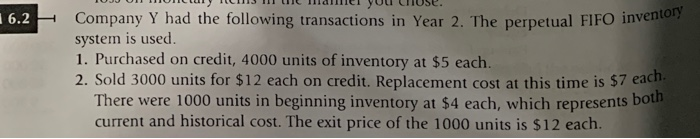

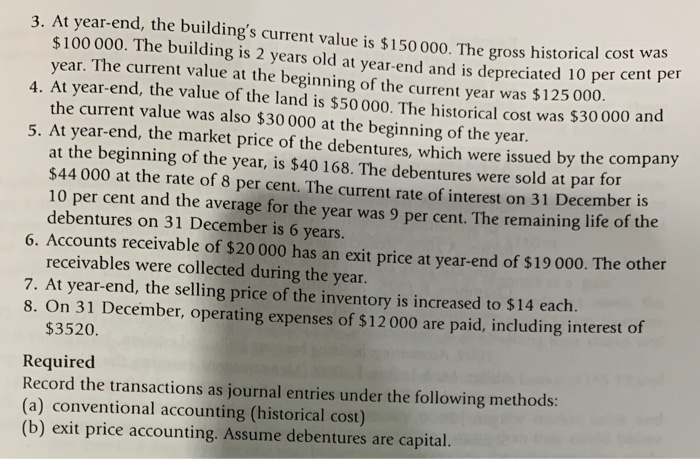

16.2 4 TUJ U Monty 3 W Maller yuu use. Company Y had the following transactions in Year 2. The perpetual FIFO inven system is used. 1. Purchased on credit, 4000 units of inventory at $5 each. 2. Sold 3000 units for $12 each on credit. Replacement cost at this time is $7 each There were 1000 units in beginning inventory at $4 each, which represents Dou current and historical cost. The exit price of the 1000 units is $12 each. 3. At year-end, the building's current value is $150 000. The gross historical cost $100 000. The building is 2 years old at year-end and is depreciated 10 per cen year. The current value at the beginning of the current year was $125 000 4. At year-end, the value of the land is $50.000 The we land is $50 000. The historical cost was $30 000 and the current value was also $30 000 at the beginning of the year. 5. At year-end, the market price of the debentures, which were issued by the company at the beginning of the year, is $40 168. The debentures were sold at par for $44 000 at the rate of 8 per cent. The current rate of interest on 31 December is 10 per cent and the average for the year was 9 per cent. The remaining life of the debentures on 31 December is 6 years. receivable of $20 000 has an exit price at year-end of $19 000. The other receivables were collected during the year. 7. At year-end, the selling price of the inventory is increased to $14 each. 8. On 31 December, operating expenses of $12000 are paid, including interest of $3520. Required Record the transactions as journal entries under the following methods: (a) conventional accounting (historical cost) (b) exit price accounting. Assume debentures are capital. 16.2 4 TUJ U Monty 3 W Maller yuu use. Company Y had the following transactions in Year 2. The perpetual FIFO inven system is used. 1. Purchased on credit, 4000 units of inventory at $5 each. 2. Sold 3000 units for $12 each on credit. Replacement cost at this time is $7 each There were 1000 units in beginning inventory at $4 each, which represents Dou current and historical cost. The exit price of the 1000 units is $12 each. 3. At year-end, the building's current value is $150 000. The gross historical cost $100 000. The building is 2 years old at year-end and is depreciated 10 per cen year. The current value at the beginning of the current year was $125 000 4. At year-end, the value of the land is $50.000 The we land is $50 000. The historical cost was $30 000 and the current value was also $30 000 at the beginning of the year. 5. At year-end, the market price of the debentures, which were issued by the company at the beginning of the year, is $40 168. The debentures were sold at par for $44 000 at the rate of 8 per cent. The current rate of interest on 31 December is 10 per cent and the average for the year was 9 per cent. The remaining life of the debentures on 31 December is 6 years. receivable of $20 000 has an exit price at year-end of $19 000. The other receivables were collected during the year. 7. At year-end, the selling price of the inventory is increased to $14 each. 8. On 31 December, operating expenses of $12000 are paid, including interest of $3520. Required Record the transactions as journal entries under the following methods: (a) conventional accounting (historical cost) (b) exit price accounting. Assume debentures are capital