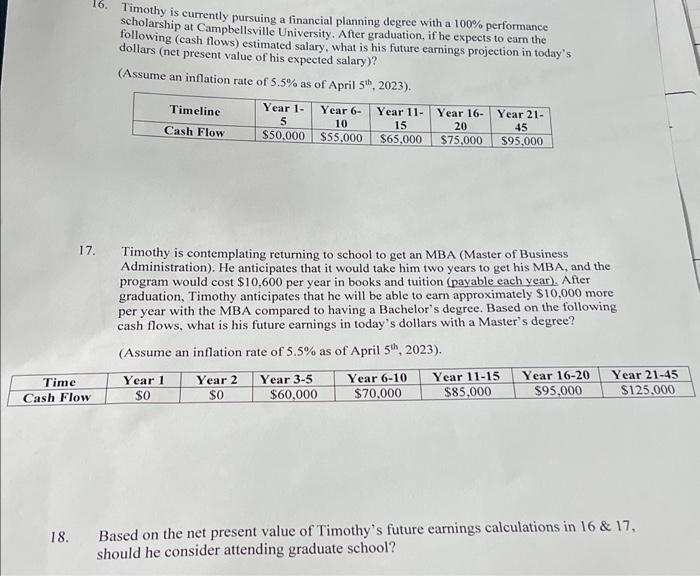

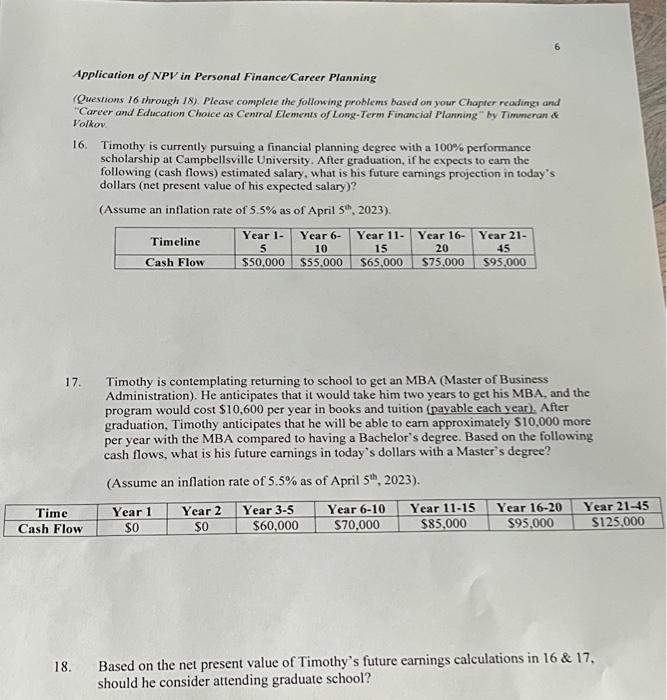

16. Timothy is currently pursuing a financial planning degree with a 100% performance scholarship at Campbellsville University. After graduation, if he expects to earn the following (cash flows) estimated salary, what is his future earnings projection in today's dollars (net present value of his expected salary)? (Assume an inflation rate of 5.5% as of April 5th,2023 ). 17. Timothy is contemplating returning to school to get an MBA (Master of Business Administration). He anticipates that it would take him two years to get his MBA, and the program would cost $10,600 per year in books and tuition (payable each year). After graduation, Timothy anticipates that he will be able to earn approximately $10,000 more per year with the MBA compared to having a Bachelor's degree. Based on the following cash flows, what is his future earnings in today's dollars with a Master's degree? (Assume an inflation rate of 5.5% as of April 5th,2023 ). 18. Based on the net present value of Timothy's future earnings calculations in 16&17, should he consider attending graduate school? Application of NPV in Personal Finance/Career Planning (Quevtions 16 through 18). Please complete the following problems based on your Chapter readings and "Career and Education Choice as Central Elements of Long-Term Financial Planning" by Timmeran \& Volkow. 16. Timothy is currently pursuing a financial planning degree with a 100% performance scholarship at Campbellsville University. After graduation, if he expects to eam the following (cash flows) estimated salary, what is his future earnings projection in today's dollars (net present value of his expected salary)? (Assume an inflation rate of 5.5% as of April 5th,2023 ). 17. Timothy is contemplating returning to school to get an MBA (Master of Business Administration). He anticipates that it would take him two years to get his MBA, and the program would cost $10,600 per year in books and tuition (payable each vear). After graduation, Timothy anticipates that he will be able to eam approximately $10,000 more per year with the MBA compared to having a Bachelor's degree. Based on the following cash flows, what is his future earnings in today's dollars with a Master's degree? (Assume an inflation rate of 5.5% as of April 5th,2023 ). 18. Based on the net present value of Timothy's future earnings calculations in 16&17, should he consider attending graduate school