Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16. Watts Corporation made a very large arithmetical error in the preparation of its year-end financial statements by improper placement of a decimal point in

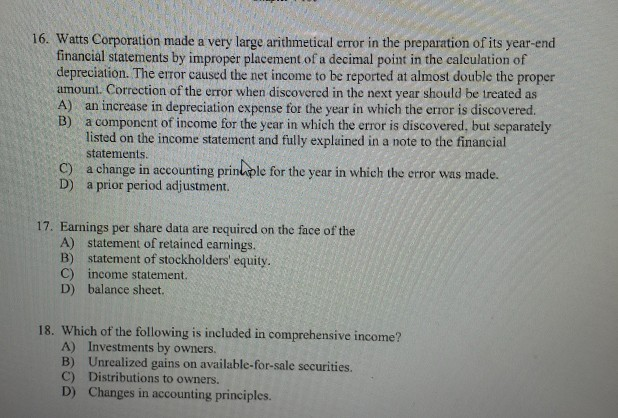

16. Watts Corporation made a very large arithmetical error in the preparation of its year-end financial statements by improper placement of a decimal point in the calculation of depreciation. The error caused the net income to be reported at almost double the proper amount. Correction of the error when discovered in the next year should be treated as A) an increase in depreciation expense for the year in which the error is discovered. B) a component of income for the year in which the error is discovered, but separately listed on the income statement and fully explained in a note to the financial statements. C) a change in accounting prinkple for the year in which the error was made. D) a prior period adjustment. 17. Earnings per share data are required on the face of the A) statement of retained earnings. B) statement of stockholders' equity. C) income statement. D) balance sheet 18. Which of the following is included in comprehensive income? A) Investments by owners. B) Unrealized gains on available-for-sale securities. C) Distributions to owners. D) Changes in accounting principles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started