Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.6. The discount rate that equates the present value of the cash inflows with the initial investment is known as the A payback period B.

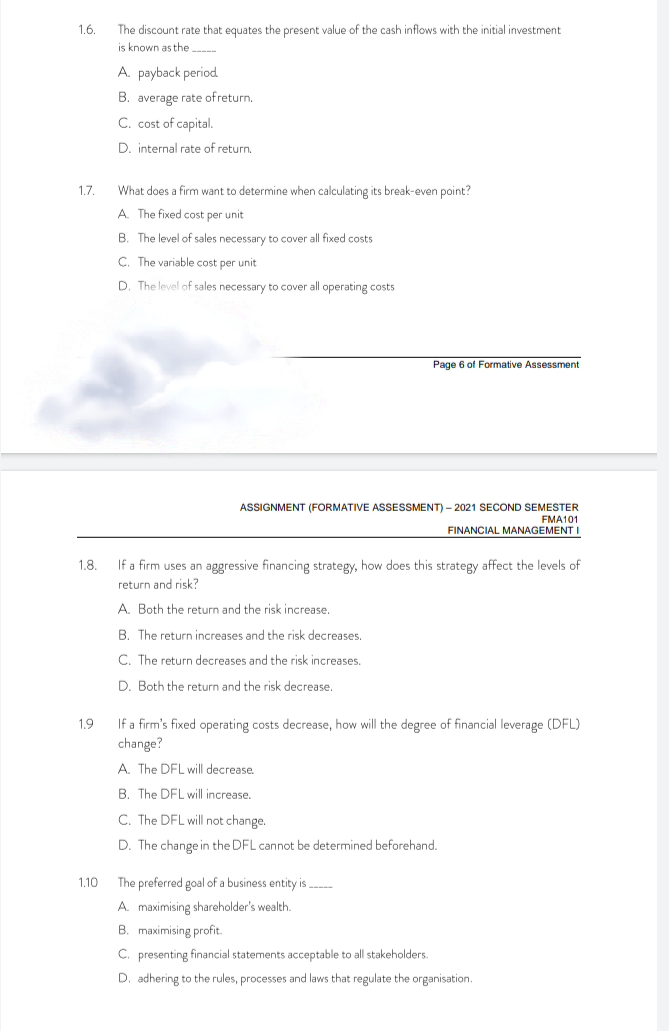

1.6. The discount rate that equates the present value of the cash inflows with the initial investment is known as the A payback period B. average rate ofreturn C. cost of capital. D. internal rate of return 1.7. What does a firm want to determine when calculating its break-even point? A The fixed cost per unit B. The level of sales necessary to cover all fixed costs C. The variable cost per unit D. The level of sales necessary to cover all operating costs Page 6 of Formative Assessment ASSIGNMENT (FORMATIVE ASSESSMENT) - 2021 SECOND SEMESTER FMA101 FINANCIAL MANAGEMENT 1.8 If a firm uses an aggressive financing strategy, how does this strategy affect the levels of return and risk? A Both the return and the risk increase. B. The return increases and the risk decreases. C. The return decreases and the risk increases. D. Both the return and the risk decrease. 1.9 If a firm's fixed operating costs decrease, how will the degree of financial leverage (DFL) change? A The DFL will decrease B. The DFL will increase C. The DFL will not change. D. The change in the DFL cannot be determined beforehand. 1.10 The preferred goal of a business entity is... A maximising shareholder's wealth. B. maximising profit. C. presenting financial statements acceptable to all stakeholders. D. adhering to the rules, processes and laws that regulate the organisation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started