Answered step by step

Verified Expert Solution

Question

1 Approved Answer

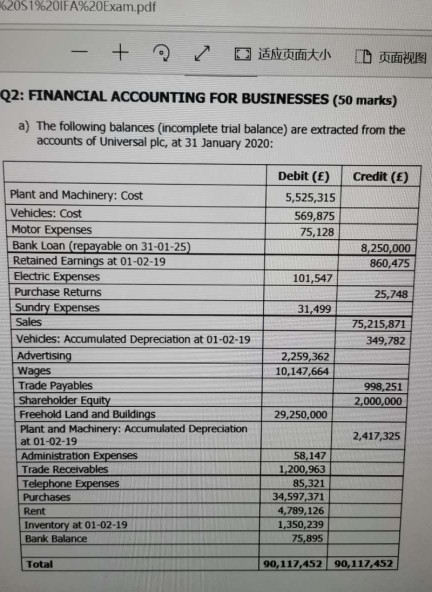

162051%201FA%20Exam.pdf - + Not D dues Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (50 marks) a) The following balances (incomplete trial balance) are extracted from the accounts

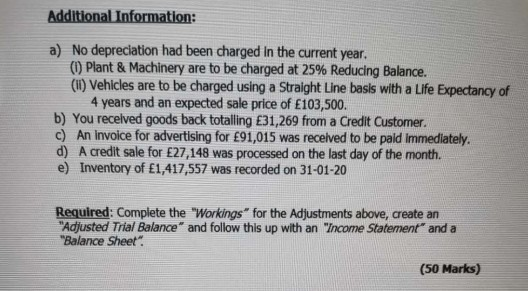

162051%201FA%20Exam.pdf - + Not D dues Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (50 marks) a) The following balances (incomplete trial balance) are extracted from the accounts of Universal plc, at 31 January 2020: Credit (E) Debit (E) 5,525,315 569,875 75,128 8,250,000 860,475 101,547 25,748 31,499 75,215,871 349,782 Plant and Machinery: Cost Vehicles: Cost Motor Expenses Bank Loan (repayable on 31-01-25) Retained Earnings at 01-02-19 Electric Expenses Purchase Returns Sundry Expenses Sales Vehicles: Accumulated Depreciation at 01-02-19 Advertising Wages Trade Payables Shareholder Equity Freehold Land and Buildings Plant and Machinery: Accumulated Depreciation at 01-02-19 Administration Expenses Trade Receivables Telephone Expenses Purchases Rent Inventory at 01-02-19 Bank Balance 2,259,362 10,147,664 998,251 2,000,000 29,250,000 2,417,325 58,147 1,200.963 85,321 34,597,371 4,789,126 1,350,239 25,895 90,117,452 90,117.452 Additional Information: a) No depreciation had been charged in the current year. () Plant & Machinery are to be charged at 25% Reducing Balance. (1) Vehicles are to be charged using a Straight Line basis with a Life Expectancy of 4 years and an expected sale price of 103,500. b) You received goods back totalling E31,269 from a Credit Customer. c) An Invoice for advertising for 91,015 was received to be paid immediately. d) A credit sale for 27,148 was processed on the last day of the month. e) Inventory of 1,417,557 was recorded on 31-01-20 Required: Complete the "Workings for the Adjustments above, create an "Adjusted Trial Balance and follow this up with an "Income Statement and a "Balance Sheet (50 Marks) 162051%201FA%20Exam.pdf - + Not D dues Q2: FINANCIAL ACCOUNTING FOR BUSINESSES (50 marks) a) The following balances (incomplete trial balance) are extracted from the accounts of Universal plc, at 31 January 2020: Credit (E) Debit (E) 5,525,315 569,875 75,128 8,250,000 860,475 101,547 25,748 31,499 75,215,871 349,782 Plant and Machinery: Cost Vehicles: Cost Motor Expenses Bank Loan (repayable on 31-01-25) Retained Earnings at 01-02-19 Electric Expenses Purchase Returns Sundry Expenses Sales Vehicles: Accumulated Depreciation at 01-02-19 Advertising Wages Trade Payables Shareholder Equity Freehold Land and Buildings Plant and Machinery: Accumulated Depreciation at 01-02-19 Administration Expenses Trade Receivables Telephone Expenses Purchases Rent Inventory at 01-02-19 Bank Balance 2,259,362 10,147,664 998,251 2,000,000 29,250,000 2,417,325 58,147 1,200.963 85,321 34,597,371 4,789,126 1,350,239 25,895 90,117,452 90,117.452 Additional Information: a) No depreciation had been charged in the current year. () Plant & Machinery are to be charged at 25% Reducing Balance. (1) Vehicles are to be charged using a Straight Line basis with a Life Expectancy of 4 years and an expected sale price of 103,500. b) You received goods back totalling E31,269 from a Credit Customer. c) An Invoice for advertising for 91,015 was received to be paid immediately. d) A credit sale for 27,148 was processed on the last day of the month. e) Inventory of 1,417,557 was recorded on 31-01-20 Required: Complete the "Workings for the Adjustments above, create an "Adjusted Trial Balance and follow this up with an "Income Statement and a "Balance Sheet (50 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started