Answered step by step

Verified Expert Solution

Question

1 Approved Answer

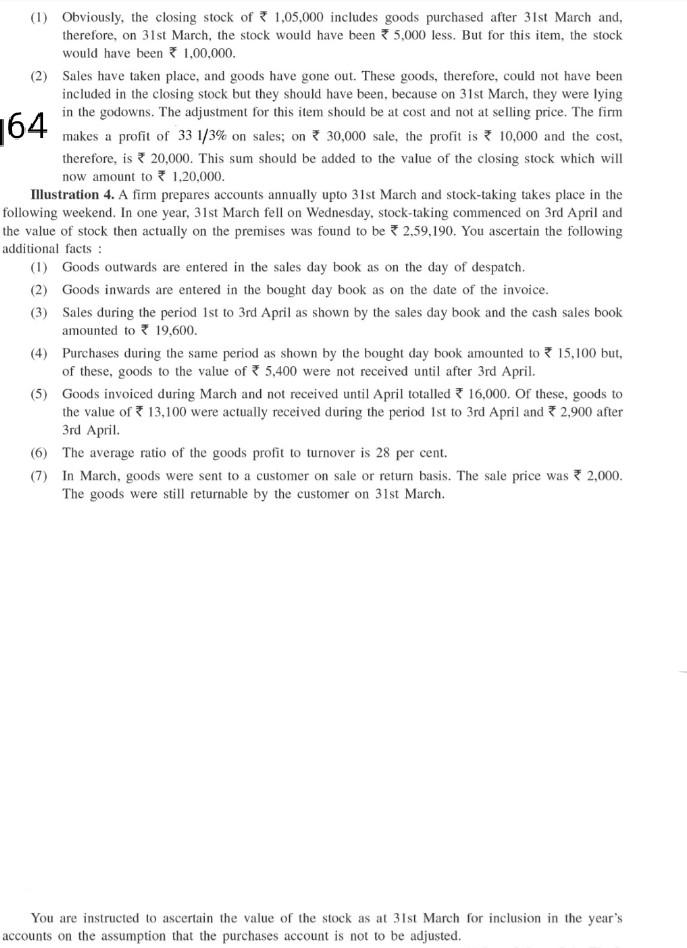

164 (1) Obviously, the closing stock of 1,05,000 includes goods purchased after 31st March and, therefore, on 31st March, the stock would have been 5,000

164 (1) Obviously, the closing stock of 1,05,000 includes goods purchased after 31st March and, therefore, on 31st March, the stock would have been 5,000 less. But for this item, the stock would have been 1,00,000 (2) Sales have taken place, and goods have gone out. These goods, therefore, could not have been included in the closing stock but they should have been, because on 31st March, they were lying in the godowns. The adjustment for this item should be at cost and not at selling price. The firm makes a profit of 33 1/3% on sales; on 30,000 sale, the profit is 10,000 and the cost, therefore, is 320,000. This sum should be added to the value of the closing stock which will now amount to 1,20,000. Illustration 4. A firm prepares accounts annually upto 31st March and stock-taking takes place in the following weekend. In one year, 31st March fell on Wednesday, stock-taking commenced on 3rd April and the value of stock then actually on the premises was found to be * 2,59,190. You ascertain the following additional facts: (1) Goods outwards are entered in the sales day book as on the day of despatch. (2) Goods inwards are entered in the bought day book as on the date of the invoice. (3) Sales during the period Ist to 3rd April as shown by the sales day book and the cash sales book amounted to 319,600. (4) Purchases during the same period as shown by the bought day book amounted to 15,100 but, of these, goods to the value of 5.400 were not received until after 3rd April. (5) Goods invoiced during March and not received until April totalled 16,000. Of these, goods to the value of 13,100 were actually received during the period Ist to 3rd April and * 2,900 after 3rd April (6) The average ratio of the goods profit to turnover is 28 per cent. (7) In March, goods were sent to a customer on sale or return basis. The sale price was 2,000. The goods were still returnable by the customer on 31st March. You are instructed to ascertain the value of the stock as at 31st March for inclusion in the year's accounts on the assumption that the purchases account is not to be adjusted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started