16/12

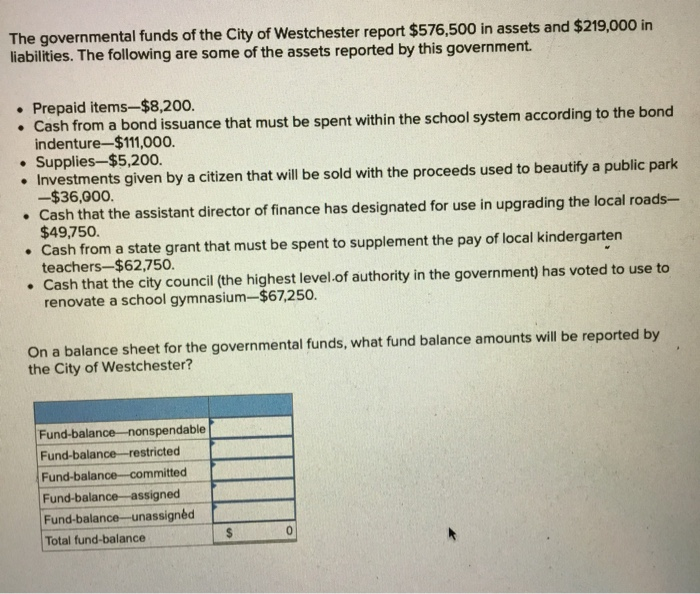

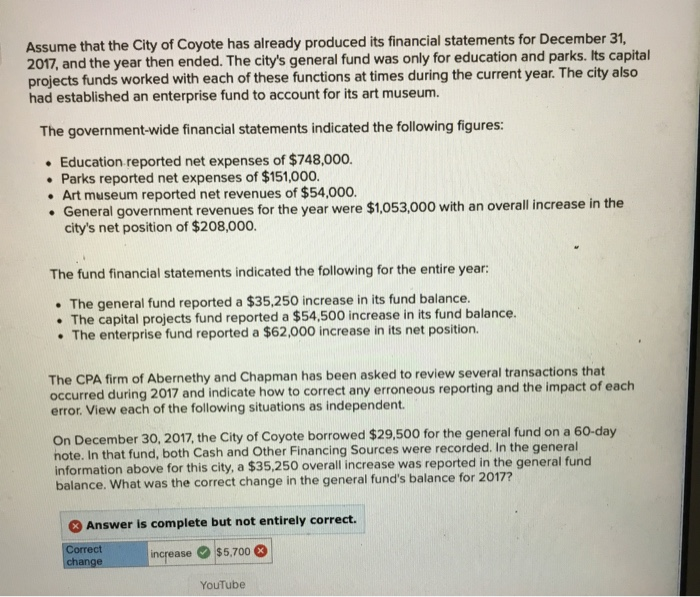

Assume that the City of Coyote has already produced its financial statements for December 31, 2017, and the year then ended. The city's general fund was only for education and parks. Its capital projects funds worked with each of these functions at times during the current year. The city also had established an enterprise fund to account for its art museum. The government-wide financial statements indicated the following figures: Education reported net expenses of $748,000. Parks reported net expenses of $151,000. Art museum reported net revenues of $54,000. General government revenues for the year were $1,053,000 with an overall increase in the city's net position of $208,000. The fund financial statements indicated the following for the entire year: The general fund reported a $35,250 increase in its fund balance. The capital projects fund reported a $54,500 increase in its fund balance. The enterprise fund reported a $62,000 increase in its net position. The CPA firm of Abernethy and Chapman has been asked to review several transactions that occurred during 2017 and indicate how to correct any erroneous reporting and the impact of each error. View each of the following situations as independent. On December 30, 2017, the City of Coyote borrowed $29,500 for the general fund on a 60-day hote. In that fund, both Cash and Other Financing Sources were recorded. In the general information above for this city, a $35,250 overall increase was reported in the general fund balance. What was the correct change in the general fund's balance for 2017? Answer is complete but not entirely correct. Correct change increase $5,700 YouTube The governmental funds of the City of Westchester report $576,500 in assets and $219,000 in liabilities. The following are some of the assets reported by this government. Prepaid items-$8,200. Cash from a bond issuance that must be spent within the school system according to the bond indenture-$111,000. Supplies-$5,200. Investments given by a citizen that will be sold with the proceeds used to beautify a public park -$36,000 Cash that the assistant director of finance has designated for use in upgrading the local roads- $49,750. Cash from a state grant that must be spent to supplement the pay of local kindergarten teachers-$62,750. Cash that the city council (the highest level of authority in the government) has voted to use to renovate a school gymnasium-$67,250. On a balance sheet for the governmental funds, what fund balance amounts will be reported by the City of Westchester? Fund-balance-nonspendable Fund-balance-restricted Fund-balance committed Fund-balance assigned Fund-balance-unassigned Total fund balance $ 0

16/12

16/12