Answered step by step

Verified Expert Solution

Question

1 Approved Answer

16-20 Sales Tax Far and Wide Broadband provides Internet connection services to customers living in remote areas. During February 2020, It billed a customer a

16-20

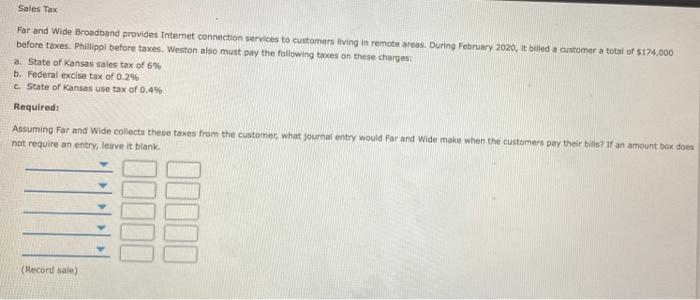

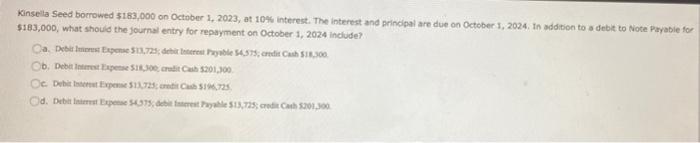

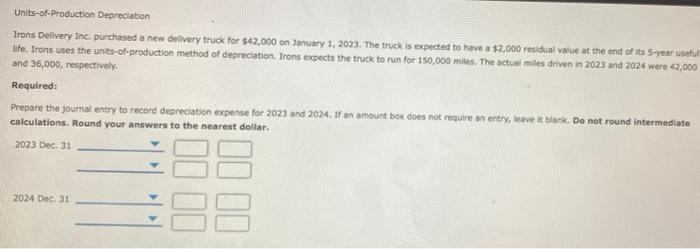

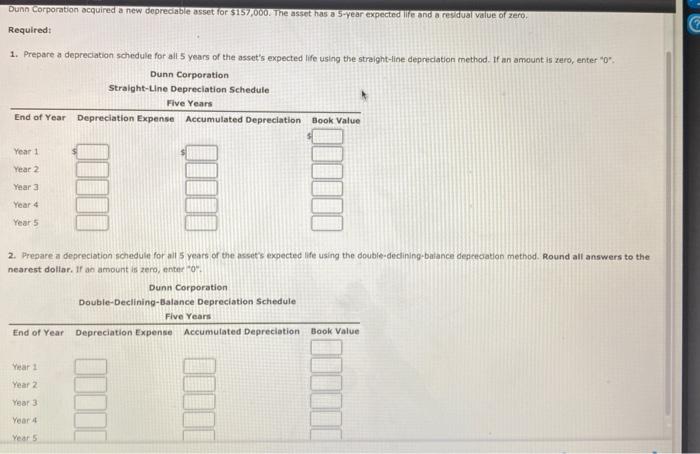

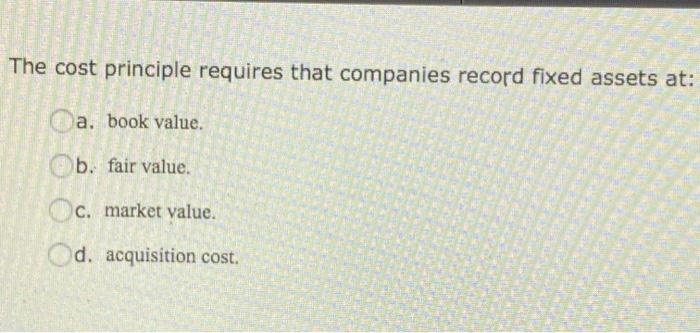

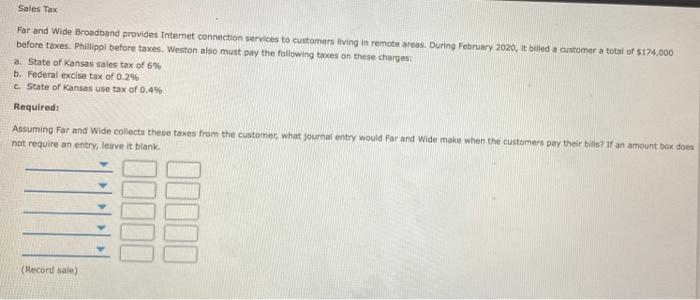

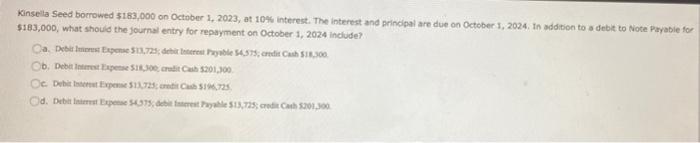

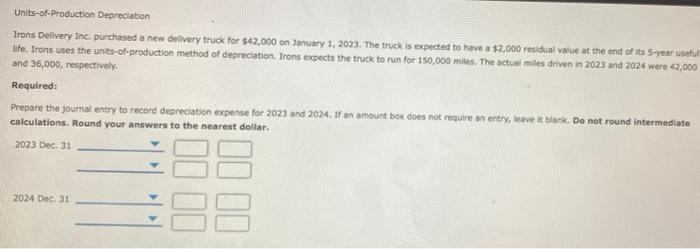

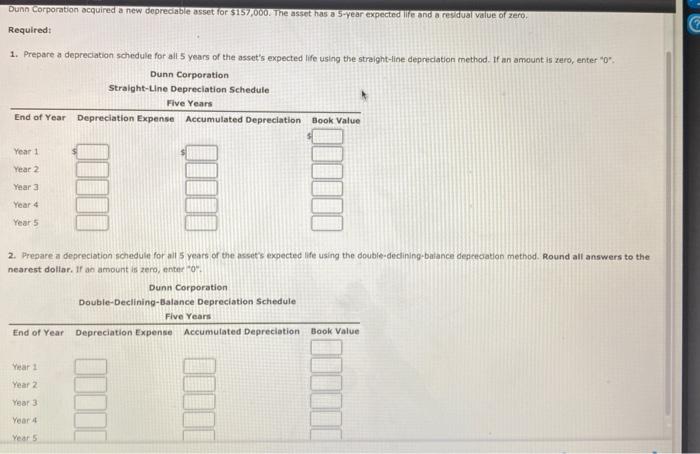

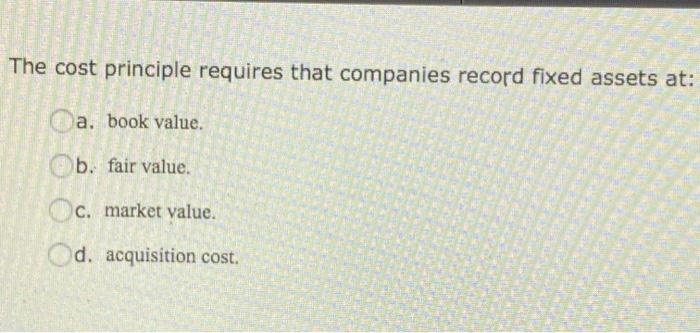

Sales Tax Far and Wide Broadband provides Internet connection services to customers living in remote areas. During February 2020, It billed a customer a total of $174,000 before taxes. Phillipol before taxes. Weston also must pay the following taxes on these charges a. State of Kansas sales tax of 6% b. Federal excise tax of 0.2% c. State of Kansas use tax of 0.4% Required: Assuming Far and Wide collects these taxes from the customer, what journal entry would Far and wide make when the customers pay their bils? If an amount box does not require an entry, leave it blank. (Record sale Kinsella Seed borrowed 5183,000 on October 2, 2023, at 10% interest. The interest and principal are due on October 1, 2024. In addition to a debit to Note Payable to $183,000, what should the journal entry for repayment on October 1, 2024 include? O Debitmes Expense 513,729; dit interest Table 14.375. credit Cah 518,300 b. Debit Interest Expense SIR,30, crudit Cash 5201,300 c. Debit pe 511728 1725 d. Debit Expert 513,25 credit 2010 Units-of-Production Depreciation Irons Delivery Inc. purchased a new delivery truck for $42.000 on January 1, 2023. The truck is expected to have a $2,000 residual value at the end of its 5-year useful life. Irons uses the units-of-production method of depreciation. Irons expects the truck to run for 150,000 miles. The actual miles driven in 2023 and 2024 were-42,000 and 36,000, respectively Required: Prepare the journal entry to record depreciation expense for 2023 and 2024, 1 an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Round your answers to the nearest dollar. 2023 Dec. 31 II II 2024 Dec 31 Dunn Corporation acquired a new depreciable asset for $157,000. The asset has a 5-year expected for and a residual value of zero Required: 1. Prepare a depreciation schedule for all 5 years of the asset's expected life using the straight-line depreciation method. If an amount is zero, enter "O" Dunn Corporation Straight-Line Depreciation Schedule Five Years End of Year Depreciation Expense Accumulated Depreciation Book Value Year 1 Year 2 Year 3 Year 4 Year 5 2. Prepare a depreciation schedule for all 5 years of the asset's expected life using the double-declining-balance deprecation method. Round all answers to the nearest dollar. If an amount is zero, enter* Dunn Corporation Double-Declining-Balance Depreciation Schedule Five Years End of Year Depreciation Expense Accumulated Depreciation Book Value Year a Year 2 Year 3 Year Year 5 The cost principle requires that companies record fixed assets at: a. book value. b. fair value. c. market value. d. acquisition cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started