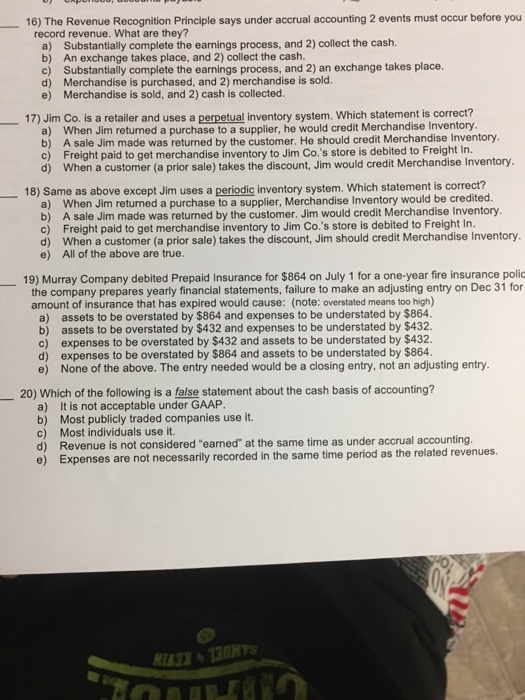

16) The Revenue Recognition Principle says under accrual ccounting 2 events must occur before you record revenue. What are they? Substantially complete the earnings process, and 2) collect the cash. b) a) An exchange takes place, and 2) collect the cash Substantially complete the earnings process, and 2) an exchange takes place. c) d) Merchandise is purchased, and 2) merchandise is sold e) Merchandise is sold, and 2) cash is collected. 17) Jim Co. is a retailer and uses a perpetual inventory system. Which statement is correct? a) When Jim returned a purchase to a supplier, he would credit Merchandise Inventory. b) A sale Jim made was returned by the customer. He should credit Merchandise Inventory c) Freight paid to get merchandise inventory to Jim Co.'s store is debited to Freight In d) When a customer (a prior sale) takes the discount, Jim would credit Merchandise Inventory 18) Same as above except Jim uses a periodic inventory system. Which statement is correct? When Jim returned a purchase to a supplier, Merchandise Inventory would be credited. b) a) A sale Jim made was returned by the customer. Jim would credit Merchandise Inventory. c) Freight paid to get merchandise inventory to Jim Co.'s store is debited to Freight In. d) When a customer (a prior sale) takes the discount, Jim should credit Merchandise Inventory. e) All of the above are true 19) Murray Company debited Prepaid Insurance for $864 on July 1 for a one-year fire insurance poli the company prepares yearly financial statements, failure to make an adjusting entry on Dec 31 for amount of insurance that has expired would cause: (note: overstated means too high) a) assets to be overstated by $864 and expenses to be understated by $864 b) assets to be overstated by $432 and expenses to be understated by $432. c) expenses to be overstated by $432 and assets to be understated by $432. d) expenses to be overstated by $864 and assets to be understated by $864 e) None of the above. The entry needed would be a closing entry, not an adjusting entry 20) Which of the following is a false statement about the cash basis of accounting? a) It is not acceptable under GAAP b) Most publicly traded companies use it. c) Most individuals use it. d) Revenue is not considered "eaned" at the same time as under accrual accounting e) Expenses are not necessarily recorded in the same time period as the related revenues