16/3

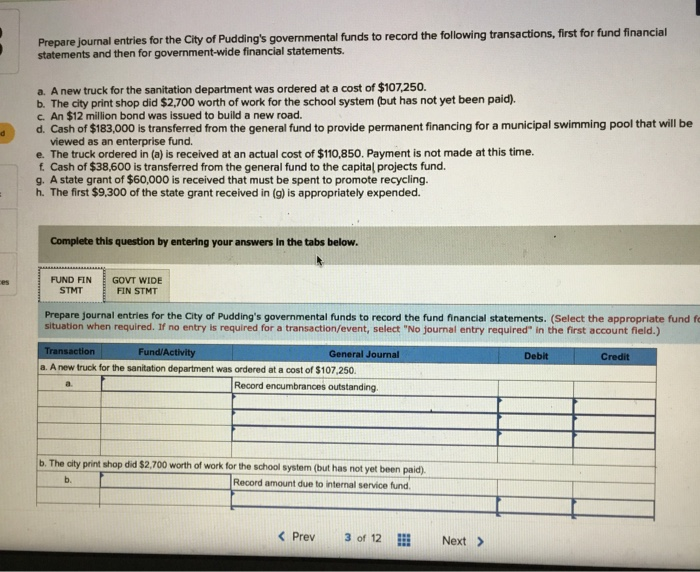

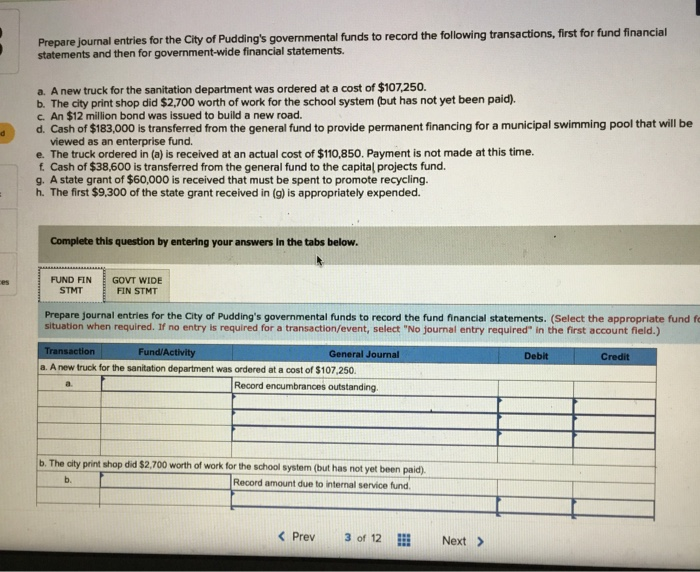

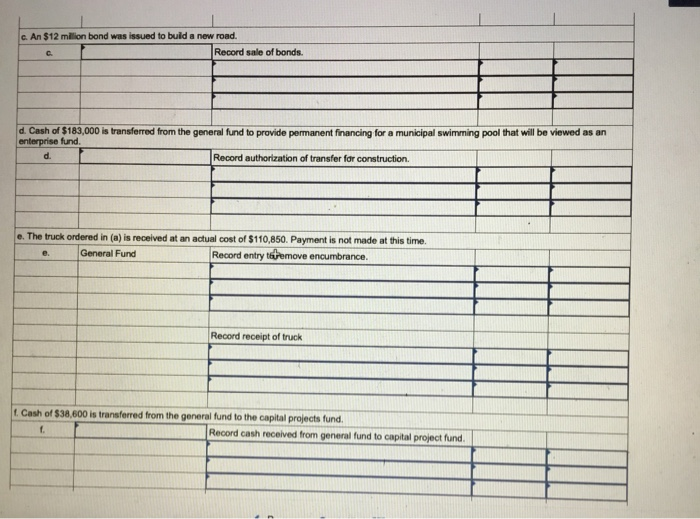

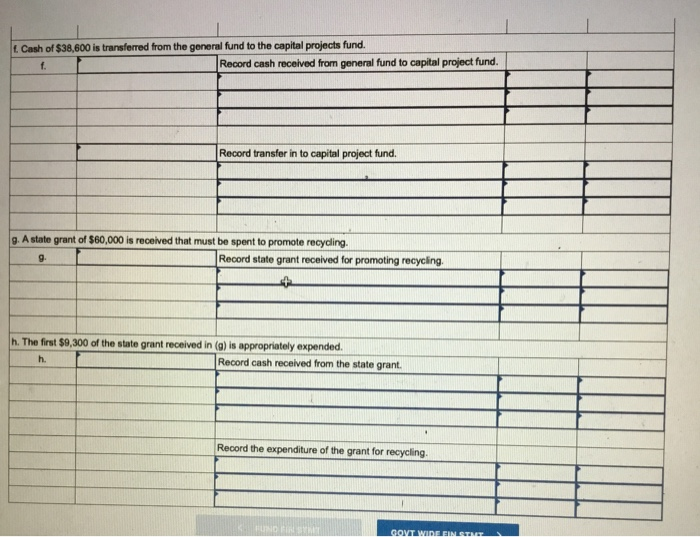

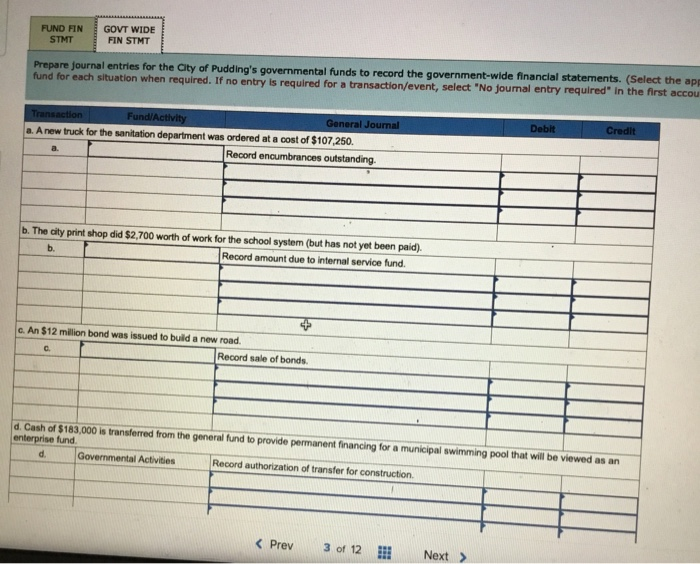

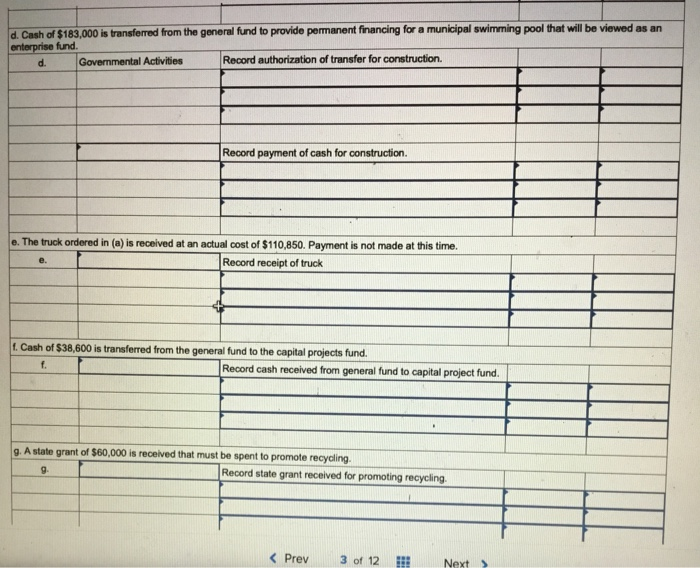

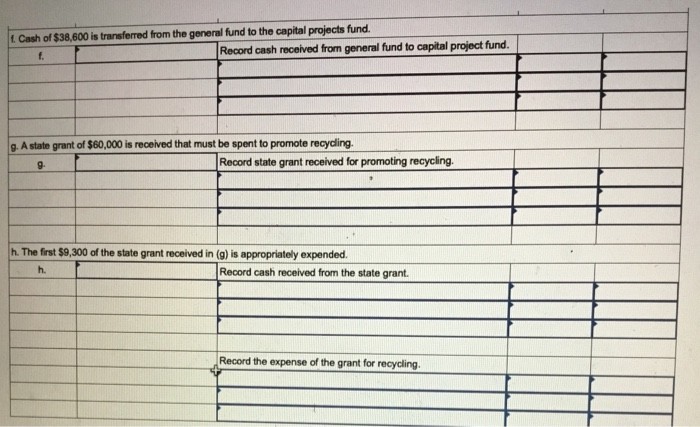

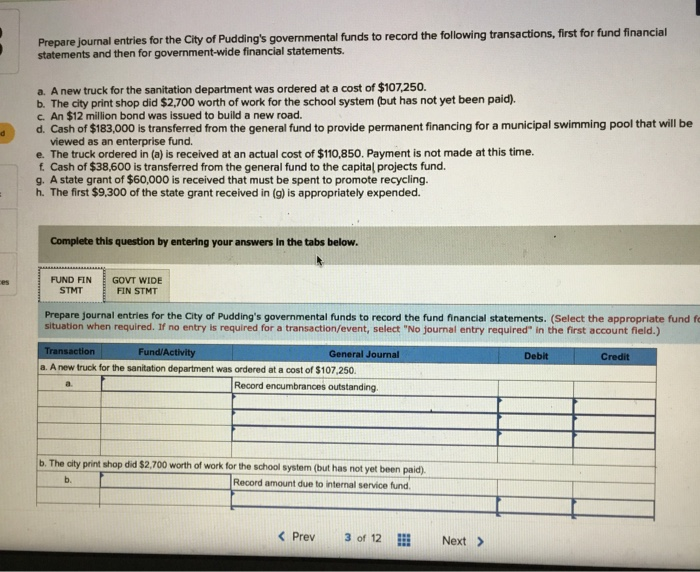

Prepare journal entries for the City of Pudding's governmental funds to record the following transactions, first for fund financial statements and then for government-wide financial statements. d a. A new truck for the sanitation department was ordered at a cost of $107,250. b. The city print shop did $2,700 worth of work for the school system (but has not yet been paid). c. An $12 million bond was issued to build a new road. d. Cash of $183,000 is transferred from the general fund to provide permanent financing for a municipal swimming pool that will be viewed as an enterprise fund. e. The truck ordered in (a) is received at an actual cost of $110,850. Payment is not made at this time. f. Cash of $38,600 is transferred from the general fund to the capital projects fund. 9. A state grant of $60,000 is received that must be spent to promote recycling. h. The first $9,300 of the state grant received in (g) is appropriately expended. Complete this question by entering your answers in the tabs below. es FUND FIN GOVT WIDE STMT FIN STMT Prepare journal entries for the City of Pudding's governmental funds to record the fund financial statements. (Select the appropriate fund fe situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Fund/Activity General Journal Debit Credit a. A new truck for the sanitation department was ordered at a cost of $107,250. Record encumbrances outstanding. Transaction b. The city print shop did $2,700 worth of work for the school system (but has not yet been paid). b. Record amount due to internal service fund. c. An $12 million bond was issued to build a new road. Record sale of bonds. C d. Cash of $183,000 is transferred from the general fund to provide permanent financing for a municipal swimming pool that will be viewed as an enterprise fund d Record authorization of transfer for construction. e. The truck ordered in (a) is received at an actual cost of $110,850. Payment is not made at this time. e. General Fund Record entry to remove encumbrance. Record receipt of truck Cash of $38,600 is transferred from the general fund to the capital projects fund. Record cash received from general fund to capital project fund t. Cash of $38,600 is transferred from the general fund to the capital projects fund. f. Record cash received from general fund to capital project fund. Record transfer in to capital project fund. g. A state grant of $60,000 is received that must be spent to promote recycling. 9. Record state grant received for promoting recycling h. The first $9,300 of the state grant received in (a) is appropriately expended. h. Record cash received from the state grant. Record the expenditure of the grant for recycling FUND FIN GOVT WIDE FIM SERVICE FUND FIN STMT GOVT WIDE FIN STMT Prepare journal entries for the City of Pudding's governmental funds to record the government-wide financial statements. (Select the app fund for each situation when required. If no entry is required for a transaction/event, select "No journal entry required" in the first accou Transaction Fund/Activity General Journal a. A new truck for the sanitation department was ordered at a cost of $107,250 Record encumbrances outstanding Debit Credit b. The city print shop did $2,700 worth of work for the school system (but has not yet been paid). b. Record amount due to internal service fund. c. An $12 million bond was issued to build a new road. Record sale of bonds. d. Cash of $183,000 is transferred from the general fund to provide permanent financing for a municipal swimming pool that will be viewed as an enterprise fund d Governmental Activities Record authorization of transfer for construction d. Cash of $183,000 is transferred from the general fund to provide permanent financing for a municipal swimming pool that will be viewed as an enterprise fund. d. Governmental Activities Record authorization of transfer for construction. Record payment of cash for construction. e. The truck ordered in (a) is received at an actual cost of $110,850. Payment is not made at this time. Record receipt of truck e. 1. Cash of $38,600 is transferred from the general fund to the capital projects fund. f. Record cash received from general fund to capital project fund. g. A state grant of $60,000 is received that must be spent to promote recycling. Record state grant received for promoting recycling