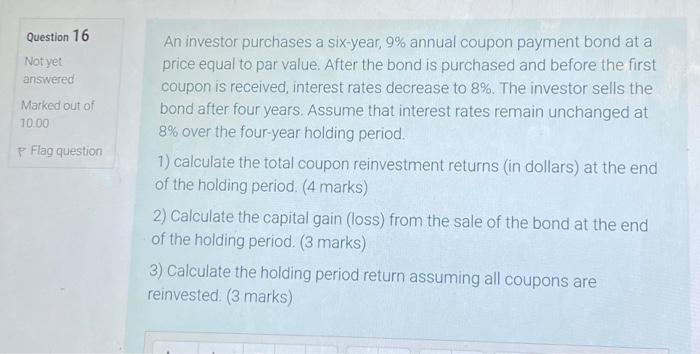

16 Question 16 Not yet answered Marked out of 70.00 P Flag question An investor purchases a six-year, 9% annual coupon payment bond at a

16

Question 16 Not yet answered Marked out of 70.00 P Flag question An investor purchases a six-year, 9% annual coupon payment bond at a price equal to par value. After the bond is purchased and before the first coupon is received, interest rates decrease to 8%. The investor sells the bond after four years. Assume that interest rates remain unchanged at 8% over the four-year holding period. 1) calculate the total coupon reinvestment returns (in dollars) at the end of the holding period. (4 marks) 2) Calculate the capital gain (loss) from the sale of the bond at the end of the holding period. (3 marks) 3) Calculate the holding period return assuming all coupons are reinvested

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started