Answered step by step

Verified Expert Solution

Question

1 Approved Answer

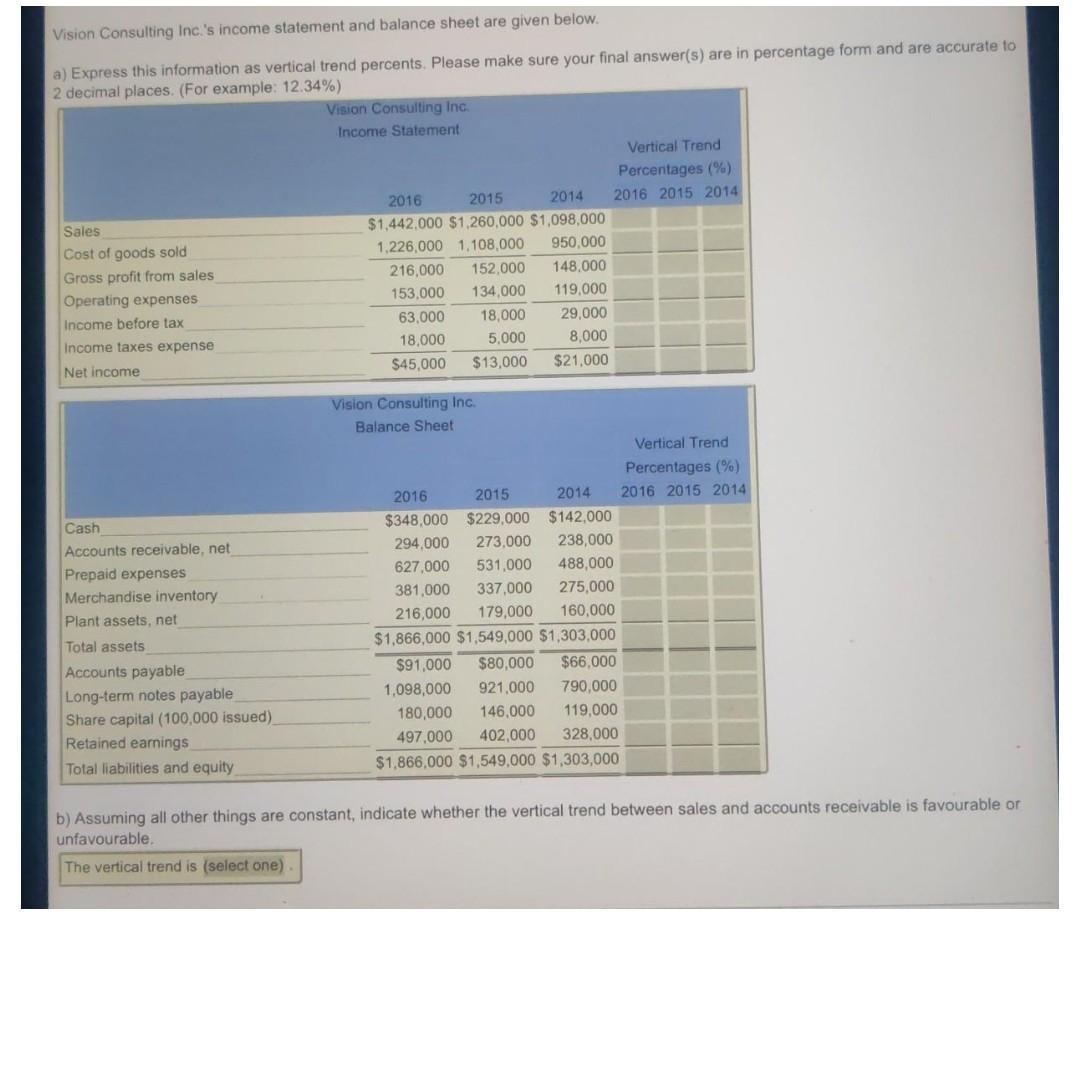

Vision Consulting Inc.'s income statement and balance sheet are given below. a) Express this information as vertical trend percents. Please make sure your final

Vision Consulting Inc.'s income statement and balance sheet are given below. a) Express this information as vertical trend percents. Please make sure your final answer(s) are in percentage form and are accurate to 2 decimal places. (For example: 12.34%) Sales Cost of goods sold Gross profit from sales Operating expenses Income before tax Income taxes expense Net income Cash Accounts receivable, net Prepaid expenses Merchandise inventory Plant assets, net Total assets Accounts payable Long-term notes payable Share capital (100,000 issued) Retained earnings Total liabilities and equity Vision Consulting Inc. Income Statement 2016 2015 2014 $1,442,000 $1,260,000 $1,098,000 1,226,000 1,108,000 950,000 148,000 119,000 216,000 152,000 153,000 134,000 63,000 18,000 18,000 5,000 $45,000 $13,000 Vision Consulting Inc. Balance Sheet 29,000 8,000 $21,000 Vertical Trend Percentages (%) 2016 2015 2014 Vertical Trend Percentages (%) 2014 2016 2015 2014 2015 2016 $348,000 $229,000 $142,000 294,000 273,000 238,000 627,000 531,000 488,000 275,000 381,000 337,000 216,000 179,000 160,000 $1,866,000 $1,549,000 $1,303,000 $91,000 $80,000 $66,000 1,098,000 921,000 790,000 180,000 146,000 119,000 497,000 402,000 328,000 $1,866,000 $1,549,000 $1,303,000 b) Assuming all other things are constant, indicate whether the vertical trend between sales and accounts receivable is favourable or unfavourable. The vertical trend is (select one)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

I see youve provided an income statement and balance sheet for Vision Consulting Inc Youve asked to express this information as vertical trend percent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started