Answered step by step

Verified Expert Solution

Question

1 Approved Answer

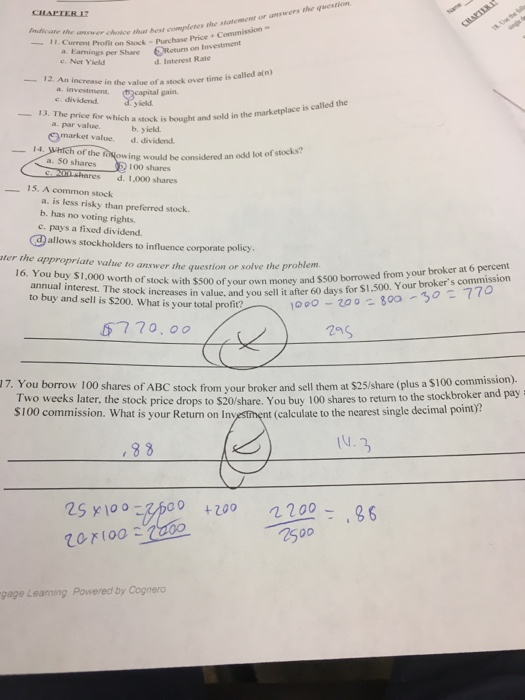

16. you buy 1000 worth of stock with 500 of your own money and 500 borrowed from your broker at 6 percent annual interest. the

16. you buy 1000 worth of stock with 500 of your own money and 500 borrowed from your broker at 6 percent annual interest. the stock increases in value, and you sell it after 60 days for 1500. your brokers commission to buy and sell is 200. what is your total profit?

And 17.

answers the question Indicate ehe nswer cholce theat best completes the statemen r hase Price 11.Current Profit on Soxck Purch a Earnings per Share Retun on Investment c. Net Yield d. Interest Rate is called ain) 12. An increase in the value of a stock over time e.dividend a stock is bought and sold in the marketplace is called the b. yield yield a. par value o market value . divd. ng would be considered an odd lot of stocks? 100 shares of the a. 50 shares d. 1,000 shares 15. A common stock a. is less risky than preferred stock b. has no voting rights. c. pays a fixed dividend. G)allows stockholders to influence corporate policy ter the appropriate value to answer the question or solve the problem. 16. You buy $1,000 worth of stock with $500 of your own money and S500 Bor s1.500oubroker s en broker at 6 percent from your and $500 annual interest. The stock increases in value, and you sell it after to buy and sell is $200. What is your total profit? Your broker's 60 days for SI 100800 2 s 770 30 6770.o 7. You borrow 100 shares of ABC stock from your broker and sell them at $25/share (plus a 5100 commissin Two weeks later, the stock price drops to $20/share. You buy 100 shares to return to the stockbroker and pay i $100 commission. What is your Retum on Inyesthent (calculate to the nearest single decimal point)? ,88 gage Leaning Powered by Cognerc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started