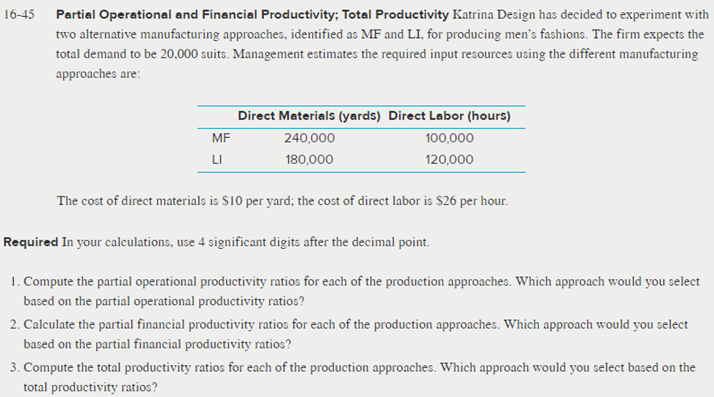

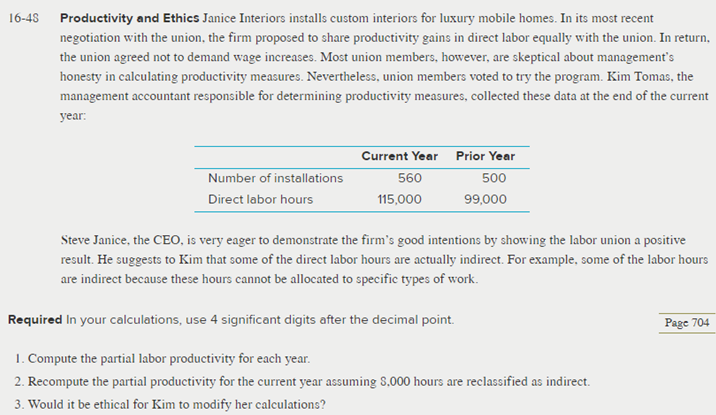

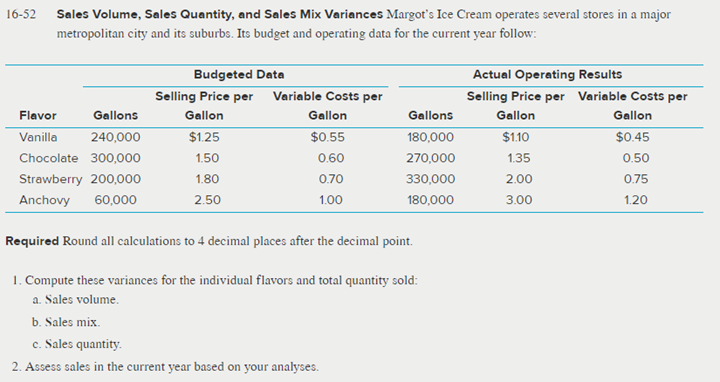

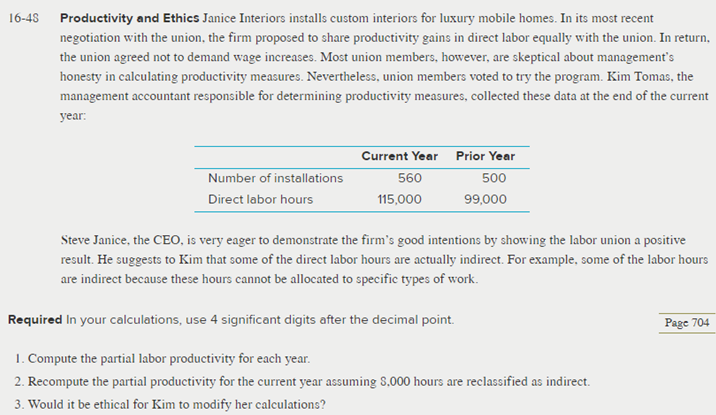

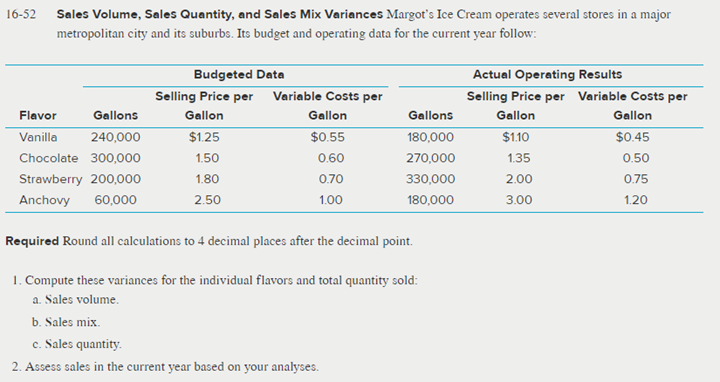

16-45 Partial Operational and Financial Productivity; Total Productivity Katrina Design has decided to experiment with two alternative manufacturing approaches, identified as MF and LI, for producing men's fashions. The firm expects the total demand to be 20,000 suits. Management estimates the required input resources using the different manufacturing approaches are: MF LI Direct Materials (yards) Direct Labor (hours) 240,000 100,000 180,000 120,000 The cost of direct materials is $10 per yard; the cost of direct labor is $26 per hour. Required in your calculations, use 4 significant digits after the decimal point. 1. Compute the partial operational productivity ratios for each of the production approaches. Which approach would you select based on the partial operational productivity ratios? 2. Calculate the partial financial productivity ratios for each of the production approaches. Which approach would you select based on the partial financial productivity ratios? 3. Compute the total productivity ratios for each of the production approaches. Which approach would you select based on the total productivity ratios? 16-48 Productivity and Ethics Janice Interiors installs custom interiors for luxury mobile homes. In its most recent negotiation with the union, the firm proposed to share productivity gains in direct labor equally with the union. In return, the union agreed not to demand wage increases. Most union members, however, are skeptical about management's honesty in calculating productivity measures. Nevertheless, union members voted to try the program. Kim Tomas, the management accountant responsible for determining productivity measures, collected these data at the end of the current year: Number of installations Direct labor hours Current Year Prior Year 560 500 115,000 99,000 Steve Janice, the CEO, is very eager to demonstrate the firm's good intentions by showing the labor union a positive result. He suggests to Kim that some of the direct labor hours are actually indirect. For example, some of the labor hours are indirect because these hours cannot be allocated to specific types of work. Required in your calculations, use 4 significant digits after the decimal point. Page 704 1. Compute the partial labor productivity for each year. 2. Recompute the partial productivity for the current year assuming 8.000 hours are reclassified as indirect. 3. Would it be ethical for Kim to modify her calculations? 16-52 Sales Volume, Sales Quantity, and Sales Mix Variances Margot's Ice Cream operates several stores in a major metropolitan city and its suburbs. Its budget and operating data for the current year follow: Flavor Gallons Vanilla 240,000 Chocolate 300,000 Strawberry 200,000 Anchovy 60,000 Budgeted Data Selling Price per Variable Costs per Gallon Gallon $1.25 $0.55 1.50 0.60 1.80 0.70 2.50 1.00 Actual Operating Results Selling Price per Variable costs per Gallons Gallon Gallon 180,000 $1.10 $0.45 1.35 0.50 330,000 2.00 0.75 180,000 3.00 1.20 270,000 Required Round all calculations to 4 decimal places after the decimal point 1. Compute these variances for the individual flavors and total quantity sold: a. Sales volume. b. Sales mix c. Sales quantity 2. Assess sales in the current year based on your analyses