Answered step by step

Verified Expert Solution

Question

1 Approved Answer

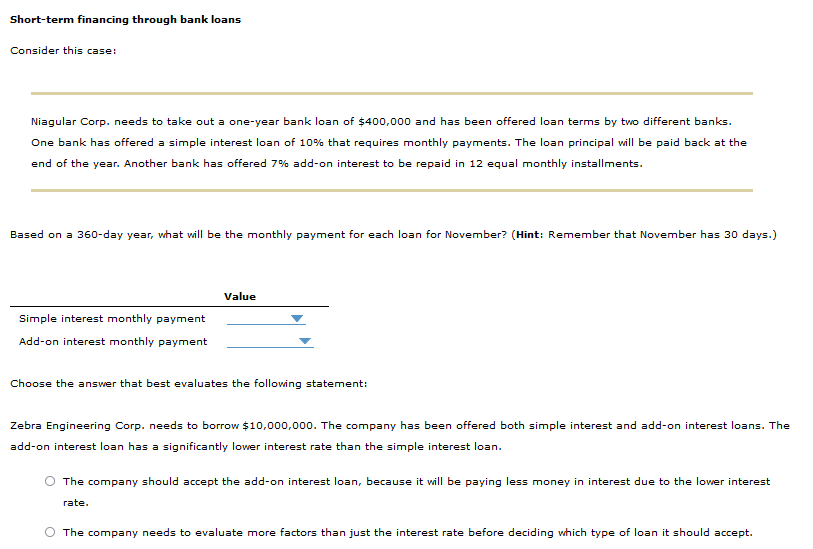

16.5 Simple interest monthly payment options: 2833.33 3666.66 4000.00 3333.33 add on interest monthly payment options: 30316.67 35666.67 39233.34 42800.00 Short-term financing through bank loans

16.5

Simple interest monthly payment options:

2833.33

3666.66

4000.00

3333.33

add on interest monthly payment options:

30316.67

35666.67

39233.34

42800.00

Short-term financing through bank loans Consider this case: Niagular Corp. needs to take out a one-year bank loan of $400,000 and has been offered loan terms by two different banks. One bank has offered a simple interest loan of 10% that requires monthly payments. The loan principal will be paid back at the end of the year. Another bank has offered 7% add-on interest to be repaid in 12 equal monthly installments. Based on a 360-day year, what will be the monthly payment for each loan for November? (Hint: Remember that November has 30 days.) Value Simple interest monthly payment Add-on interest monthly payment Choose the answer that best evaluates the following statement: Zebra Engineering Corp. needs to borrow $10,000,000. The company has been offered both simple interest and add-on interest loans. The add-on interest loan has a significantly lower interest rate than the simple interest loan. The company should accept the add-on interest loan, because it will be paying less money in interest due to the lower interest rate. The company needs to evaluate more factors than just the interest rate before deciding which type of loan it should acceptStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started