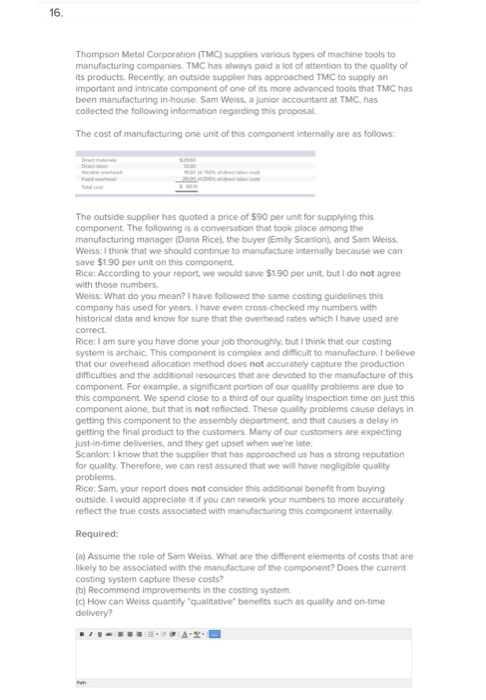

16. Thompson Metal Corporation (TMC) supplies various types of machine tools to manufacturing companies. TMC has always paid a lot of attention to the quality of its products. Recently, an outside supplier has approached TMC to supply an important and intricate component of one of its more advanced tools that TMC has been manufacturing in-house. Sam Weiss, a junior accountant at TMC, has collected the following information regarding this proposal The cost of manufacturing one unit of this component internally are as follows The outside supplier has quoted a price of $90 per unit for supplying this component. The following is a conversation that took place among the manufacturing manager (Dano Rice), the buyer (Emily Scanlonl, and Sam Weiss Welss: I think that we should continue to manufacture internally because we can save $1.90 per unit on this component Rice: According to your report, we would save $1.90 per unit, but I do not agree with those numbers Weiss: What do you mean? I have followed the same costing guidelines this company has used for years. I have even cross-checked my numbers with historical data and know for sure that the overhead rates which I have used are correct Rice:I am sure you have done your job thoroughly, but I think that our costing system is archaic. This component is complex and difficult to manufacture. I believe that our overhead allocation method does not accurately capture the production difficulties and the additional resources that are devoted to the manufacture of this component. For example, a significant portion of our quality problems are due to this component. We spend close to a third of our quality inspection time on just this component alone, but that is not reflected. These quality problems cause delays in getting this component to the assembly department and that causes a delay in getting the final product to the customers. Many of our customers are expecting just-in-time deliveries, and they get upset when we're late Scanlon: I know that the supplier that has approached us has a strong reputation for quality. Therefore, we can rest assured that we will have negligible quality problems. Rice: Sam, your report does not consider this additional benefit from buying outside. I would appreciate it if you can rework your numbers to more accurately reflect the true costs associated with manufacturing this component internaly Required: (a) Assume the role of Sam Weiss. What are the different elements of costs that are likely to be associated with the manufacture of the component? Does the current costing system capture these costs? (b) Recommend improvements in the costing system (c) How can Weiss quantify "qualitative" benefits such as quality and on-time delivery? 16. Thompson Metal Corporation (TMC) supplies various types of machine tools to manufacturing companies. TMC has always paid a lot of attention to the quality of its products. Recently, an outside supplier has approached TMC to supply an important and intricate component of one of its more advanced tools that TMC has been manufacturing in-house. Sam Weiss, a junior accountant at TMC, has collected the following information regarding this proposal The cost of manufacturing one unit of this component internally are as follows The outside supplier has quoted a price of $90 per unit for supplying this component. The following is a conversation that took place among the manufacturing manager (Dano Rice), the buyer (Emily Scanlonl, and Sam Weiss Welss: I think that we should continue to manufacture internally because we can save $1.90 per unit on this component Rice: According to your report, we would save $1.90 per unit, but I do not agree with those numbers Weiss: What do you mean? I have followed the same costing guidelines this company has used for years. I have even cross-checked my numbers with historical data and know for sure that the overhead rates which I have used are correct Rice:I am sure you have done your job thoroughly, but I think that our costing system is archaic. This component is complex and difficult to manufacture. I believe that our overhead allocation method does not accurately capture the production difficulties and the additional resources that are devoted to the manufacture of this component. For example, a significant portion of our quality problems are due to this component. We spend close to a third of our quality inspection time on just this component alone, but that is not reflected. These quality problems cause delays in getting this component to the assembly department and that causes a delay in getting the final product to the customers. Many of our customers are expecting just-in-time deliveries, and they get upset when we're late Scanlon: I know that the supplier that has approached us has a strong reputation for quality. Therefore, we can rest assured that we will have negligible quality problems. Rice: Sam, your report does not consider this additional benefit from buying outside. I would appreciate it if you can rework your numbers to more accurately reflect the true costs associated with manufacturing this component internaly Required: (a) Assume the role of Sam Weiss. What are the different elements of costs that are likely to be associated with the manufacture of the component? Does the current costing system capture these costs? (b) Recommend improvements in the costing system (c) How can Weiss quantify "qualitative" benefits such as quality and on-time delivery